‘Painful But Necessary’ Job Cuts at Target Support Buying the High-Yield Dividend Stock Here

Target Corporation (TGT) announced plans to eliminate approximately 1,800 corporate positions on Oct. 23, its first major workforce reduction in a decade. The cuts include about 1,000 current roles and 800 unfilled positions, or roughly 8% of the global corporate team.

The move comes as sales remain under pressure, with a 1.9% decline in comparable store sales in the most recent quarter and annual revenue essentially flat over the last four years. TGT shares have tumbled 31.97% year-to-date (YTD), closing at $92.91 on Oct. 30.

Even with the slide, the stock still pays a high-yield dividend at 4.84% annually. The company’s market value has fallen to $43 billion, and the stock is down 64% from its all-time highs, trailing key rivals like Walmart (WMT) and Costco (COST).

Still, Jefferies analyst Corey Tarlowe maintained a “Buy” rating after the announcement, calling the move painful but necessary and suggesting incoming CEO Michael Fiddelke, who takes over in February 2026, is ready to make tough calls after several years of weak results.

Can these drastic cuts truly lay the foundation for a turnaround, or are they simply a desperate attempt to stem the bleeding at a retailer that has lost its competitive edge? Let’s find out.

Target's Current Financial Standing

Target operates one of the most recognizable discount retail chains in the U.S., with more than 1,900 stores and a model that connects in-store shopping with fast digital fulfillment like Drive Up and same-day delivery.

Over the last 52 weeks, TGT stock is down 38.01%, which shows investors have been worried about softer demand.

Even so, the shares look inexpensive on a relative basis: the forward P/E is 12.68x versus 16.06x for the Consumer Staples sector, pointing to a noticeable discount.

In the second quarter of 2025, net sales were $25.2 billion, down 0.9% year-over-year (YoY), an improvement of nearly two percentage points versus the first quarter. Comparable sales fell 1.9%, with stores down 3.2%, partly offset by 4.3% growth in digital. Traffic dipped 1.3%, and the average ticket slipped 0.6%.

Profitability tightened: operating income fell 19.4% to $1.3 billion, and gross margin compressed by 100 bps to 29% on heavier markdowns, purchase order cancellation costs, and mix. Diluted EPS was $2.05, down 20.2% from $2.57 and just under the $2.09 consensus. There were some clear offsets: non‑merchandise sales climbed 14.2% with Roundel advertising, membership, and marketplace all growing double digits, and digital comps rose 4.3% with more than 25% growth in same‑day delivery through Target Circle 360 plus continued Drive Up momentum.

What's Driving Target's Strategic Reset

Target is backing its growth plan by putting newer features in stores, like a first-of-its-kind accessible self-checkout experience nationwide, designed specifically for guests with disabilities, including those who are blind or have low vision. These upgrades are rolling out in stores across the country this holiday season and into early 2026.

At the same time, Target is working with Alloy.ai to improve its supplier network. Alloy.ai takes sales and supply chain data, spots store shelves running low, and figures out what needs to be restocked. This system should save time, help stores avoid empty shelves, and make sure popular products don’t run out—good news for sales and inventory turnover.

Target’s focus on digital sales is improving as well. Online and same-day delivery services saw noticeable growth this quarter, with Drive Up and Target Circle 360 leading the way. These options give shoppers more reasons to visit Target, especially as more people want convenient, fast ways to buy.

For income-focused investors, the dividend remains a key draw. The annual yield is 4.50% to 4.63%, well above the consumer staples average of 1.89%. The forward payout ratio sits at 58.62%, backed by 55 straight years of dividend increases, and the most recent quarterly dividend was $1.14 per share paid on Aug. 13.

Analyst Confidence in Target's Path Forward

For fiscal 2025, management expects a small, low single-digit drop in sales, with GAAP EPS between $8 and $10 and adjusted EPS, which excludes litigation gains, between $7 and $9.

Beyond Jefferies, DA Davidson remains one of the more positive voices. On Oct. 13, it cut its price target from $115 to $108 but kept a “Buy” rating. The firm points to expense control and the turnaround plan, arguing that the tough job cuts should lift margins as the cost actions flow through results.

A day later, Evercore ISI’s Greg Melich took a more cautious view, trimming the target from $103 to $100 and keeping an “In Line” rating. Evercore flagged heavier promotions and softer in-store sales as key issues, the kind of near-term pressures that temper sentiment even as operations improve.

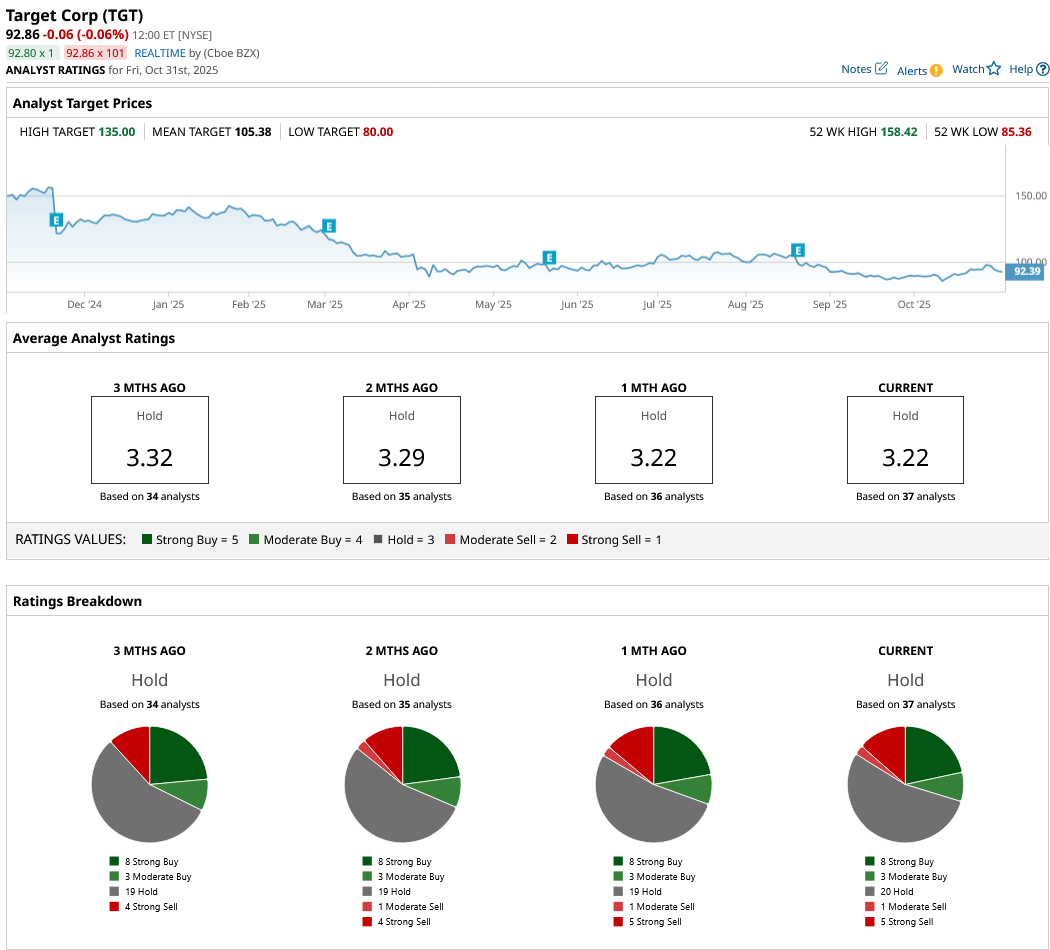

Consensus is steady but cautious. Among 37 analysts, TGT stock holds a “Hold” rating overall. The average target price is $105.38, which suggests about 13% upside from the current price.

Conclusion

When all is said and done, Target’s sweeping layoffs and tech-driven resets are tough pills to swallow, but they might just be what the retailer needs after years of stagnation. With new leadership and a leaner playbook, the odds of seeing modest upside are reasonably strong, especially for patient income investors drawn by the high-yield dividend. If progress sticks and consumer demand steadies, shares could finally find their footing. So the next year looks more promising than the last, though caution still makes sense.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English