Butterfly Network (BFLY): Evaluating Valuation After Strong Q3 Results, AI Advances, and Global Product Launches

Butterfly Network, a medical imaging innovator, grabbed investor attention after its third-quarter 2025 earnings topped revenue expectations. Management reaffirmed their full-year guidance and highlighted progress across new products, AI advancements, and international market launches.

See our latest analysis for Butterfly Network.

Butterfly Network’s third-quarter rally fueled a sharp jump in the share price, with a 31.86% one-day gain and 88.11% return over the past 90 days. Upbeat earnings and new product momentum caught investors’ attention. While the year-to-date share price return remains negative, the one-year total shareholder return now stands at 32.51%. This shows renewed confidence but also highlights how volatile sentiment has been throughout the year.

If Butterfly Network’s bold leap in medical innovation has you curious about what else is developing in healthcare, take the next step and check out See the full list for free.

With the recent rally boosting shares and fundamentals showing early signs of improvement, the key question is whether Butterfly Network is now a bargain for investors or if the market has already factored in its future growth potential.

Most Popular Narrative: 15.1% Undervalued

Butterfly Network’s latest narrative points to a fair value notably above the last close of $2.69. The consensus among analysts suggests investors may be overlooking some key drivers behind future growth and profitability.

The launch of next-generation Compass AI software, with automated documentation and workflow enhancements, is expected to drive increased enterprise adoption and higher software subscription revenues. This may improve gross margin mix and boost earnings by increasing the share of recurring, high-margin digital revenue.

Want to see what is powering this bullish price target? The most closely watched projections focus on sustained revenue growth and a major turnaround in earnings margins. Find out which surprising financial assumptions are setting the stage for Butterfly Network’s ambitious valuation. Click to discover the detailed logic behind the numbers.

Result: Fair Value of $3.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent delays in enterprise deal closures or stalled domestic growth could quickly undermine the positive outlook that is driving Butterfly Network’s current valuation narrative.

Find out about the key risks to this Butterfly Network narrative.

Another View: Is the Company Expensive by Industry Standards?

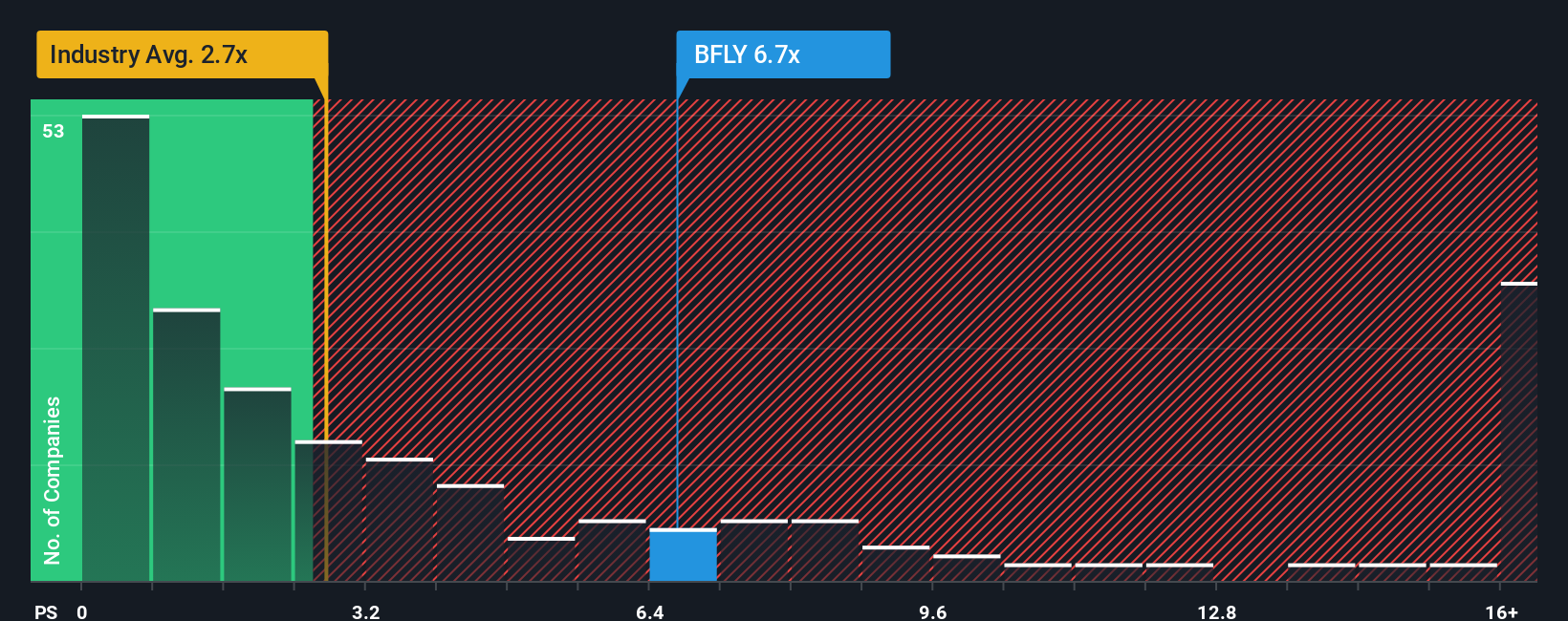

While analyst forecasts paint Butterfly Network as undervalued based on future growth assumptions, its current price-to-sales ratio of 7.7x looks steep compared to the US Medical Equipment industry average of 2.9x and the peer average of 2.7x. The estimated fair ratio is just 1.7x, suggesting investors are paying a notable premium at this time. Does this premium signal belief in future breakthroughs, or are risks getting overlooked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Butterfly Network Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own take in just a few minutes: Do it your way.

A great starting point for your Butterfly Network research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for Your Next Investing Move?

Take your strategies further and find opportunities often missed by others. The smart way to spot potential winners is just a click away. Make your next investment decision count with trusted, data-driven tools.

- Capitalize on emerging artificial intelligence trends by checking out these 26 AI penny stocks, where leaders in AI innovation shape tomorrow's industries.

- Zero in on companies boasting robust dividends and consistent income potential through these 22 dividend stocks with yields > 3% for yields stronger than 3%.

- Get ahead of the market and identify quality businesses trading below their intrinsic value thanks to these 840 undervalued stocks based on cash flows opportunities based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English