Is the Gianni Bini x Sydney Silverman Launch Reframing Dillard's (DDS) Brand Strategy?

- On October 23, 2025, Dillard's and fashion influencer Sydney Silverman announced the upcoming launch of the Gianni Bini x Sydney Silverman limited-edition capsule collection, set to debut nationwide and online on November 14th.

- This collaboration harnesses Silverman's significant social media presence to blend luxury with modern West Coast style, aiming to attract new audiences and energize Dillard's seasonal offerings.

- We'll explore how leveraging Sydney Silverman's online influence and fashion credibility may shape Dillard's ongoing investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Dillard's Investment Narrative?

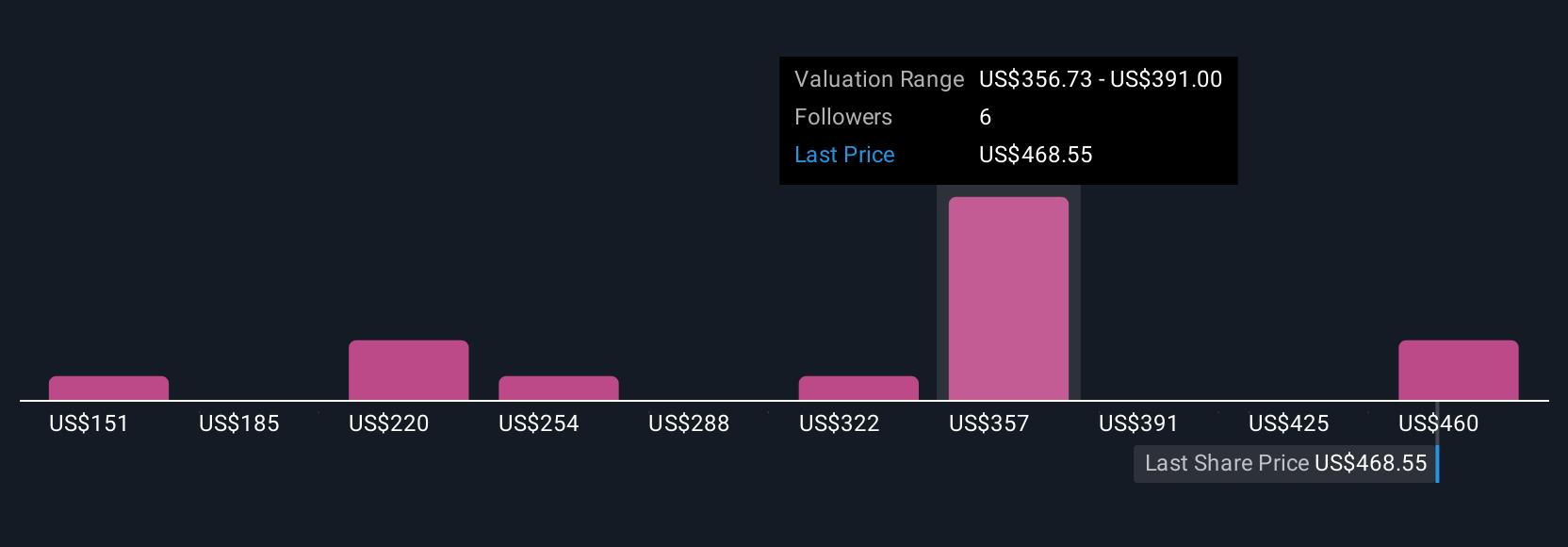

For investors considering Dillard’s, the big picture hinges on whether the company can sustain relevance and drive sales in a tough retail market where earnings are forecast to decline and revenue growth remains elusive. The Gianni Bini x Sydney Silverman collection offers a chance for near-term brand revitalization, potentially bringing in new, younger customers and energizing seasonal sales. While this collaboration taps into influencer marketing and could help offset some of the ongoing challenges, its financial impact is likely to be incremental rather than transformative, given the scale of the company’s operations and the highly competitive nature of fashion retail. Previous catalysts and risks, such as negative earnings outlook, falling profit margins, and valuation pressures, still dominate the investment case, but this new initiative does offer a fresh angle for the holiday quarter. On the other hand, volatile earnings forecasts remain a concern investors should not ignore.

Dillard's share price has been on the slide but might be up to 7% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 8 other fair value estimates on Dillard's - why the stock might be a potential multi-bagger!

Build Your Own Dillard's Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dillard's research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dillard's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dillard's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English