Rocket Companies (RKT): Assessing Valuation After Recent Share Price Volatility

Rocket Companies (RKT) shares have seen varied movement over the past month, with the stock rising over 4% in the last day but dropping about 15% across the past month. Investors continue to weigh recent performance trends in relation to the wider market backdrop.

See our latest analysis for Rocket Companies.

Zooming out, Rocket Companies’ share price has surged over 53% so far this year, signaling a strong revival. However, recent momentum has cooled following last month’s pullback. Long-term investors have seen a 12% total shareholder return over the past year, reflecting gradual value-building amid a shifting market landscape.

If you’re on the lookout for your next opportunity, the market’s shifting trends make now a great time to discover fast growing stocks with high insider ownership

With shares recently bouncing back after a sharp dip, investors are now debating whether Rocket Companies’ current price accurately reflects its future potential, or if this could be an overlooked buy positioned for renewed growth.

Most Popular Narrative: 9.9% Undervalued

Compared to its last close price, Rocket Companies’ narrative fair value comes in higher, suggesting the stock could have more room to run. This sets the stage for some bold assumptions underpinning the prevailing narrative on future value.

The market may be ascribing premium value to Rocket's data ecosystem and cross-sell capabilities from the expanded "FinTech ecosystem." However, this could prove overly optimistic if younger demographic cohorts delay home-buying due to persistent affordability problems, which could dampen anticipated growth in customer lifetime value and overall revenues.

What is driving this optimism? Behind the headline fair value are aggressive growth assumptions and a powerful future profit surge, all wrapped up in a bold valuation framework. Find out which specific forecasts could redefine expectations. Dive into the narrative for the numbers and the reasoning that could shape Rocket Companies’ market story.

Result: Fair Value of $18.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent housing affordability issues and intensifying fintech competition could challenge Rocket Companies’ optimistic outlook and put the strength of its recent rebound to the test.

Find out about the key risks to this Rocket Companies narrative.

Another View: Market-Based Valuation

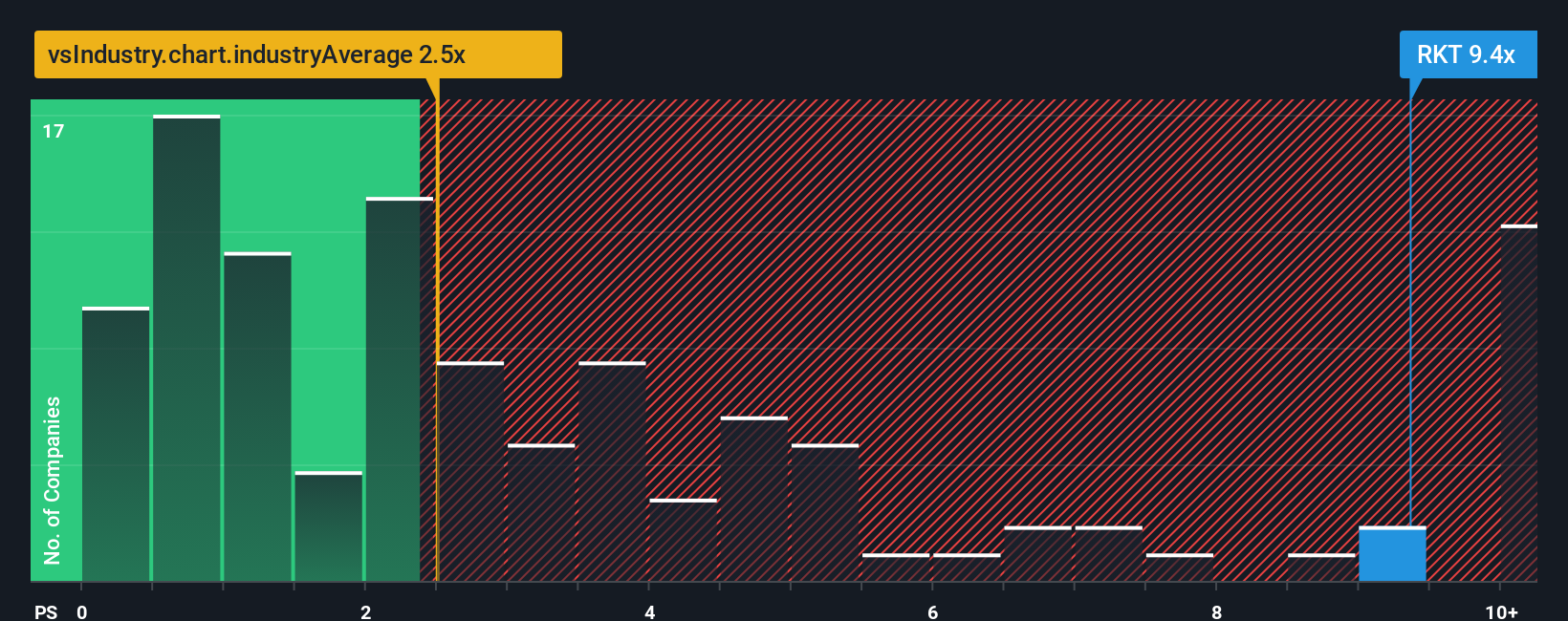

While the narrative points to Rocket Companies being undervalued, a look at its price-to-sales ratio tells a different story. At 9.1 times sales, the company trades much higher than both industry (2.4x) and peer (2.2x) averages. Even compared to its fair ratio of 9.1x, there is little apparent discount. This raises the stakes. Could the market be ripe for a re-rating, or are today’s expectations already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rocket Companies Narrative

If this perspective does not align with your own, or you want an independent take, you can piece together a personal narrative in just a few minutes. Do it your way

A great starting point for your Rocket Companies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep an edge by searching for tomorrow’s winners, not just today’s headlines. Don’t miss your chance to spot breakthrough opportunities others might overlook.

- Tap into up-and-comers targeting powerful trends in artificial intelligence when you try these 26 AI penny stocks to see who is positioned to disrupt entire industries.

- Fuel your strategy with steady income potential by checking out these 22 dividend stocks with yields > 3%, which highlights companies offering yields above 3% for resilient returns.

- Get ahead of the crowd and pinpoint undervalued businesses with strong underlying cash flows using these 832 undervalued stocks based on cash flows before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English