The Bull Case For Sunrun (RUN) Could Change Following Rising Anxiety Over Grid Reliability and Home Energy Demand

- Sunrun recently released survey data highlighting that Americans are increasingly anxious about electricity reliability and affordability, driven by rising energy demand from AI, data centers, and worsening extreme weather.

- This shift in sentiment is prompting Sunrun to expand its home storage and solar offerings as more homeowners seek greater energy independence and solutions for grid stability.

- Next, we assess how rising consumer anxiety about grid reliability reinforces Sunrun’s long-term investment narrative and growth trajectory.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Sunrun Investment Narrative Recap

To hold Sunrun stock, you need to believe that resilient home energy solutions like solar-plus-storage will see growing demand as homeowners seek protection from rising utility costs and frequent grid disruptions. The company’s survey highlighting anxiety over grid reliability aligns with this thesis, potentially reinforcing Sunrun’s key catalyst of storage adoption, but does not materially reduce the biggest risk, the phase-out of major solar tax credits that could shrink the market post-2025 and increase margin pressure.

Among recent announcements, Sunrun’s deployment of over 37,000 batteries to stabilize Puerto Rico’s grid stands out as directly relevant, illustrating its ability to deliver grid support where reliability is most pressing. Initiatives like this show Sunrun’s operational scale as it pursues recurring revenue from storage and virtual power plants, key factors underpinning its long-term story amid evolving consumer energy needs.

Yet, despite rising interest in energy independence, investors should be attentive to how sudden regulatory or policy changes could alter...

Read the full narrative on Sunrun (it's free!)

Sunrun's outlook forecasts $2.9 billion in revenue and $465.4 million in earnings by 2028. This assumes a 10.4% annual revenue growth rate and an earnings increase of about $3.07 billion from current earnings of -$2.6 billion.

Uncover how Sunrun's forecasts yield a $21.03 fair value, in line with its current price.

Exploring Other Perspectives

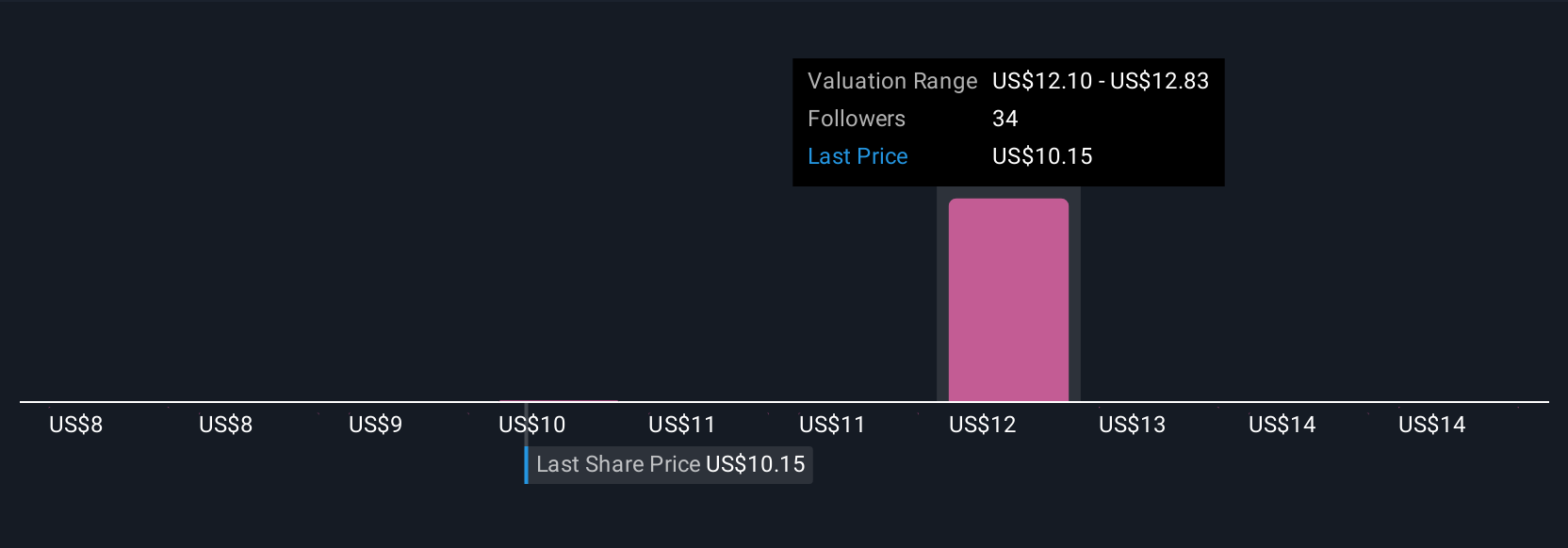

Five members of the Simply Wall St Community valued Sunrun shares from US$13.14 to US$23.58, reflecting a wide spectrum of earnings outlooks. While market optimism follows Sunrun’s storage expansion, keep in mind the looming end of key tax credits that could reshape long-term growth, explore these community viewpoints for broader insight.

Explore 5 other fair value estimates on Sunrun - why the stock might be worth as much as 14% more than the current price!

Build Your Own Sunrun Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunrun research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Sunrun research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunrun's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English