Not Many Are Piling Into Ever Reach Group (Holdings) Company Limited (HKG:3616) Just Yet

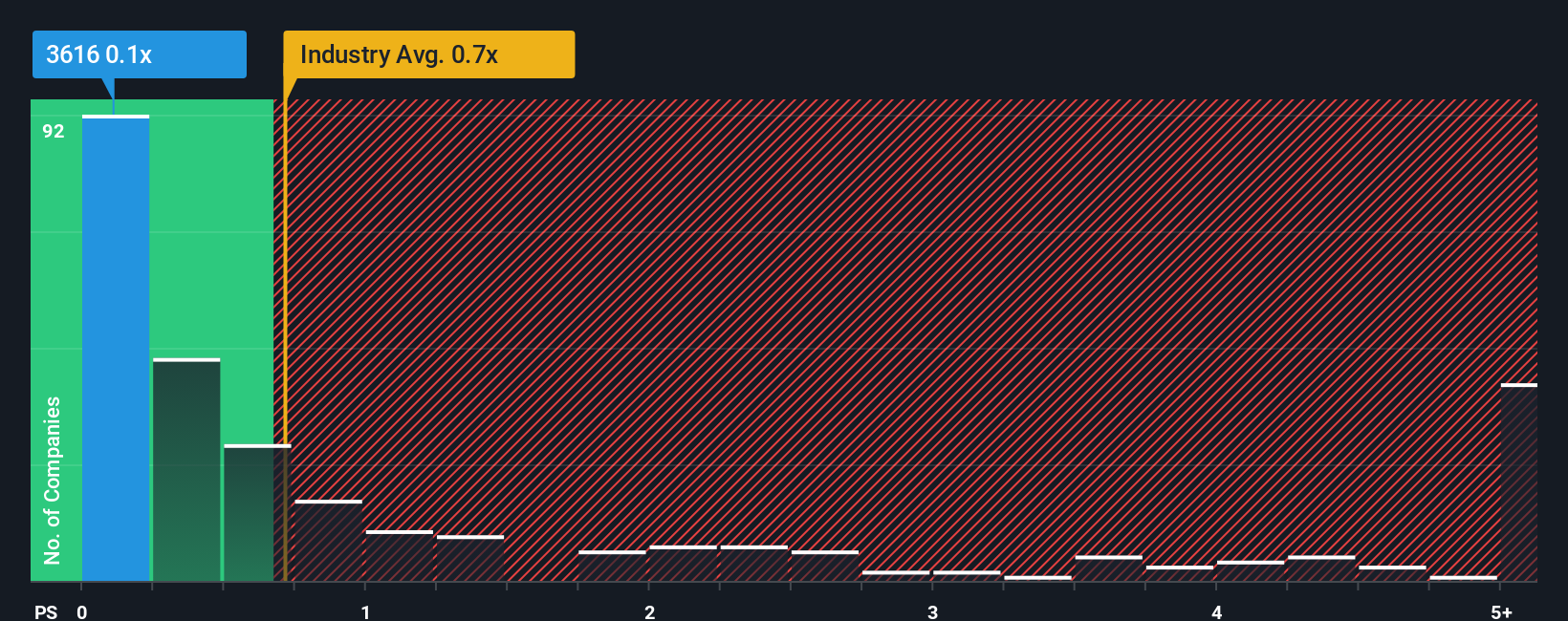

Ever Reach Group (Holdings) Company Limited's (HKG:3616) price-to-sales (or "P/S") ratio of 0.1x might make it look like a buy right now compared to the Real Estate industry in Hong Kong, where around half of the companies have P/S ratios above 0.7x and even P/S above 3x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Ever Reach Group (Holdings)

How Ever Reach Group (Holdings) Has Been Performing

As an illustration, revenue has deteriorated at Ever Reach Group (Holdings) over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Ever Reach Group (Holdings)'s earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Ever Reach Group (Holdings)?

The only time you'd be truly comfortable seeing a P/S as low as Ever Reach Group (Holdings)'s is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. Regardless, revenue has managed to lift by a handy 15% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 5.3% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this in consideration, we find it intriguing that Ever Reach Group (Holdings)'s P/S falls short of its industry peers. It may be that most investors are not convinced the company can maintain recent growth rates.

What We Can Learn From Ever Reach Group (Holdings)'s P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Ever Reach Group (Holdings) revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Ever Reach Group (Holdings) (3 are a bit concerning) you should be aware of.

If you're unsure about the strength of Ever Reach Group (Holdings)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English