Sky Quarry Inc. (NASDAQ:SKYQ) Might Not Be As Mispriced As It Looks After Plunging 29%

Sky Quarry Inc. (NASDAQ:SKYQ) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 79% share price decline.

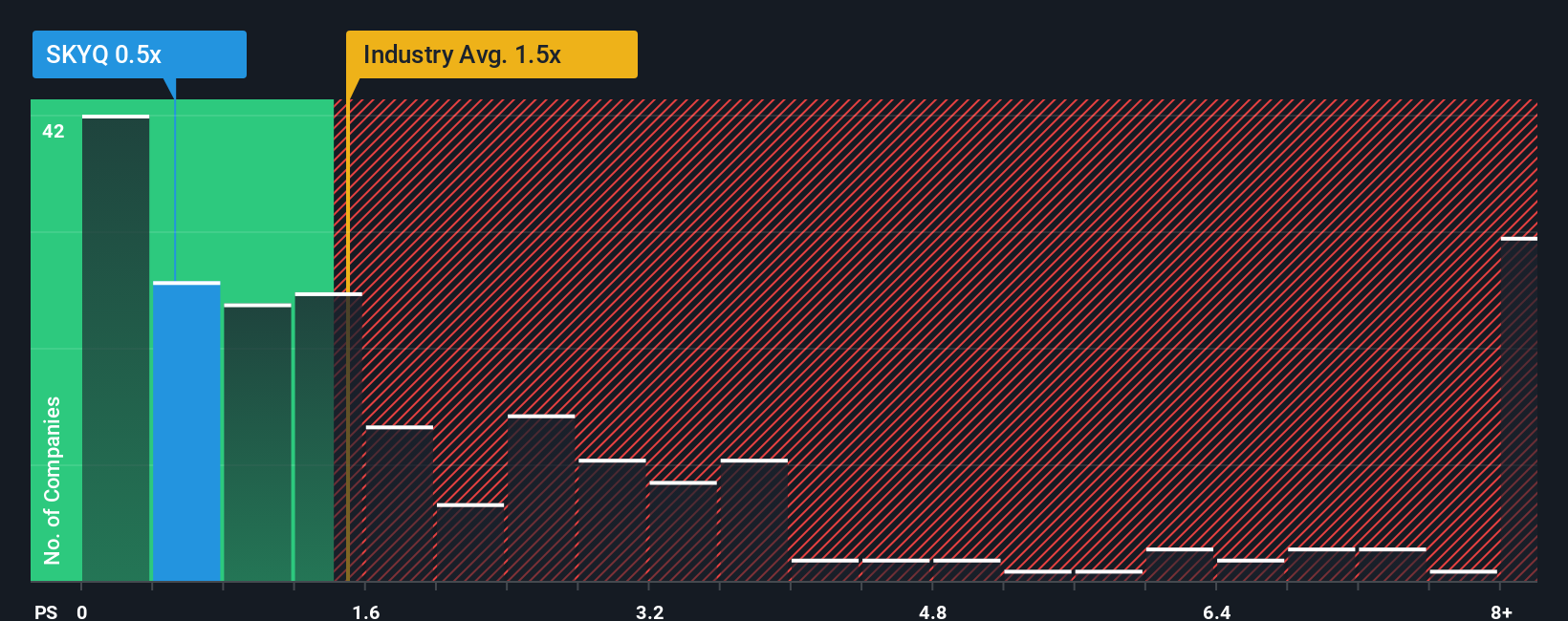

Since its price has dipped substantially, Sky Quarry's price-to-sales (or "P/S") ratio of 0.5x might make it look like a buy right now compared to the Oil and Gas industry in the United States, where around half of the companies have P/S ratios above 1.5x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Sky Quarry

How Has Sky Quarry Performed Recently?

For instance, Sky Quarry's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Sky Quarry will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sky Quarry's earnings, revenue and cash flow.How Is Sky Quarry's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Sky Quarry's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 51% decrease to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

When compared to the industry's one-year growth forecast of 4.0%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that Sky Quarry's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Sky Quarry's P/S?

Sky Quarry's recently weak share price has pulled its P/S back below other Oil and Gas companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Sky Quarry revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You need to take note of risks, for example - Sky Quarry has 5 warning signs (and 2 which are potentially serious) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English