Butterfly Network (BFLY): Revenue Growth Outpaces Market but Persistent Losses Challenge Bull Case

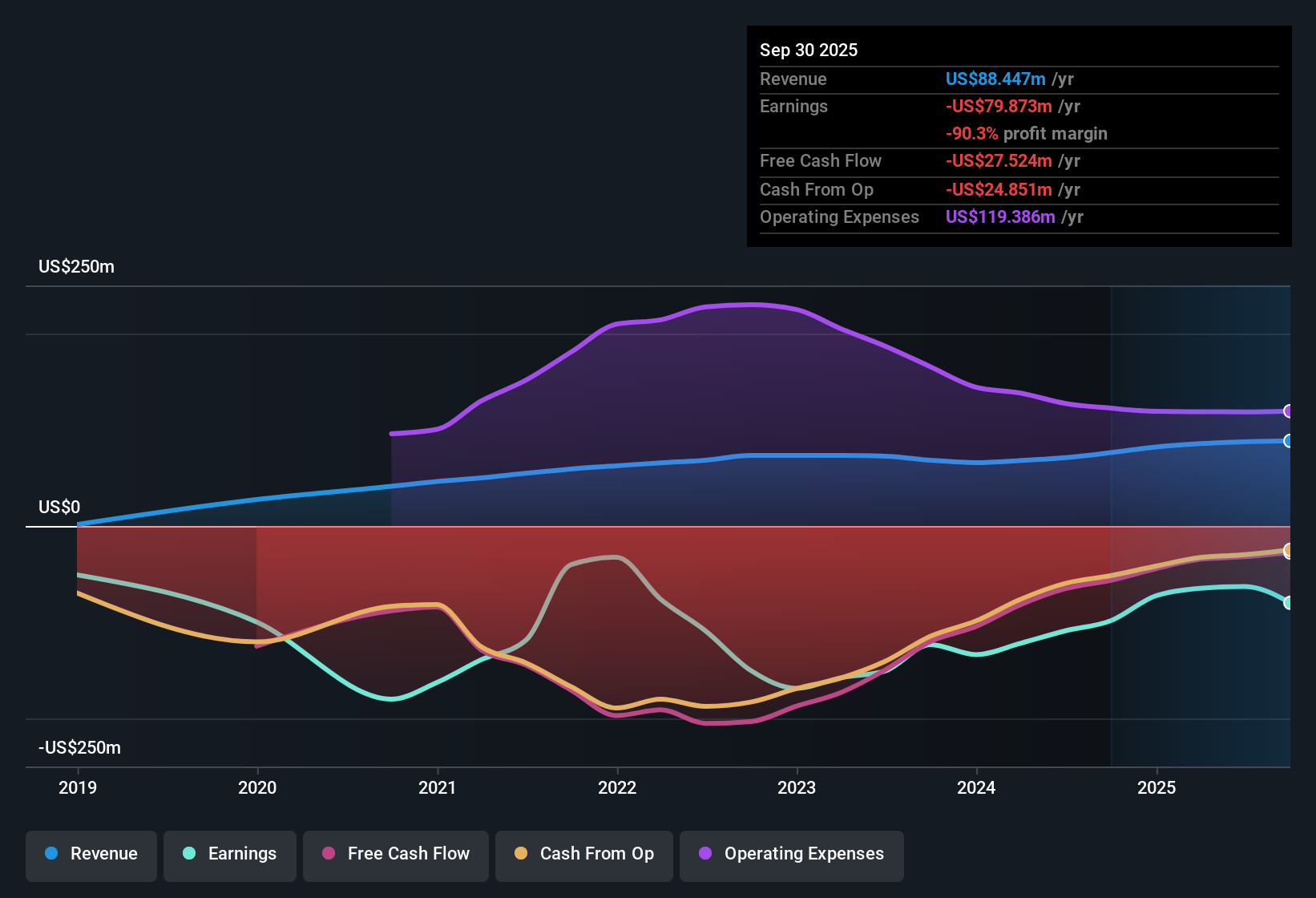

Butterfly Network (BFLY) remains unprofitable, but there are notable signs of progress. Losses have been reduced by 8.3% per year over the last five years. Revenue is forecast to grow 15.2% per year, well ahead of the US market average of 10.3%. Investors will likely find the company’s projected revenue trajectory encouraging. However, persistent unprofitability and a steep price-to-sales ratio of 7.7x keep the earnings outlook nuanced.

See our full analysis for Butterfly Network.Next, we will see how these headline numbers fit with the dominant narratives around Butterfly Network and whether the latest figures reinforce or challenge the market’s expectations.

See what the community is saying about Butterfly Network

Enterprise Deals Drive Recurring Revenue

- Butterfly Network’s pipeline of large enterprise and medical school partnerships, highlighted by the recent win of a top global health system rollout, signals real momentum for recurring digital revenue as healthcare shifts toward more decentralized, accessible diagnostics.

- Analysts' consensus view sees this enterprise revenue push as a key driver:

- Success with Compass AI software and clinician-friendly apps is expected to boost software subscription growth, increasing recurring, higher-margin revenue streams and supporting margin expansion.

- Despite these strategic wins, sluggish growth in the domestic market and volatility in international revenues call into question just how much recurring growth can be locked in if customer stickiness lags in core home markets.

Analysts think expanding partnerships could transform Butterfly’s business model, but the latest numbers keep the debate alive about how sustainably these deals will turn into profits. 📈 Read the full Butterfly Network Consensus Narrative. 📊 Read the full Butterfly Network Consensus Narrative.

High R&D Needs Prolong Path to Profit

- Butterfly continues to report negative margins, with analysts forecasting continued operating losses through at least the next three years because of significant ongoing R&D and technology investment requirements.

- Consensus narrative highlights a tension between growth ambitions and near-term profitability:

- Tech advancements such as P5 platform development and new AI software are intended to pave a path to future margin lift, but require high upfront investment that delays breakeven and puts pressure on overall earnings.

- Leadership transitions, including a recent CFO departure and an interim replacement, add uncertainty to execution and could disrupt operating focus during this critical investment phase.

Premium Valuation a Double-Edged Sword

- At a price-to-sales ratio of 7.7x, Butterfly trades at more than double the US Medical Equipment industry average of 3.1x and substantially above peers at 2.7x. This underscores the market’s willingness to pay up for growth but also sets a high bar for execution.

- Analysts' consensus view notes there is a clear disconnect between the $2.69 share price and the $3.17 analyst target, reflecting the premium placed on Butterfly’s future prospects versus today’s fundamentals:

- If projected annual revenue growth of 15.8% and a move to 12.5% profit margins by 2028 materialize, the current valuation could be justified. This path, however, assumes a dramatic turnaround in profitability and operating leverage not yet visible in reported results.

- With share count expected to rise 7.0% per year over the next three years, future returns risk being diluted unless outsized growth and margin improvements are delivered.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Butterfly Network on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the numbers tell a different story? Put your perspective together and shape a fresh narrative for Butterfly Network in just minutes. Do it your way

A great starting point for your Butterfly Network research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Butterfly Network faces persistent unprofitability, heavy investment needs, and a demanding valuation, which could test returns if growth or margins disappoint.

If you want greater value potential and less risk of overpaying, compare your options with these 833 undervalued stocks based on cash flows that match strong fundamentals to more reasonable prices right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English