Yangtze Optical (SEHK:6869) Margin Slump Challenges Bullish Growth Narrative Despite Strong Outlook

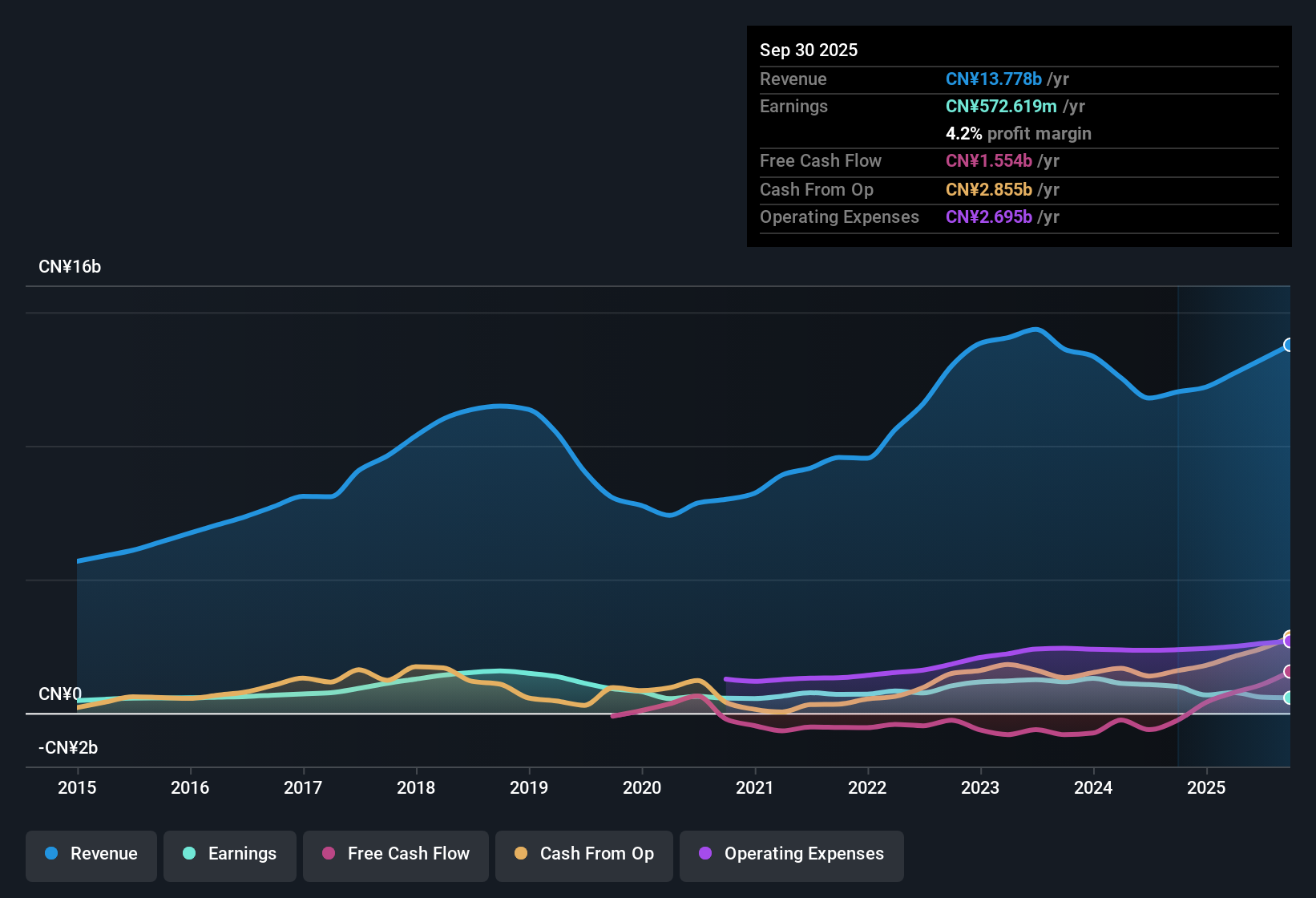

Yangtze Optical Fibre And Cable Limited (SEHK:6869) is expected to deliver revenue growth of 13.1% per year and a strong annual EPS increase of 34.6%, both outpacing the Hong Kong market averages. However, the company’s net profit margin has slipped to 4.5% from 9.1% last year, and its most recent earnings show a negative trend despite a solid five-year compound annual growth of 7.4%. Investors are weighing upbeat growth forecasts and a trading price below estimated fair value against the recent deterioration in profitability and a relatively high price-to-earnings ratio.

See our full analysis for Yangtze Optical Fibre And Cable Limited.Next, we examine how the latest fundamentals align with Simply Wall St’s crowd-sourced narratives and whether the numbers tell a different story from consensus expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Slumps Below Peers

- The company’s net profit margin has dropped sharply to 4.5%, down from 9.1% last year, now lagging behind regional sector averages as cost pressures mount.

- What stands out is that, despite this margin squeeze, sector trends highlight growing demand for fibre optics. This means profit pressures contrast with industry optimism about new orders and digitalization:

- Even as profit margins face a setback, policy developments and recent news suggest that infrastructure investment and large orders could soon provide support.

- The market is watching if these positive sector shifts can clearly translate into a turnaround in future profitability, especially after such a sharp margin decline.

Fair Value Discount, But High PE Ratio

- The current share price of HK$35.82 trades far below the DCF fair value estimate of HK$177.88, yet at a high 41.8x Price-to-Earnings Ratio, well above the Asian communications industry average of 36.3x and peer average of 15.5x.

- This creates a complex tension: while the valuation appears attractive based on DCF, the elevated PE ratio leaves little room for error if aggressive profit growth does not occur:

- Valuation seems compelling, but the premium PE could amplify downside if profit margins remain weak or sector growth falls short of expectations.

- The market is essentially expecting that forecasted earnings growth of 34.6% per year will justify paying such a high multiple today.

Five-Year Earnings Growth Masks Recent Weakness

- Despite averaging 7.4% annual earnings growth over the past five years, recent filings show a negative short-term earnings trend and falling margin, indicating that recent performance does not match the strong long-term trajectory.

- The prevailing market view is that industry upgrades and infrastructure spending should drive renewed momentum, but the current disconnect between past growth and future forecasts puts pressure on execution:

- Investors may focus on whether the company can deliver the forecasted 34.6% annual profit expansion despite the recent setback.

- Until margins recover, optimistic long-term growth projections may struggle to offset short-term concerns.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Yangtze Optical Fibre And Cable Limited's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Yangtze Optical’s sliding profit margin, recent earnings weakness, and high valuation all raise concerns about whether its strong growth forecasts will materialize.

If you want greater confidence in future returns, use our stable growth stocks screener (2108 results) to find companies that consistently deliver steady expansion. This approach can help balance growth with resilience through changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English