Assessing the Opportunity in Kohl's After Recent Buyout Speculation and 16% Price Jump

- Thinking about whether Kohl's is a hidden gem or just another department store stock? You're not alone. There's a lot to unpack if you're curious about where the value really lies.

- After a modest 16.0% jump so far this year, but a -0.7% dip in the last week, Kohl's price is showing both signs of renewed optimism and lingering caution from investors.

- Much of this movement comes as the sector faces speculation about changing consumer habits and reports of activist investor interest aiming to shake up company strategy. Notably, recent headlines suggest strategic partnerships and discussions around potential buyout offers have added intrigue, fueling both excitement and uncertainty in the market.

- The company currently scores a 5 out of 6 on our value check, indicating undervaluation in most metrics. Let’s dig into what this means by looking at traditional valuation methods next. Stay tuned, because there’s an even clearer way to spot value that we’ll reveal at the end.

Find out why Kohl's's -3.7% return over the last year is lagging behind its peers.

Approach 1: Kohl's Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a business by forecasting its future cash flows and then discounting those amounts back to today’s dollars. By looking at future expected free cash flow, this method works to gauge what the business should be worth if current projections hold true.

For Kohl's, recent calculations put its last twelve months’ free cash flow at $431 million. Analysts forecast this figure to continue rising, with projections reaching $640 million by 2028. Looking further ahead, from 2026 through 2035, Simply Wall St extrapolates cash flows expected to reach $858 million in 2035, with each year’s value discounted back to present day to account for time and risk.

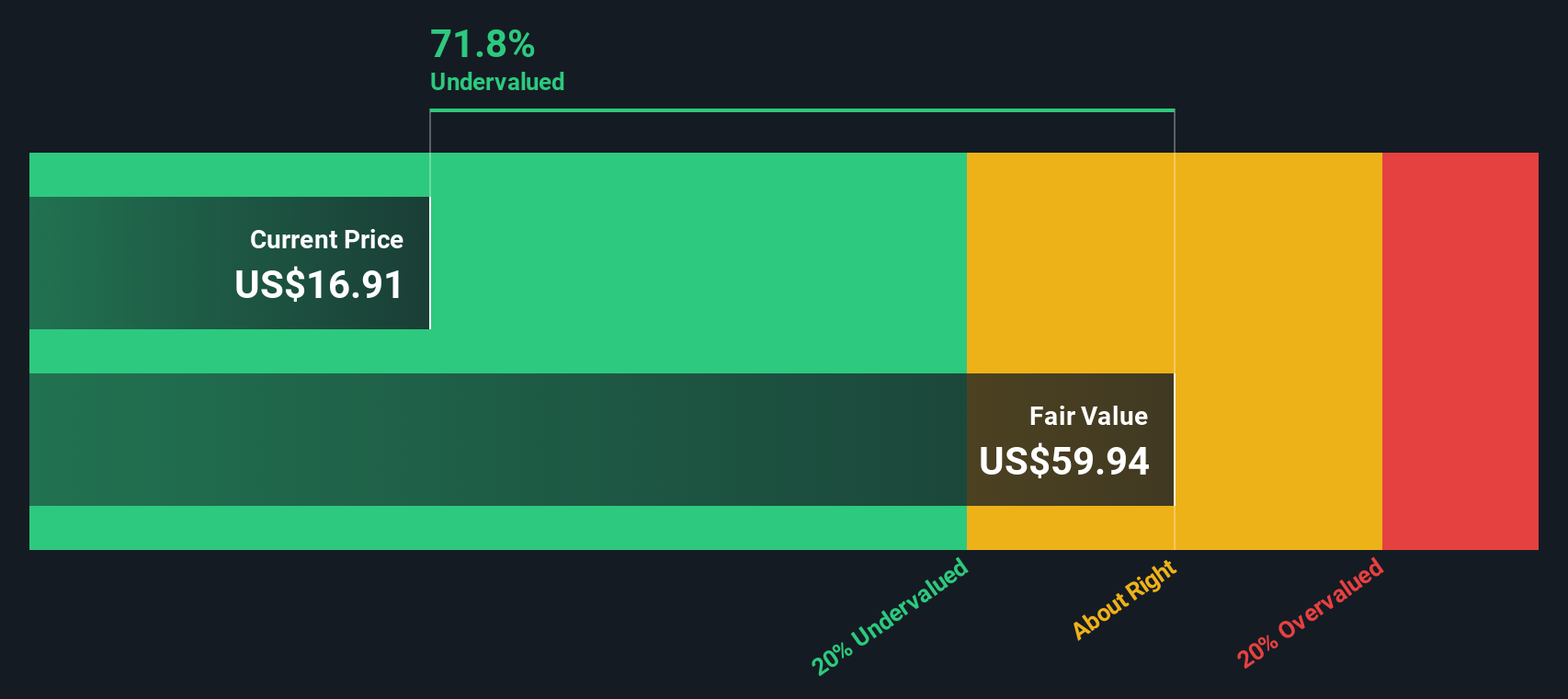

Based on these cash flow projections and discounting, the DCF model values Kohl’s intrinsic worth at $61.47 per share. Remarkably, this is about 73.5% higher than the current price, suggesting the market is undervaluing the stock by a significant margin right now.

In summary, the DCF points to Kohl’s as a clear value opportunity for long-term investors focused on fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kohl's is undervalued by 73.5%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: Kohl's Price vs Earnings

The price-to-earnings (PE) ratio is a highly effective metric for evaluating companies like Kohl’s that generate consistent profits. Since it measures how much investors are willing to pay for each dollar of current earnings, the PE ratio is most meaningful for established, profitable businesses in stable sectors.

Interpreting the PE ratio requires considering growth prospects and risk. High-growth companies typically warrant higher PE ratios, while those facing headwinds or risks often trade at lower multiples. In addition, industry dynamics and economic cycles play a significant role in what is considered a “normal” or “fair” PE for any given stock.

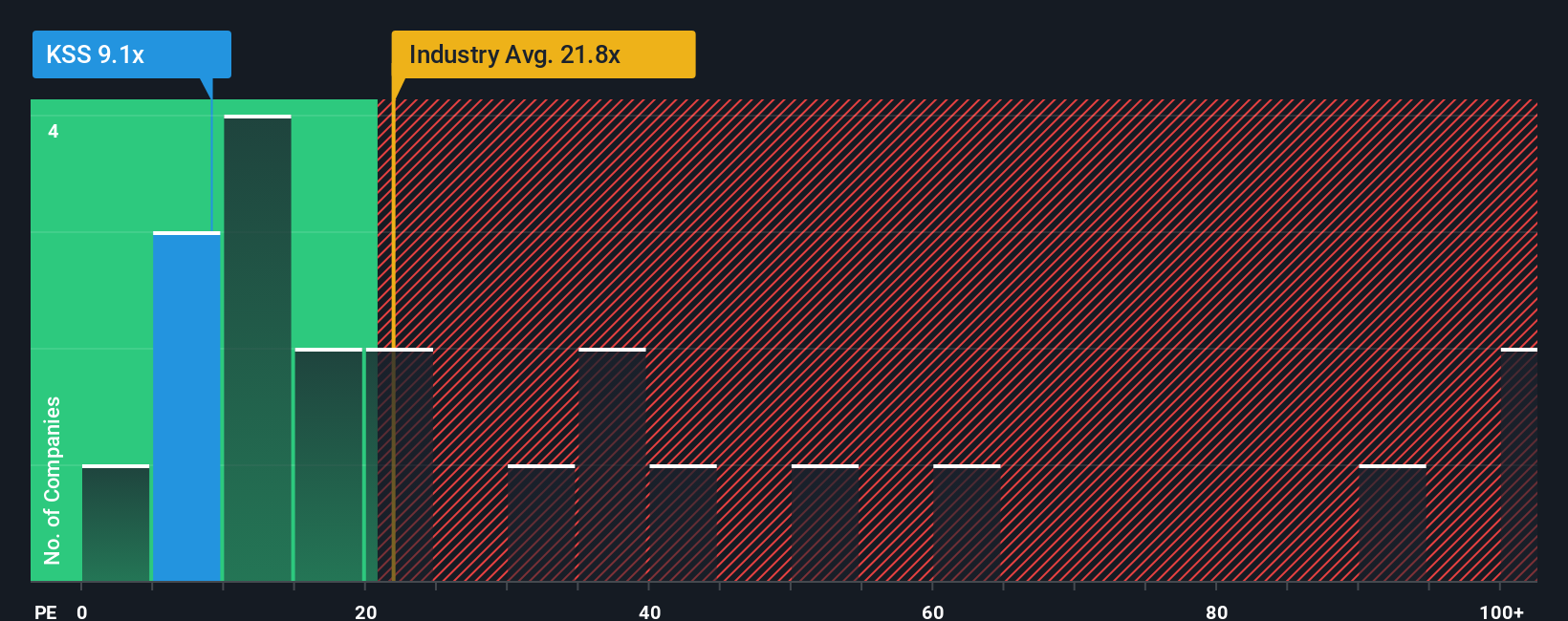

As it stands, Kohl’s trades at a PE ratio of just 8.7x. For context, the average for the Multiline Retail industry is substantially higher at 19.8x, and the peer group average comes in at 28.2x. This sizable gap suggests Kohl’s is much more cheaply valued than both its direct competitors and the broader sector.

However, to get a truer sense of value, it is important to look beyond raw industry and peer multiples. Instead, Simply Wall St’s proprietary “Fair Ratio” calculates a customized benchmark, factoring in not only Kohl’s unique growth potential and risk profile but also its profit margins, market cap, and its industry as a whole. The Fair Ratio distills all these variables into a single figure, making it a more accurate gauge than simple industry averages or peer comparisons.

Kohl’s Fair Ratio stands at 22.4x, well above its current 8.7x multiple. This discrepancy indicates that, relative to its own fundamentals and outlook, Kohl's is undervalued by the market at present.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kohl's Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives, a more powerful and intuitive approach to investing that brings the story behind the numbers front and center.

A Narrative is your unique take on a company’s outlook, tying together your expectations for things like future revenue, earnings, and profit margins, and turning that story into a fair value estimate, all in one place.

By linking a company’s current realities with your financial assumptions and forecast, Narratives help you answer the key question: “What do I think this stock should be worth, and why?”

Narratives are available for every stock on the Simply Wall St Community page, where millions of investors share and compare their perspectives. This makes it easy and accessible to see how different stories lead to different valuations.

They update automatically when news, earnings, or key events hit, ensuring that your view of fair value always reflects the latest information. This helps you make informed buy or sell decisions in real time.

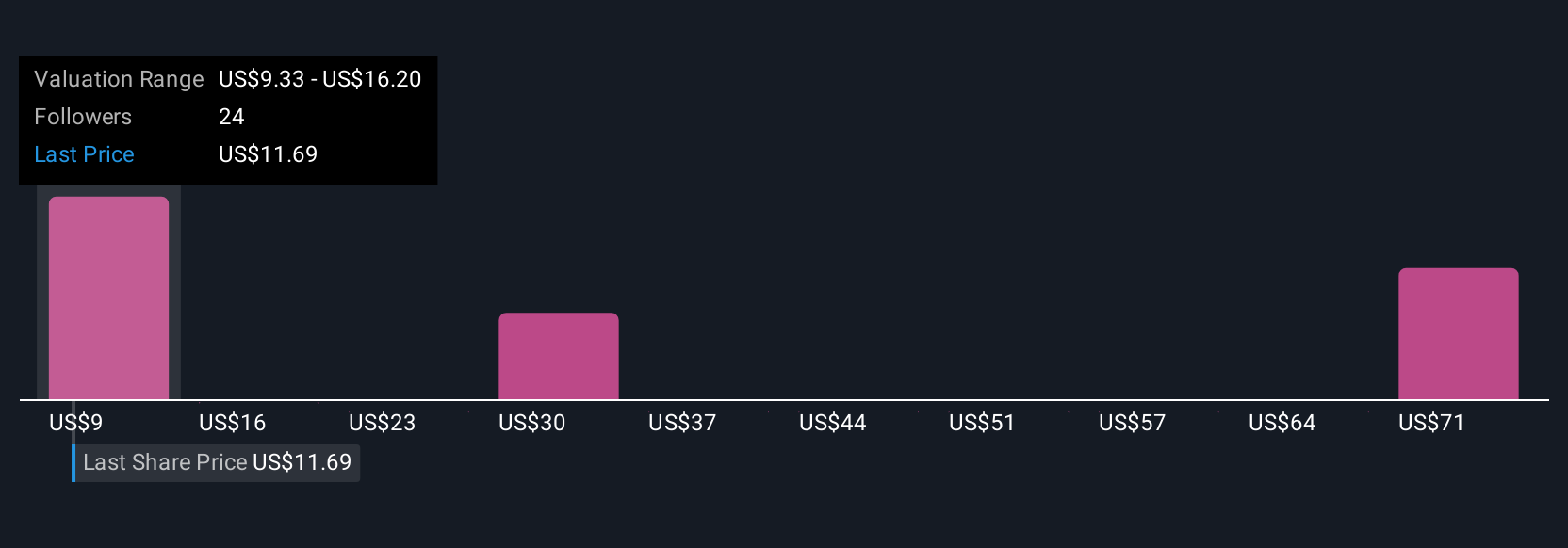

For example, some investors currently value Kohl’s as high as $34 per share, based on its tangible assets and turnaround potential, while others see fair value closer to $14, reflecting a more cautious narrative about retail headwinds. This demonstrates how powerful it can be to define your own Narrative.

For Kohl's, we'll make it really easy for you with previews of two leading Kohl's Narratives:

Fair value: $34.00

Current price is approximately 52.1% below this target

Forecast revenue growth: 48.01%

- Kohl’s price drop is seen as a market overreaction, with shares now trading well below both historical and liquidation value despite strong free cash flow and significant real estate holdings.

- Bankruptcy is considered highly unlikely, as underlying financials suggest misinterpretation and excessive pessimism; lease liabilities are being overstated relative to true debt.

- Management’s store rationalization and ongoing profitability, combined with a book value above $34 per share, point to strong upside potential and possible buyout interest.

Fair value: $14.92

Current price is approximately 9.1% over this target

Forecast revenue growth: -1.52%

- Persistent declines in customer transactions and slow digital adoption threaten revenue growth, as brick-and-mortar retail faces structural headwinds and a shrinking core demographic.

- Rising labor costs, heavy promotional activity, and sluggish digital transformation keep margins under pressure, limiting the potential for sustainable profit recovery.

- Consensus analyst forecasts expect continued earnings and revenue challenges through 2028, with a consensus price target below the current share price despite turnaround initiatives and strategic partnerships like Sephora.

Do you think there's more to the story for Kohl's? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English