How QuantumScape’s 232.9% Rally and Automaker Partnerships Stack Up Against Its Fundamentals

- Ever wondered if QuantumScape is truly a hidden gem or just riding market hype? You are not alone. Investors everywhere are looking beneath the hood to see what the buzz is all about.

- The stock has rocketed higher this year, boasting a 232.9% gain year-to-date and a 260.2% return over the last twelve months, making it one of the standout performers in its sector.

- Part of this momentum comes on the heels of recent headlines highlighting new partnerships with major automakers and optimistic updates about breakthroughs in their solid-state battery technology. Headlines like these have fueled speculation, drawing both risk-takers and cautious observers into the QuantumScape conversation.

- But when it comes to the numbers, QuantumScape nabs a 0 out of 6 on our undervaluation checklist, meaning it did not pass any of the value screens investors often watch. Next up, let us dig deeper into the specific valuation approaches used to assess QuantumScape. Stick around for an even smarter way to put valuation into context by the end of this article.

QuantumScape scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: QuantumScape Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This approach attempts to determine what QuantumScape is truly worth, based on its ability to generate cash over time.

According to DCF analysis, QuantumScape’s current Free Cash Flow (FCF) is negative, at -$280 million. This reflects the company's continued heavy investment and early-stage business model. Analyst estimates show ongoing negative FCF for several more years, with projections only turning positive in 2029 when the company is expected to generate $167.5 million. These projections are extended over the next decade, with increasing FCF estimates through to 2035 as the company matures. All figures are based on cash flows in US dollars.

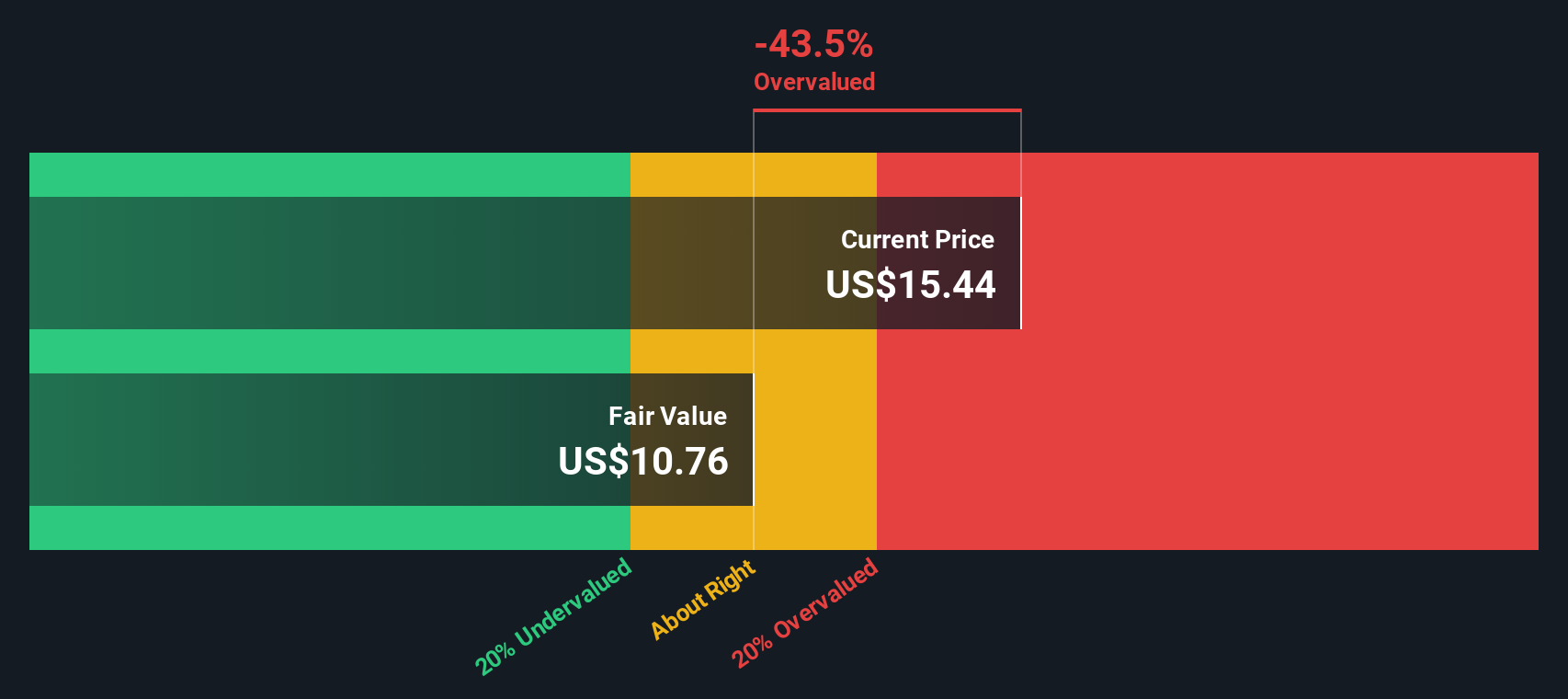

Based on the DCF model using these projections, the estimated fair value for QuantumScape shares comes out at $11.68. Compared to the current market price, DCF analysis suggests the stock is 57.9% overvalued at present.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests QuantumScape may be overvalued by 57.9%. Discover 832 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: QuantumScape Price vs Book

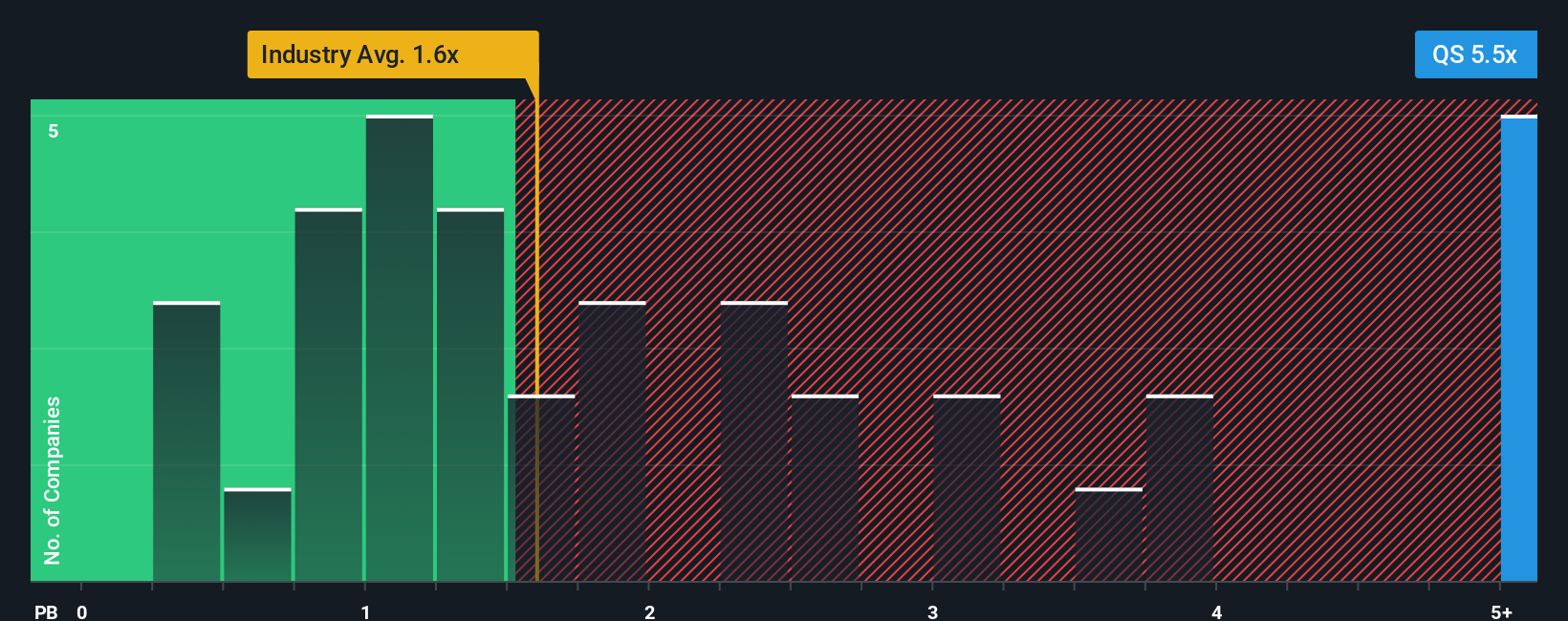

For companies like QuantumScape that are not yet profitable, the Price-to-Book (PB) ratio is often a more suitable way to value the business. Unlike price-to-earnings, PB ratios focus on the company’s net assets, which can provide investors with real-world context for what the stock price represents even when earnings are negative or unpredictable.

Growth prospects and risk play a major role in determining what is considered a normal or fair PB ratio. Higher expected growth or lower risk can justify paying a higher premium, while riskier or slower-growing companies typically trade closer to, or even below, their asset values. Context is important, so it is helpful to see where QuantumScape stands compared to its sector and peers.

QuantumScape currently trades at a PB ratio of 9.12x. For comparison, the average PB ratio among its Auto Components industry peers is 1.57x, while the peer group average is 3.40x. On the surface, this means QuantumScape’s shares are trading at a significant premium to their book value relative to both of those benchmarks.

This is where Simply Wall St’s “Fair Ratio” becomes relevant. Rather than relying solely on industry or peer averages, the Fair Ratio takes into account the company’s specific factors such as its growth outlook, profitability, risk profile, market capitalization, and industry dynamics. This proprietary measure offers a more tailored view of whether QuantumScape’s multiple is justified, particularly for innovative, high-growth businesses where traditional benchmarks may not fully apply.

Comparing QuantumScape’s PB ratio directly with the Fair Ratio can show whether the current market valuation is reasonable. If the stock’s actual PB multiple is significantly above its Fair Ratio, the stock could be overvalued, while trading below would suggest it is undervalued. In this case, QuantumScape’s PB ratio is much higher than both the peer and industry averages, and based on the absence of a Fair Ratio provided, the elevated multiple suggests an overvalued stock when considering its current fundamentals.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your QuantumScape Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, powerful tool that lets investors explain their perspective on a company by connecting its story and unique potential to a detailed financial forecast and their own estimate of fair value. Narratives help make sense of the numbers by linking what you believe about QuantumScape’s future, such as how fast revenues might grow, expected margins, or breakthrough milestones, to a clear financial outcome.

On Simply Wall St’s Community page, millions of investors can quickly create and update Narratives, seeing how their outlooks and assumptions compare to others in real time. Narratives do not just sit still; they respond dynamically to new information, like big news announcements or quarterly results, refreshing your valuation so you always see how the latest developments impact your thesis.

By using Narratives, you can easily compare your Fair Value with the current market price, helping you decide when you believe buying or selling makes sense. For example, some QuantumScape bulls see significant potential ahead and assign a Fair Value as high as $25 a share, while the most cautious skeptics set their estimate much lower. In just a few clicks, you can pick the Narrative that fits your view or create your own, making investment decisions smarter and more tailored to your conviction.

Do you think there's more to the story for QuantumScape? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English