Does Affirm's (AFRM) Worldpay and Wayfair Expansion Redefine Its Path to Broader Market Access?

- In October 2025, Affirm announced expanded partnerships with Worldpay and Wayfair, leading to wider integration of its payment solutions across over 1,000 SaaS platforms and the entire Wayfair brand portfolio, offering flexible pay-over-time plans to more online and in-store shoppers.

- The integration with Worldpay alone connects Affirm to a payments ecosystem handling over US$400 billion in annual transaction volume, potentially giving it access to a much larger merchant and consumer base.

- We'll explore how Affirm's broadening reach through Worldpay's high-volume platform could reshape its growth prospects and investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Affirm Holdings Investment Narrative Recap

To be an Affirm shareholder, you need to believe that ongoing partnerships with major payment processors and retailers will widen Affirm’s reach and support continued top-line growth, even as elevated interest rates and the risk of losing a large merchant partner remain prominent factors. The recently announced Worldpay and Wayfair integrations may help offset potential disruptions to gross merchandise volume in the near term, but the most immediate risk around partner concentration has not fundamentally changed as a result of these deals.

Among recent announcements, the Worldpay partnership stands out for its potential to give Affirm direct access to a vast payments ecosystem, over US$400 billion in annual volume, making it the most relevant news item for investors assessing short term catalysts for market penetration and further merchant adoption. This integration amplifies Affirm's exposure among SaaS platforms and strengthens its argument for ongoing merchant and consumer growth, though long-term profitability will still hinge on controlling costs and maintaining differentiation in a competitive market.

But while new partnerships can broaden reach, investors should remember the underlying challenge if a single major integration were to disappear and...

Read the full narrative on Affirm Holdings (it's free!)

Affirm Holdings' narrative projects $6.0 billion in revenue and $756.6 million in earnings by 2028. This requires 22.9% yearly revenue growth and a $704.4 million increase in earnings from $52.2 million today.

Uncover how Affirm Holdings' forecasts yield a $96.30 fair value, a 34% upside to its current price.

Exploring Other Perspectives

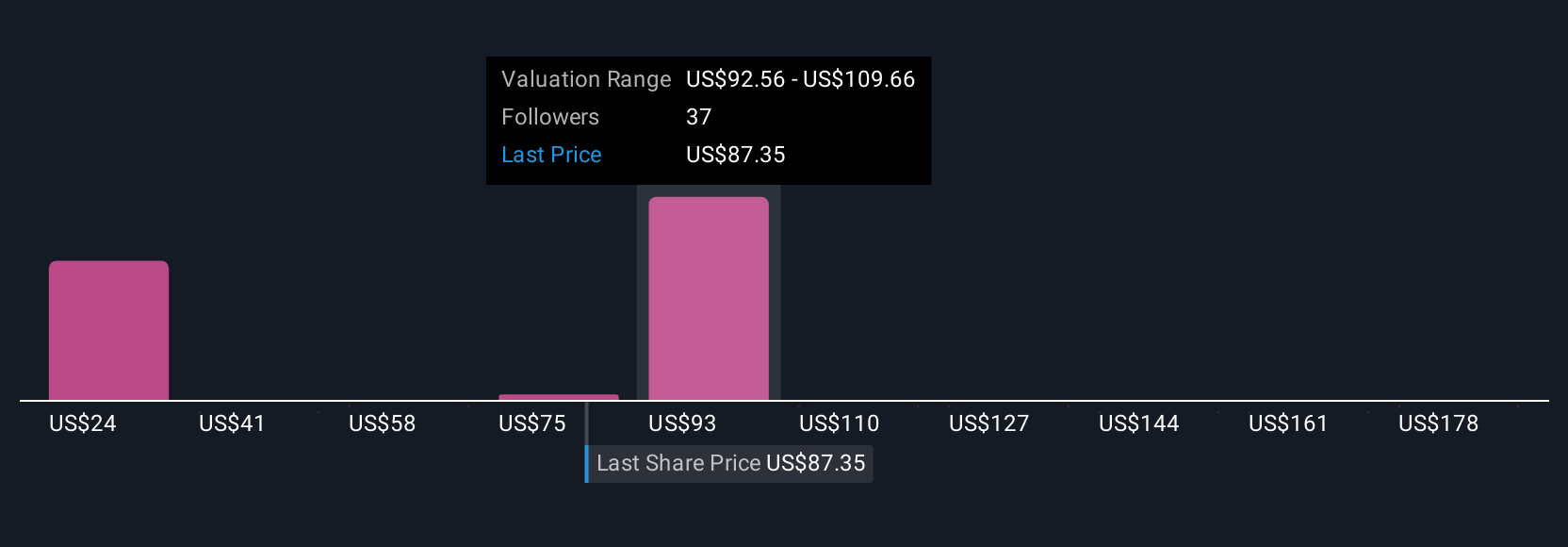

Simply Wall St Community members provide 18 fair value estimates for Affirm that range widely from US$24.18 to US$140. With partner expansion now front of mind, expectations for increased merchant adoption may warrant a closer look at why these viewpoints differ so much.

Explore 18 other fair value estimates on Affirm Holdings - why the stock might be worth less than half the current price!

Build Your Own Affirm Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Affirm Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Affirm Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Affirm Holdings' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English