Albemarle (ALB): Evaluating Valuation as Shares Rebound Short-Term but Longer-Term Returns Lag

Albemarle (ALB) stock has kept investors curious lately, as short-term gains have contrasted with mixed longer-term returns. Shares are up solidly over the past month, which has prompted some renewed attention.

See our latest analysis for Albemarle.

While Albemarle’s share price has bounced back sharply over the past quarter, booking a 43.3% gain in just 90 days, the one-year total shareholder return sits at just 2.2%, and longer-term returns remain deeply negative. Momentum is returning; however, it comes after years of underperformance and shifting sentiment about the business’s growth potential.

If you’re watching momentum shift in materials stocks, you might be interested to broaden your search and check out fast growing stocks with high insider ownership.

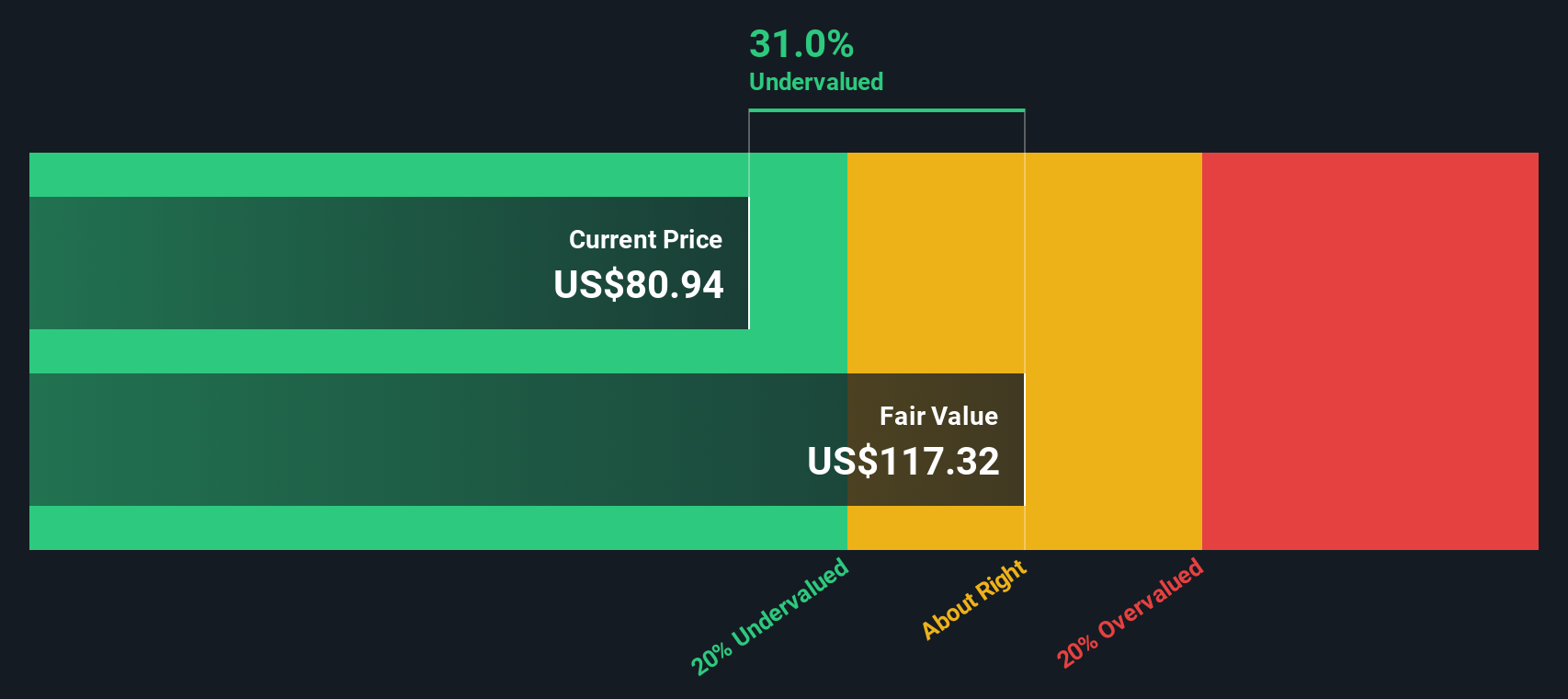

With shares rebounding while longer-term metrics lag and valuations look mixed, the key question for investors is whether Albemarle is truly undervalued at these levels, or if the market has already factored in its future growth potential.

Most Popular Narrative: 5.7% Overvalued

Albemarle’s fair value, as estimated by the most widely tracked narrative, has risen to $92.92, still below its $98.23 last close. This suggests the stock is priced above analyst consensus expectations. These views reflect shifting sentiment and fresh revisions to underlying value estimates, incorporating a changing outlook for growth and risk.

Secular policy tailwinds, such as the US Inflation Reduction Act and EU emissions targets, are incentivizing domestic lithium sourcing and battery production. This potentially allows Albemarle to command premium pricing, expand market share through its US and Chilean assets, and lock in future revenue growth as sustainability and supply chain localization accelerate.

Curious how this forecasted premium pricing and supply chain dominance could help shape Albemarle’s valuation? The narrative is built around ambitious improvements in profitability and a future earnings multiple that breaks with industry convention. Discover the bold projections and hidden leverage that support this calculation. What is driving estimates may surprise you.

Result: Fair Value of $92.92 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged low lithium prices or persistent industry oversupply could undermine Albemarle’s recovery and challenge the more optimistic outlook that analysts have priced in.

Find out about the key risks to this Albemarle narrative.

Another View: Discounted Cash Flow Suggests Deep Value

While multiples show Albemarle trading above its sector averages, our DCF model paints a different picture. The SWS DCF model estimates the company's fair value at $156.50, which places the current stock price more than 37% below this figure. Could the market be missing a long-term opportunity here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Albemarle for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Albemarle Narrative

If you want a different angle or want to work through the numbers yourself, our tools let you build your own Albemarle story in just a few minutes. Do it your way.

A great starting point for your Albemarle research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on tomorrow’s market leaders. Don’t miss your chance to spot fresh trends and unique opportunities before the crowd.

- Uncover real-world profit potential by scanning these 840 undervalued stocks based on cash flows that are trading well below their estimated worth and could offer outsized returns.

- Maximize income streams and shield your investments with these 22 dividend stocks with yields > 3% featuring yields over 3% that can boost your portfolio's cash flow.

- Ride the wave of AI innovation by targeting market movers among these 26 AI penny stocks poised to transform industries through intelligent automation and big data breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English