Evaluating Shanghai MicroPort MedBot (SEHK:2252)’s Valuation Following Major Board Resignations and Governance Changes

Shanghai MicroPort MedBot (Group) (SEHK:2252) just announced that several key board members, including its chairperson, plan to step down because of personal business commitments. The company is also looking to expand its board, pending shareholder approval.

See our latest analysis for Shanghai MicroPort MedBot (Group).

While the sudden boardroom shake-up might have introduced some uncertainty, Shanghai MicroPort MedBot (Group)’s underlying momentum is hard to miss, with a 178.1% year-to-date share price return and a 171.7% total return over the past year, even after a recent pullback. Investors appear to be weighing leadership changes against exceptionally strong longer-term performance. This suggests that optimism remains high but volatility could persist as the company refines its governance structure.

If news like this has you rethinking your next move, it’s a good opportunity to broaden your horizons and uncover See the full list for free.

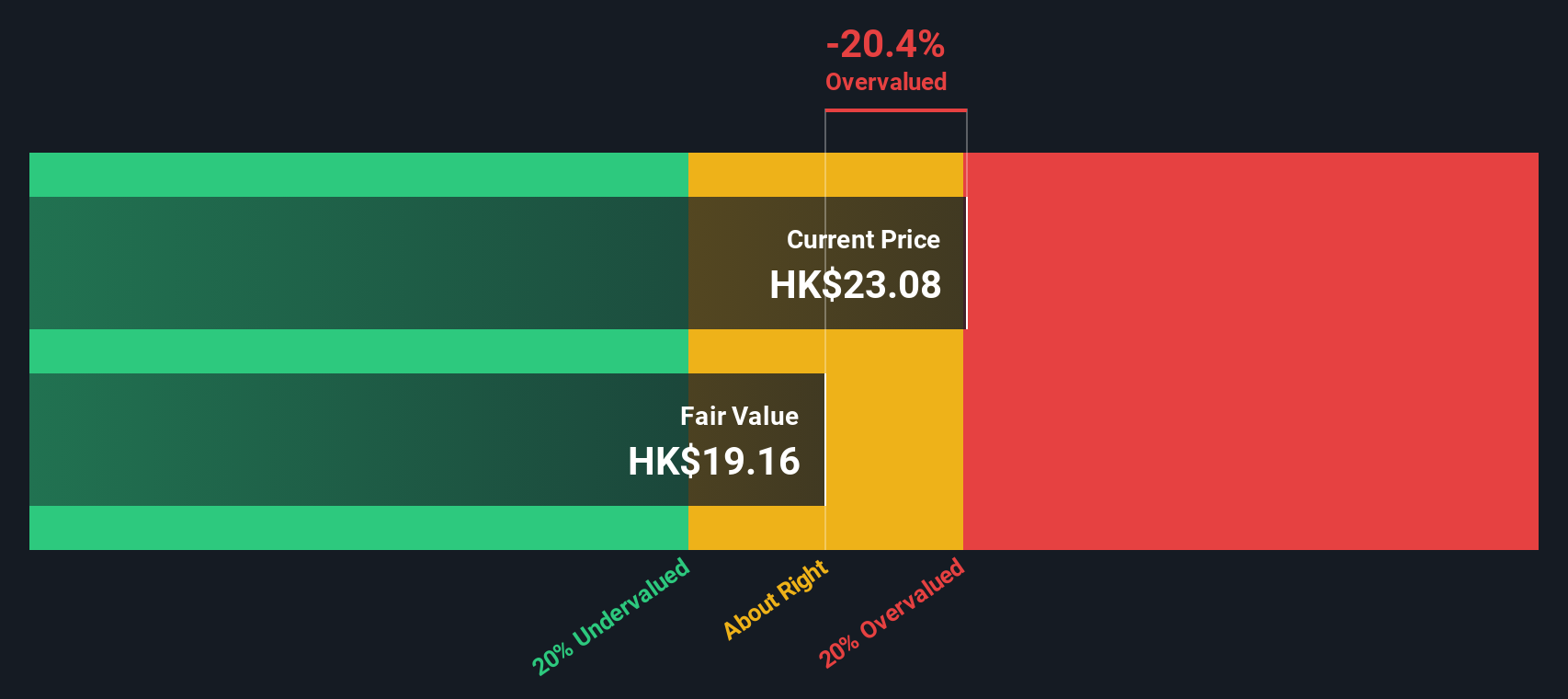

With recent gains and strong fundamentals on display, the key debate now is whether the current share price fully reflects Shanghai MicroPort MedBot (Group)’s impressive growth or if there is still room for buyers to benefit as the market projects future success.

Price-to-Book Ratio of 46x: Is it justified?

The current price-to-book (P/B) ratio for Shanghai MicroPort MedBot (Group) stands at 46x, with the last close at HK$26.06. This suggests that shares are trading at a substantial premium compared to industry peers and market benchmarks.

The price-to-book ratio measures a company's market price relative to its book value. For medical equipment companies, it gives investors an idea of how much they are paying for each dollar of net assets, which is especially relevant for firms in a capital-intensive sector where tangible assets are significant.

At 46x, Shanghai MicroPort MedBot (Group)’s shares are considerably more expensive than the Hong Kong Medical Equipment industry average of just 1.8x and well above the peer average of 3.2x. This suggests investors are pricing in exceptional future growth, but it raises questions about whether expectations are exceeding fundamentals, considering the company remains unprofitable. There is also insufficient data to assess where the fair P/B ratio should be for this stock, so any future re-rating could be sharp.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 46x (OVERVALUED)

However, ongoing board changes and the company's lack of profitability could trigger shifts in investor sentiment if growth momentum slows unexpectedly.

Find out about the key risks to this Shanghai MicroPort MedBot (Group) narrative.

Another View: Our DCF Model Analysis

Taking a different approach, our SWS DCF model estimates Shanghai MicroPort MedBot (Group)’s fair value at HK$19.05 per share. With the current price of HK$26.06, this method suggests the stock may be trading at a premium. This could mean investors are paying up for future growth, or there may be hidden upside yet to be realized.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shanghai MicroPort MedBot (Group) for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 849 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shanghai MicroPort MedBot (Group) Narrative

The conclusions you draw are only as strong as the data and perspectives you choose to explore. Take a few minutes to dig in and shape your own view. If you want a hands-on approach, Do it your way

A great starting point for your Shanghai MicroPort MedBot (Group) research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Want an edge? Don’t miss out on fresh opportunities by expanding your watchlist with other standout stocks using the screener tools trusted by investors worldwide.

- Tap into hidden value by targeting these 849 undervalued stocks based on cash flows that are trading below their intrinsic worth and may be poised for a potential rebound.

- Unleash your potential income by scanning these 17 dividend stocks with yields > 3% offering yields above 3 percent and boosting portfolio returns.

- Catalyze your portfolio’s growth by backing companies on the cutting edge with these 25 AI penny stocks powering tomorrow’s technology revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English