Should Expro’s (XPRO) Onsite Fluid Analysis Breakthrough Prompt a Rethink of Competitive Positioning?

- Expro Group Holdings recently announced the successful first deployment of its ELITE Composition™ service in Cyprus, allowing laboratory-quality fluid analysis directly at the rig site within around eight hours and reducing months-long delays typically required for sample shipment.

- This milestone underscores Expro’s technological edge in supporting client decision-making and project efficiency, highlighted alongside a recent financial update showing improved year-to-date profitability despite lower quarterly sales.

- We’ll assess how Expro’s direct wellsite technology rollout for a major operator could alter the company’s long-term investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

Expro Group Holdings Investment Narrative Recap

To own Expro Group Holdings, you need to believe that technology-driven gains in offshore efficiency can outpace the risks of customer caution and shifting energy transition agendas. The recent Cyprus ELITE Composition™ rollout boosts Expro’s innovation credentials, but it does not materially shift the near-term outlook, which is still shaped by customer spending patterns and exposure to international volatility, the primary catalyst remains multiyear project execution, while reliance on deepwater activity is the largest risk.

Among recent announcements, Expro’s October earnings update is especially relevant. Despite slower quarterly sales, the company improved year-to-date profitability, suggesting that operational innovations, such as the Cyprus deployment, may be contributing to more resilient margins and supporting the catalyst of margin expansion as new technologies are adopted. However, these gains have yet to fundamentally reduce the underlying cycle-risk and customer concentration exposure faced by the business.

Yet, even with fresh technology rollouts, investors need to watch for rising costs and regulatory hurdles that...

Read the full narrative on Expro Group Holdings (it's free!)

Expro Group Holdings is projected to reach $1.7 billion in revenue and $83.2 million in earnings by 2028. This outlook assumes an annual revenue decline of 0.3% and an increase in earnings of $11.9 million from the current level of $71.3 million.

Uncover how Expro Group Holdings' forecasts yield a $14.20 fair value, a 5% upside to its current price.

Exploring Other Perspectives

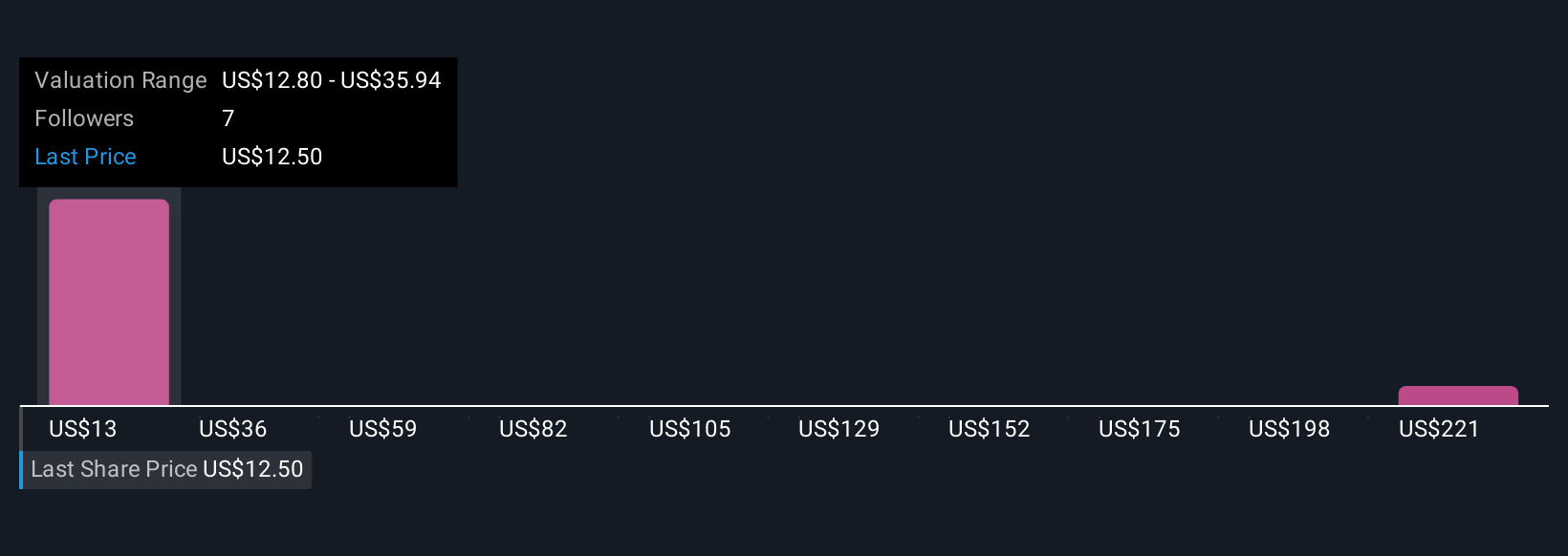

Three members of the Simply Wall St Community estimate Expro’s fair value could be anywhere from US$14.20 up to US$244.23 a share. While many see upside in Expro’s technology-driven margin expansion, your outlook may depend on how you weigh sector risks and international exposure, so it pays to consider a range of community opinions.

Explore 3 other fair value estimates on Expro Group Holdings - why the stock might be worth just $14.20!

Build Your Own Expro Group Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Expro Group Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Expro Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Expro Group Holdings' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English