LKQ (LKQ) Trades at PE Discount Despite 3.1% Annual Earnings Decline Over Five Years

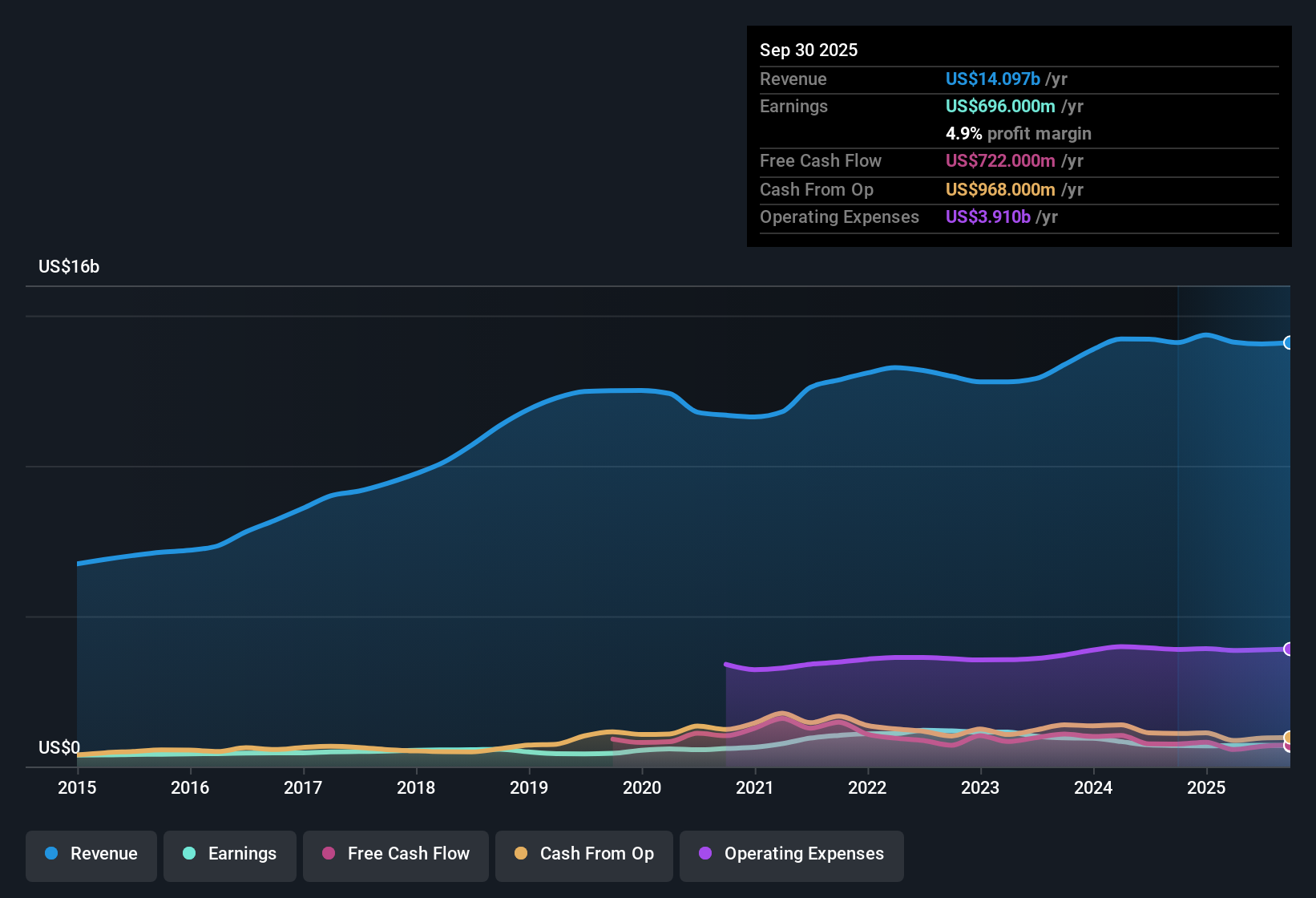

LKQ (LKQ) is forecast to grow earnings by 11.56% per year, with revenue expected to rise 2.8% annually, both trailing the broader US market growth rates. Despite profit margins slipping slightly to 5% from last year’s 5.1% and a 3.1% annual earnings decline over the last five years, the company continues to report high quality earnings. Current forecasts for profit and revenue growth set the stage for cautious optimism among investors heading into the next cycle.

See our full analysis for LKQ.With the headline figures in focus, the next section compares LKQ’s recent numbers to the narratives that drive market sentiment, highlighting exactly where the storylines converge or diverge.

See what the community is saying about LKQ

Cost Cuts Fuel Margin Upside

- LKQ's margin improvement goal is supported by $125 million of cost removals achieved over the last 12 months, with a further $75 million in cuts primarily targeted at Europe over the next few years.

- The consensus narrative highlights that these aggressive cost reductions, operational streamlining, and the shift to a leaner model should drive meaningful margin recovery and improved earnings as these changes take hold by 2026.

- Streamlined back office and SKU rationalization efforts are expected to stabilize European operations, supporting both revenue and margin expansion within 2 to 3 years.

- Analysts expect profit margins to climb from 5.0% today to 5.9% by 2026, creating runway for net margin gains even if top-line growth remains measured.

Price-to-Earnings Discount Stands Out

- LKQ trades at a Price-to-Earnings ratio of 11.3 times, significantly below both its industry average of 18 times and peer average of 23.3 times, and also below the analyst-implied 2028 forward PE of 15.6 times.

- Consensus narrative sees this PE discount as a potential opportunity, especially as current forecasts imply improving profit margins and stabilizing top-line growth.

- With the share price at $31.16 and DCF fair value estimated at $56.76, there is a sizable implied upside for value-focused investors if the margin improvement materializes.

- Analysts' consensus price target of $43.42 is 39% higher than the latest price, reflecting optimism that the business can achieve forecasted earnings improvements while resolving operational headaches.

Operational Challenges Remain a Drag

- One flagged risk is LKQ's financial position, as historical earnings have declined by 3.1% annually over the past five years and European operations continue to struggle with persistent competitive pressures and execution risks.

- Consensus narrative cautions that despite management’s cost-cutting and leadership changes, prolonged declines in organic revenue or failure to deliver on synergy targets in Europe could delay or undermine margin recovery and threaten return on investment.

- Bears argue that ongoing tariff disruptions and an evolving regulatory environment in Europe may complicate cost management and increase working capital requirements, raising the risk of disappointing gross margin outcomes.

- The company’s heavy reliance on transformation initiatives that have yet to generate sustained financial improvements adds to the risk, especially if growth projections fall short or macro headwinds intensify.

To see exactly how the current forecasts and challenges are shaping the balanced consensus view, read the key arguments and underlying numbers driving both sides of the debate. 📊 Read the full LKQ Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for LKQ on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot opportunities or interpret the data another way? Share your viewpoint by crafting your own take. It only takes a few minutes. Do it your way

A great starting point for your LKQ research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

LKQ faces persistent financial headwinds, with earnings trending down in recent years and continued challenges in its European operations affecting stability and margins.

If you want to put your money into companies with stronger balance sheets and more reliable fundamentals, find peace of mind using our solid balance sheet and fundamentals stocks screener (1981 results) that surfaces businesses built to weather uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English