Can PriceSmart’s (PSMT) Revenue Growth Offset Concerns About Declining Sales Figures?

- PriceSmart, Inc. recently released its earnings for the fourth quarter and full year ended August 31, 2025, reporting revenue of US$1.33 billion for the quarter and US$5.27 billion for the year, alongside year-over-year net income growth to US$31.54 million for the quarter and US$147.89 million for the year.

- Despite a substantial year-over-year decrease in reported "sales," revenue and earnings showed growth, with increases in both basic and diluted earnings per share from continuing operations.

- We'll explore how PriceSmart's higher revenue and earnings in the latest results influence its investment narrative and outlook for ongoing club expansion.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

PriceSmart Investment Narrative Recap

To be a PriceSmart shareholder, you need to see value in the company's ability to drive consistent revenue and earnings growth through expansion in Latin American and Caribbean markets, despite economic and operational complexity. The latest earnings release, showing higher revenue and net income, adds confidence to the near-term catalyst of club expansion but does not materially alter the biggest risk, exposure to currency volatility and liquidity challenges in key markets.

One recent announcement of interest is the new partnership with Synergy CHC Corp., bringing FOCUSfactor® products to 47 clubs across 13 countries. This move aligns with PriceSmart's focus on expanding product offerings to a growing membership base, potentially supporting club traffic and addressing consumer wellness trends.

Yet, it's important to contrast this growth narrative with the ongoing foreign currency risks facing the business, which investors should not overlook...

Read the full narrative on PriceSmart (it's free!)

PriceSmart's narrative projects $6.9 billion in revenue and $209.1 million in earnings by 2028. This requires 10.1% yearly revenue growth and a $66.5 million earnings increase from the current $142.6 million.

Uncover how PriceSmart's forecasts yield a $116.67 fair value, in line with its current price.

Exploring Other Perspectives

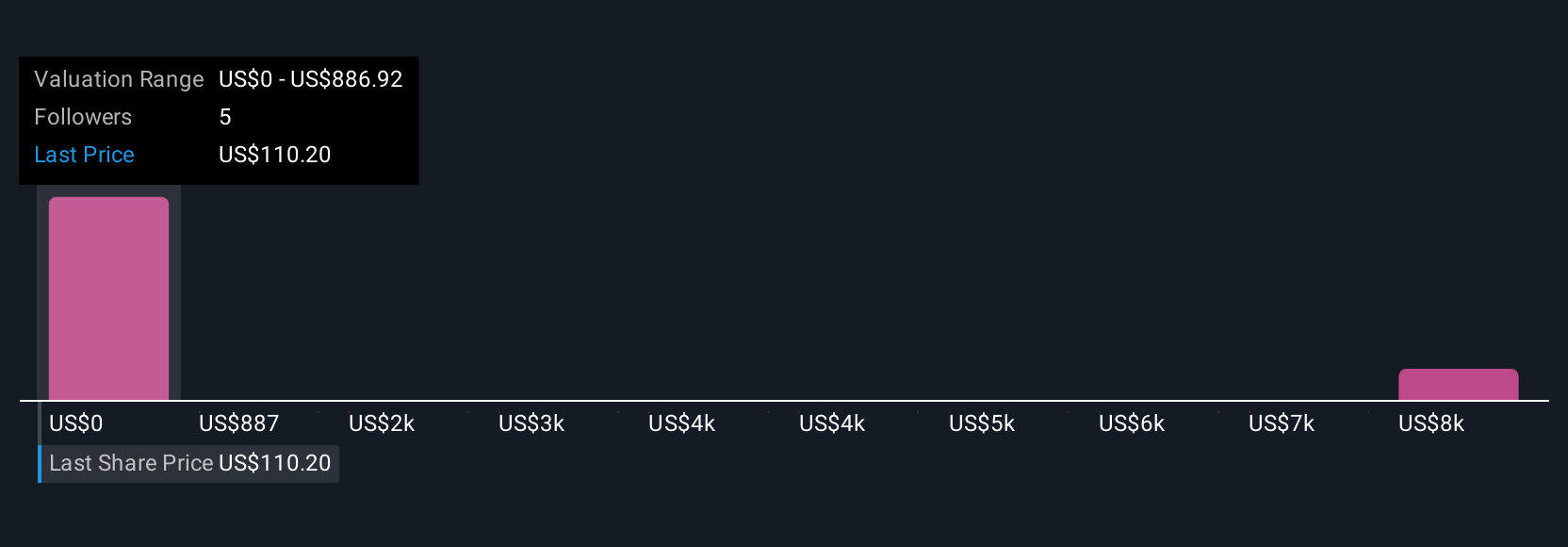

Five fair value estimates from the Simply Wall St Community range from US$886,922 to US$8,869,220, reflecting extremely varied opinions. Against this backdrop, ongoing FX headwinds could affect earnings visibility and are a concern you should explore in depth through different perspectives.

Explore 5 other fair value estimates on PriceSmart - why the stock might be worth just $886.92!

Build Your Own PriceSmart Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PriceSmart research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PriceSmart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PriceSmart's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English