Is Macy’s (M) Steady Dividend Approach a Sign of Resilience or Risk Amid Weak Sales?

- Macy's board of directors has declared a regular quarterly dividend of 18.24 cents per share, payable on January 2, 2026, to shareholders of record as of December 15, 2025, and recently unveiled an exclusive Marvel's Spider-Man collection spanning apparel, accessories, and home décor.

- While maintaining its dividend and launching new branded collaborations, Macy's has also remarked on ongoing sluggish demand and weak same-store sales, highlighting operational challenges amid changing consumer trends.

- We'll look at how Macy's continued dividend commitment reflects management's approach in the face of pressured sales and evolving demand patterns.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Macy's Investment Narrative Recap

For those considering Macy’s as a potential investment, the core case often centers on whether you see enduring value in its omni-channel retail model and brand partnerships despite ongoing consumer shifts. The latest dividend affirmation and exclusive Marvel’s Spider-Man collection offer some stability and high-profile promotion, but are unlikely to move the needle on the most pressing challenge: persistent sluggish demand and soft same-store sales, which remain the biggest swing factor for near-term performance.

Among recent developments, Macy’s launch of the Spider-Man collection stands out, aligning with efforts to refresh its merchandise mix and attract multi-generational shoppers. While this may boost store traffic and engagement, it does not materially offset concerns about longer-term revenue declines shaped by changes in consumer buying habits and ongoing store closures.

However, even with marketing wins, investors should watch for risks from continued store closures and decreasing foot traffic as...

Read the full narrative on Macy's (it's free!)

Macy's narrative projects $18.5 billion revenue and $663.0 million earnings by 2028. This requires a 6.5% yearly revenue decline and a $169.0 million earnings increase from current earnings of $494.0 million.

Uncover how Macy's forecasts yield a $16.12 fair value, a 17% downside to its current price.

Exploring Other Perspectives

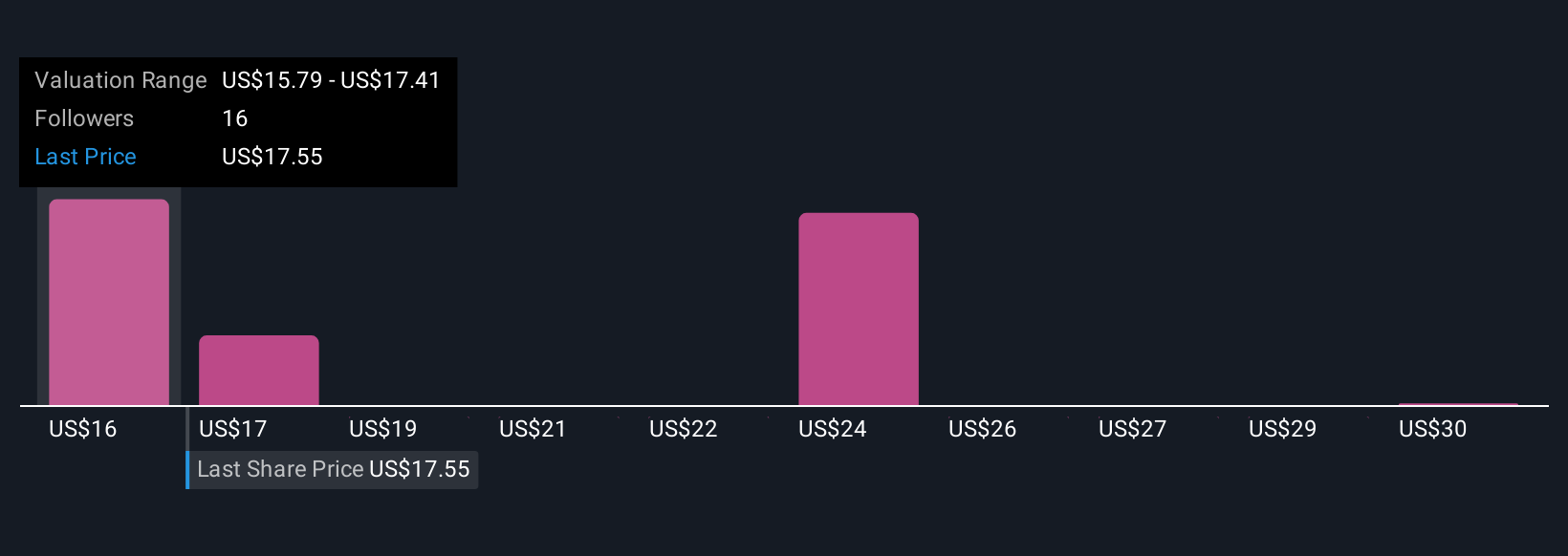

The Simply Wall St Community includes four fair value estimates for Macy’s, ranging from US$16.13 to US$32 per share. With consumer shifts toward e-commerce still front of mind, these differing viewpoints reveal just how much expectations vary on the company’s path ahead.

Explore 4 other fair value estimates on Macy's - why the stock might be worth 17% less than the current price!

Build Your Own Macy's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Macy's research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Macy's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Macy's overall financial health at a glance.

No Opportunity In Macy's?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English