Solid Power (SLDP) Teams With Samsung SDI and BMW on Next-Gen Battery Tech – What's Changed?

- In late October 2025, Samsung SDI announced a strategic collaboration with Solid Power and BMW to develop and validate a demonstration vehicle powered by all-solid-state battery (ASSB) technology, with Solid Power supplying sulfide-based solid electrolyte for cell manufacture and testing.

- This collaboration leverages the strengths of three major industry players to accelerate the commercialization of ASSB technology, which could improve vehicle battery energy density, safety, and battery life.

- We'll now explore how Solid Power's new partnership with Samsung SDI and BMW could affect its investment narrative and future prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Solid Power Investment Narrative Recap

For Solid Power shareholders, conviction largely rests on the belief that the company’s electrolyte technology will achieve broad validation and commercial adoption within the electric vehicle sector. The recently announced joint project with Samsung SDI and BMW is a clear positive for Solid Power’s product validation efforts, potentially accelerating its timeline toward market entry, however, the short-term financial impact and mitigation of its concentration risk are still uncertain.

Of all recent announcements, the expanded partnership with SK On (expected to generate at least US$50 million in revenue) stands out as a potentially relevant catalyst. This agreement, combined with the Samsung SDI and BMW collaboration, highlights increasing industry traction even as Solid Power faces ongoing cash burn and high capital requirements that could pressure its liquidity if losses persist.

By contrast, investors should be aware that reliance on a handful of major partners remains a key risk if expectations around commercial adoption or ongoing commitments do not fully materialize...

Read the full narrative on Solid Power (it's free!)

Solid Power's narrative projects $33.2 million in revenue and $1.6 million in earnings by 2028. This requires 13.5% yearly revenue growth and a $95.1 million increase in earnings from the current loss of $-93.5 million.

Uncover how Solid Power's forecasts yield a $4.00 fair value, a 25% downside to its current price.

Exploring Other Perspectives

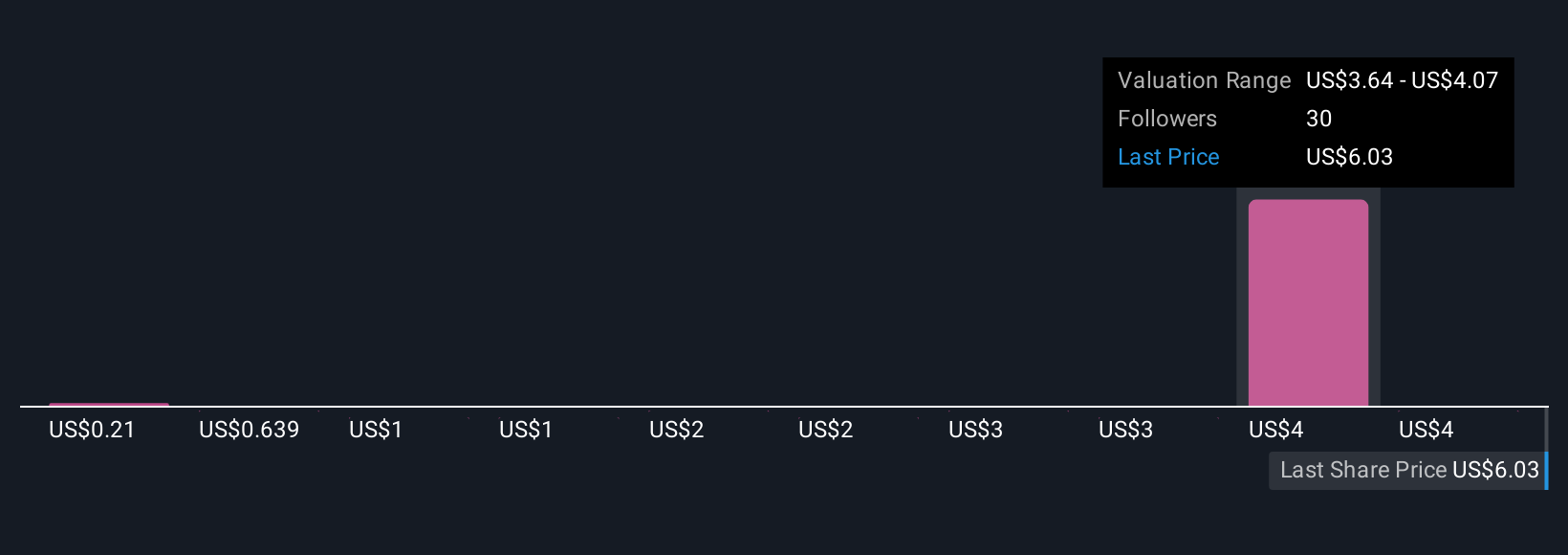

Seven members of the Simply Wall St Community set fair values for Solid Power ranging from US$0.21 to US$4.50 per share. With views this far apart, and given Solid Power’s heavy dependence on validating its technology through a few key automotive partners, you can weigh up a wide spectrum of market opinions before making your own call.

Explore 7 other fair value estimates on Solid Power - why the stock might be worth as much as $4.50!

Build Your Own Solid Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Solid Power research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Solid Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Solid Power's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English