Dollar Tree (DLTR): Exploring Valuation After Mixed Short-Term Share Price Movements

See our latest analysis for Dollar Tree.

Dollar Tree’s 1-year total shareholder return of 52.85% reflects healthy long-term momentum. However, recent share price bumps indicate that momentum has cooled in the short run. With the latest share price at $98.8, investors appear to be recalibrating expectations as the industry faces changing consumer behavior and macro uncertainty.

If you’re curious to see what else is catching investors’ attention, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With its current valuation just under analyst targets and recent results reflecting both strengths and challenges, investors must ask: is Dollar Tree undervalued at these levels, or has the market already priced in the company’s future growth?

Most Popular Narrative: 8.8% Undervalued

With Dollar Tree closing at $98.8 and the narrative fair value at $108.35, the stage is set for a deeper look at why analysts believe the market may be underpricing the company’s future prospects.

Aggressive store expansion into new markets, including conversions of legacy stores and recent acquisitions (such as former 99 Cents Only and Party City locations), leverages underserved suburban and rural regions. This supports long-term unit growth and broadens the addressable customer base, thus driving higher revenue.

Want to know what really fuels this bullish price estimate? The calculations hinge on ambitious forecasts for revenue, profit margins, and a future earnings metric rarely seen in this sector. Click ahead for the full breakdown of the numbers behind the headline valuation.

Result: Fair Value of $108.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures and ongoing operational complexity could erode margins and challenge Dollar Tree’s ability to fully realize its growth forecasts.

Find out about the key risks to this Dollar Tree narrative.

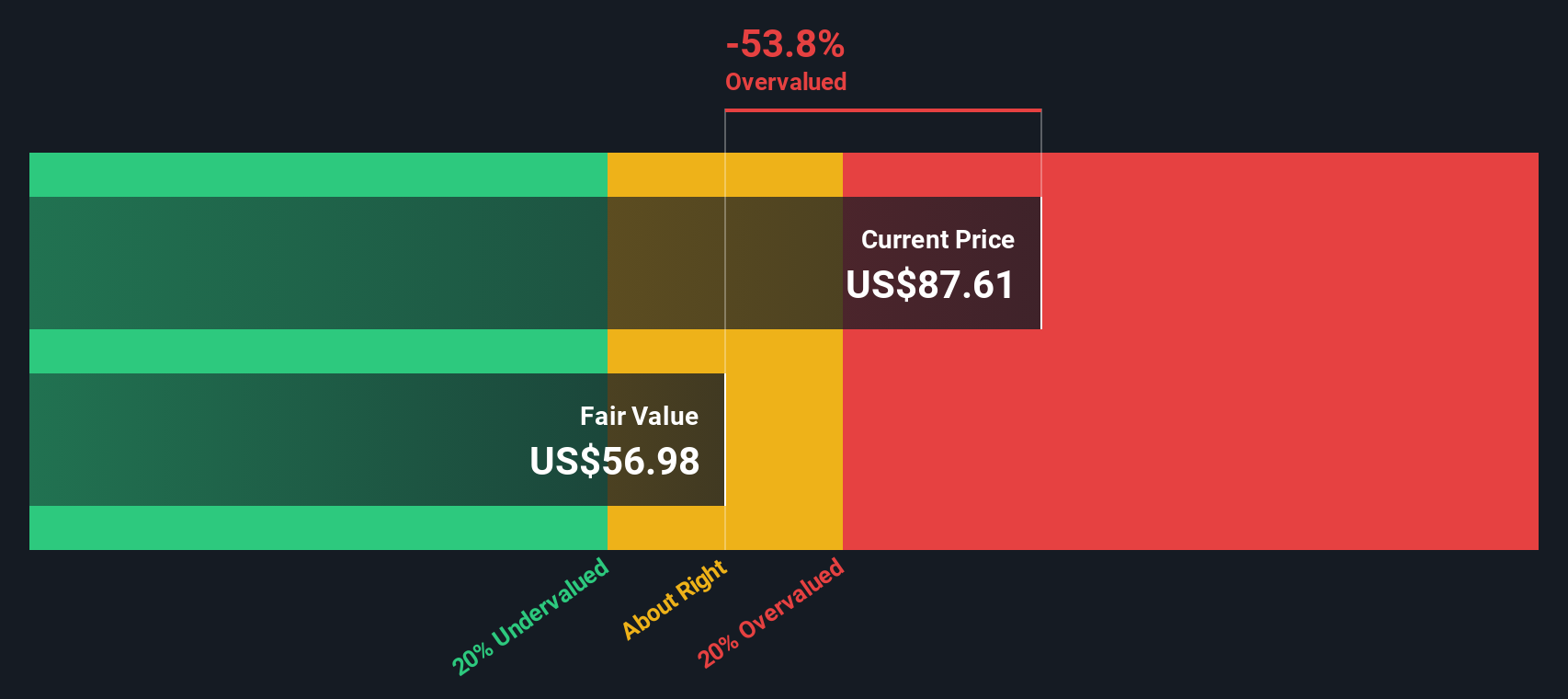

Another View: DCF Model Sees Things Differently

While the analyst consensus suggests Dollar Tree is undervalued, our SWS DCF model points to a much lower fair value of $57.34 per share. This indicates the current market price is well above what the company’s future cash flows might justify. Which method should investors trust for their next move?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dollar Tree for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 837 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dollar Tree Narrative

If the numbers or outlook above do not quite match your own views, dive in and build your own Dollar Tree scenario in just a few minutes. Do it your way

A great starting point for your Dollar Tree research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make sure you are not missing out on hidden gems and game-changers beyond Dollar Tree. Take your next investing step with these unique opportunities:

- Uncover high-yield income by targeting steady growth from these 24 dividend stocks with yields > 3% and see which companies are rewarding shareholders the most.

- Catalyze your portfolio by tapping into future technologies. Kickstart your search with these 28 quantum computing stocks pushing the frontier of computing innovation.

- Ride the momentum by checking out these 837 undervalued stocks based on cash flows, which is brimming with stocks trading at attractive discounts based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English