Coca-Cola's (KO) Earnings Beat and Mr. Pibb Relaunch Might Change The Case For Investing In KO

- In October 2025, The Coca-Cola Company reported strong third-quarter earnings, reaffirmed its 2025 financial guidance, completed a significant US$5.06 billion share repurchase program, and filed a shelf registration to enable flexible future capital raising or debt issuance.

- An important development is the nationwide 2026 relaunch of Mr. Pibb with updated packaging, a new zero sugar variant, and a marketing campaign aimed at attracting both longtime fans and new consumers from diverse backgrounds.

- We will explore how Coca-Cola’s reaffirmed growth targets and solid earnings performance could influence its forward-looking investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Coca-Cola Investment Narrative Recap

For long-term shareholders, the investment case for Coca-Cola centers on its ability to capture global growth through brand strength, product innovation, and disciplined financial management. Recent earnings and guidance reaffirm solid performance, yet short-term catalysts, such as new product rollouts like the Mr. Pibb relaunch, are not expected to materially shift the biggest near-term risk, consumer health trends and increased regulatory scrutiny of sugar-sweetened beverages.

Among recent developments, the completed US$5.06 billion share buyback stands out. While this returned capital to shareholders and can support per-share earnings metrics, it does not directly address the core catalyst of adapting the portfolio to evolving consumer preferences and expanding in emerging, health-focused categories.

However, investors should be aware that changing regulatory attitudes towards sugar content in beverages could...

Read the full narrative on Coca-Cola (it's free!)

Coca-Cola's outlook anticipates $55.1 billion in revenue and $14.8 billion in earnings by 2028. This forecasts a 5.4% annual revenue growth rate and a $2.6 billion earnings increase from the current $12.2 billion.

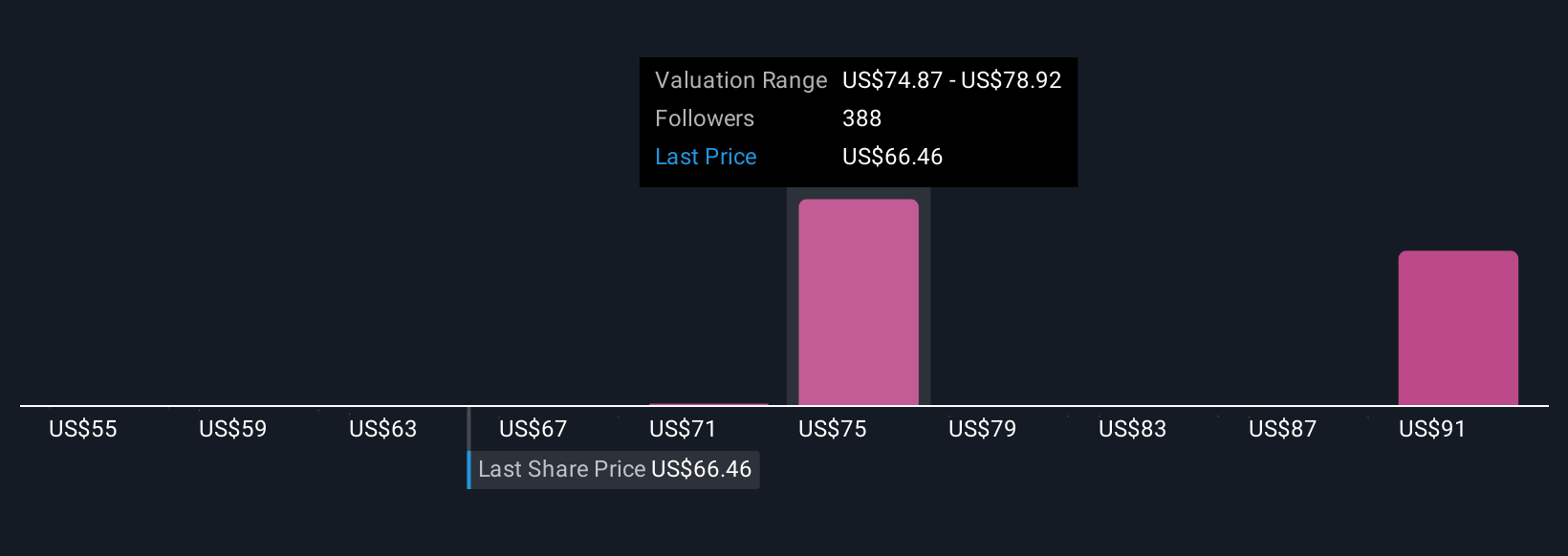

Uncover how Coca-Cola's forecasts yield a $77.57 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Fourteen community-sourced fair value estimates for Coca-Cola range from US$65.59 to US$90.61, reflecting wide variations in expectations. Many in the Simply Wall St Community recognize how shifting consumer health priorities may impact future growth, so be sure to compare these differing outlooks before deciding your own view.

Explore 14 other fair value estimates on Coca-Cola - why the stock might be worth as much as 33% more than the current price!

Build Your Own Coca-Cola Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coca-Cola research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Coca-Cola research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coca-Cola's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English