Will Settling Investor Lawsuit Let Rivian (RIVN) Refocus on Growth and Its R2 Launch?

- Rivian recently agreed to pay US$250 million to settle a 2022 securities class action lawsuit, with US$67 million funded by insurance and the remainder from cash on hand, following allegations related to disclosures after its IPO; this resolution is pending court approval.

- By removing this legal overhang, Rivian can now direct more resources toward its upcoming R2 mass market EV launch and key production initiatives.

- We'll examine how resolving the major investor lawsuit may influence Rivian's growth priorities and its evolving investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Rivian Automotive Investment Narrative Recap

To be a Rivian shareholder, you need confidence in the company’s ability to turn heavy investment in design, manufacturing, and product launches, especially the upcoming R2 SUV, into long-term gains, even through periods of high cash burn and evolving EV incentives. The newly announced US$250 million lawsuit settlement removes a visible legal headwind, but it does not change the immediate importance of successfully launching the R2, or reduce the most pressing risk: Rivian’s elevated cash burn and potential need for future capital raising.

Among recent developments, Rivian broke ground on its new Georgia manufacturing plant, which will play a significant role in scaling R2 and R3 production. This investment ties directly to the company’s main short-term catalyst, the market launch of its next-generation, more affordable EVs, while also compounding pressure on liquidity if costs escalate or sales fall short of expectations.

However, investors should be aware that if Rivian’s R2 segment fails to resonate with buyers or meet internal targets, particularly given its...

Read the full narrative on Rivian Automotive (it's free!)

Rivian Automotive's outlook anticipates $15.7 billion in revenue and $788.9 million in earnings by 2028. This scenario assumes 44.9% annual revenue growth and an earnings improvement of about $4.3 billion from the current level of -$3.5 billion.

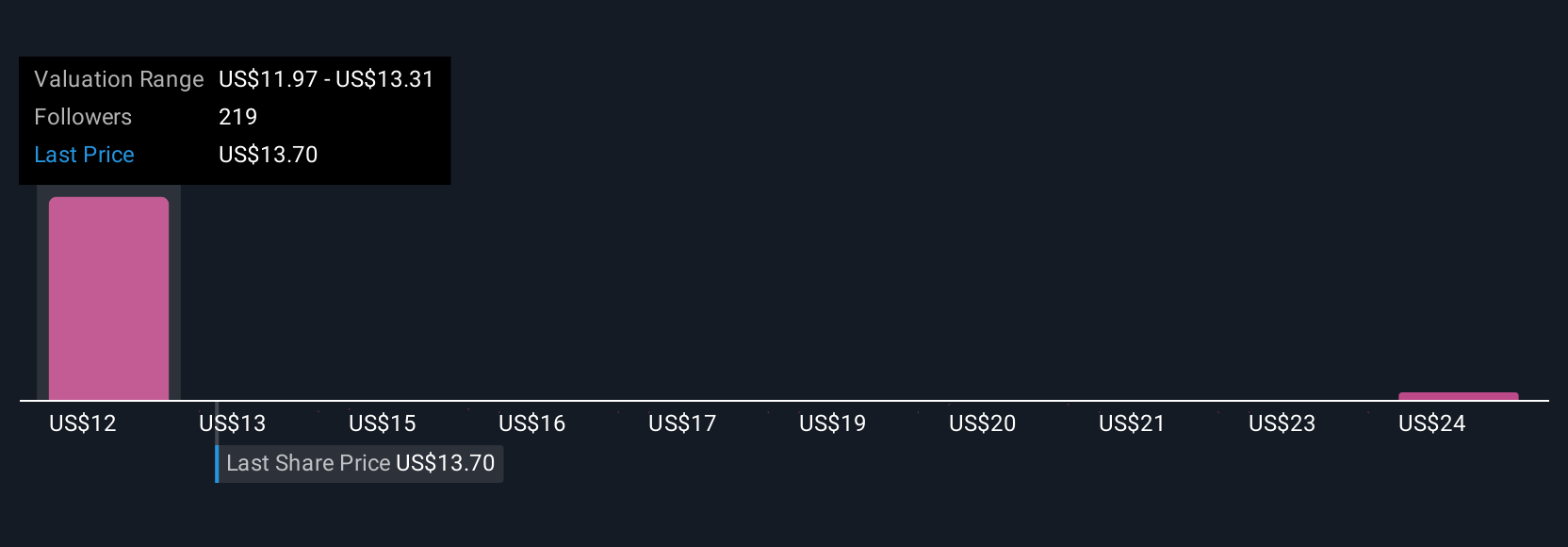

Uncover how Rivian Automotive's forecasts yield a $14.35 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Sixteen fair value estimates from the Simply Wall St Community range from US$8.25 to US$25.41 per share. As Rivian commits significant resources to its R2 launch, opinions vary widely on what this means for future results, explore several perspectives to see how your own view compares.

Explore 16 other fair value estimates on Rivian Automotive - why the stock might be worth 39% less than the current price!

Build Your Own Rivian Automotive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rivian Automotive research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Rivian Automotive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rivian Automotive's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English