First Solar (FSLR): Profit Margin Miss Challenges Bullish Growth Narrative

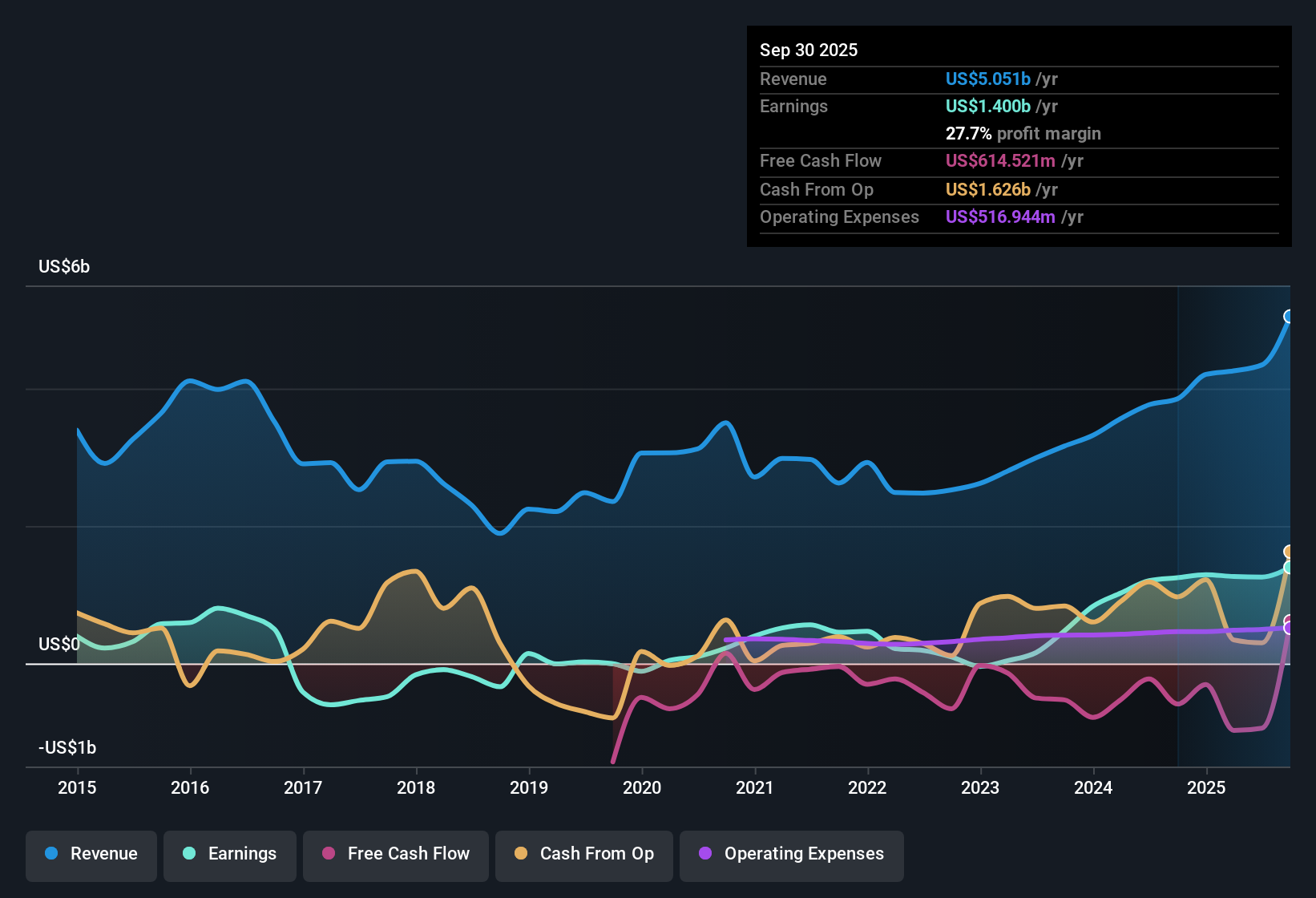

First Solar (FSLR) reported earnings growth of 12.2% over the past year, coming in below its robust five-year average of 36.9% per year. Net profit margins stand at 27.7%, lower than last year’s 32.4%. Looking ahead, analysts forecast annual earnings growth of 23.7% and revenue growth of 11.2%, both outpacing broader US market averages.

See our full analysis for First Solar.The real test is how these headline figures compare with the market’s prevailing narratives. Some expectations may remain unchanged, while others could be reconsidered.

See what the community is saying about First Solar

Policy Drives Outperformance, Margins Attempt a Comeback

- Analysts expect profit margins to expand from 29.0% today to 45.7% within three years, reflecting confidence in both pricing power and cost control as domestic solar demand accelerates.

- According to the analysts' consensus view, several US policy shifts and increased incentives now give First Solar a clear competitive edge, especially over foreign module makers.

- Consensus narrative highlights that new trade restrictions and domestic manufacturing incentives help shield margins and support strong long-term pricing. This aligns with the projected margin jump despite current compression.

- However, the anticipated improvement in margins relies heavily on maintaining policy support and continued innovation. The consensus view is that both factors are crucial for delivering these ambitious targets.

- For investors, the balance between policy tailwinds and execution on margin recovery could be pivotal for future upside.

📊 Read the full First Solar Consensus Narrative.

Manufacturing Scale and Backlog Secure Growth Path

- First Solar’s contracted backlog sits at $18.5 billion and 64 GW, with price adjusters tied to technology milestones and tariffs. This setup provides stability against market volatility and clear multi-year revenue visibility.

- The consensus narrative notes that as new Alabama and Louisiana plants come online, First Solar is positioned to tap further into tax credits and premium pricing from domestic content requirements.

- Expanding US capacity and innovation in thin-film modules are seen as strategic moves that help lock in high-visibility sales and improve the company's ability to weather global demand swings.

- Yet, persistent competition and evolving technology could pressure contracts and market share unless First Solar continues to deliver on technology milestones and cost discipline.

Valuation Gap: Discount to Peers and Analyst Targets

- First Solar trades at 20.4x Price-To-Earnings, lower than both its peer group (36.6x) and US semiconductor industry averages (37.7x). Its share price of $266.94 also remains below the DCF fair value estimate of $447.57 and just under the consensus analyst target of $259.11.

- Analysts' consensus view suggests this valuation points to potential upside, so long as the company can deliver on its growth forecasts.

- The low P/E and robust contracted backlog contribute to sentiment that the stock could rerate higher if margin expansion materializes, supporting the consensus target.

- Conversely, consensus warns that shifts in policy or weaker-than-expected margin recovery would challenge the case for a valuation catch-up versus industry peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for First Solar on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the numbers? It only takes a few minutes to share your perspective and shape the story your way with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding First Solar.

See What Else Is Out There

First Solar’s outlook for margin improvement and sustained outperformance depends heavily on policy continuity and the company’s execution. This makes future growth less predictable compared to steady, cycle-tested peers.

If choppy cash flow worries you, use stable growth stocks screener (2099 results) to focus on companies showing steady revenue and earnings through cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English