Yangtze Optical Fibre (SEHK:6869): Do Lower Earnings Amid Board Change Hint at Shifting Priorities?

- Yangtze Optical Fibre and Cable Joint Stock Limited Company announced that Mr. Xiong Xiangfeng has resigned as a non-executive director, effective October 30, 2025, due to his retirement, alongside the release of its earnings for the nine months ended September 30, 2025.

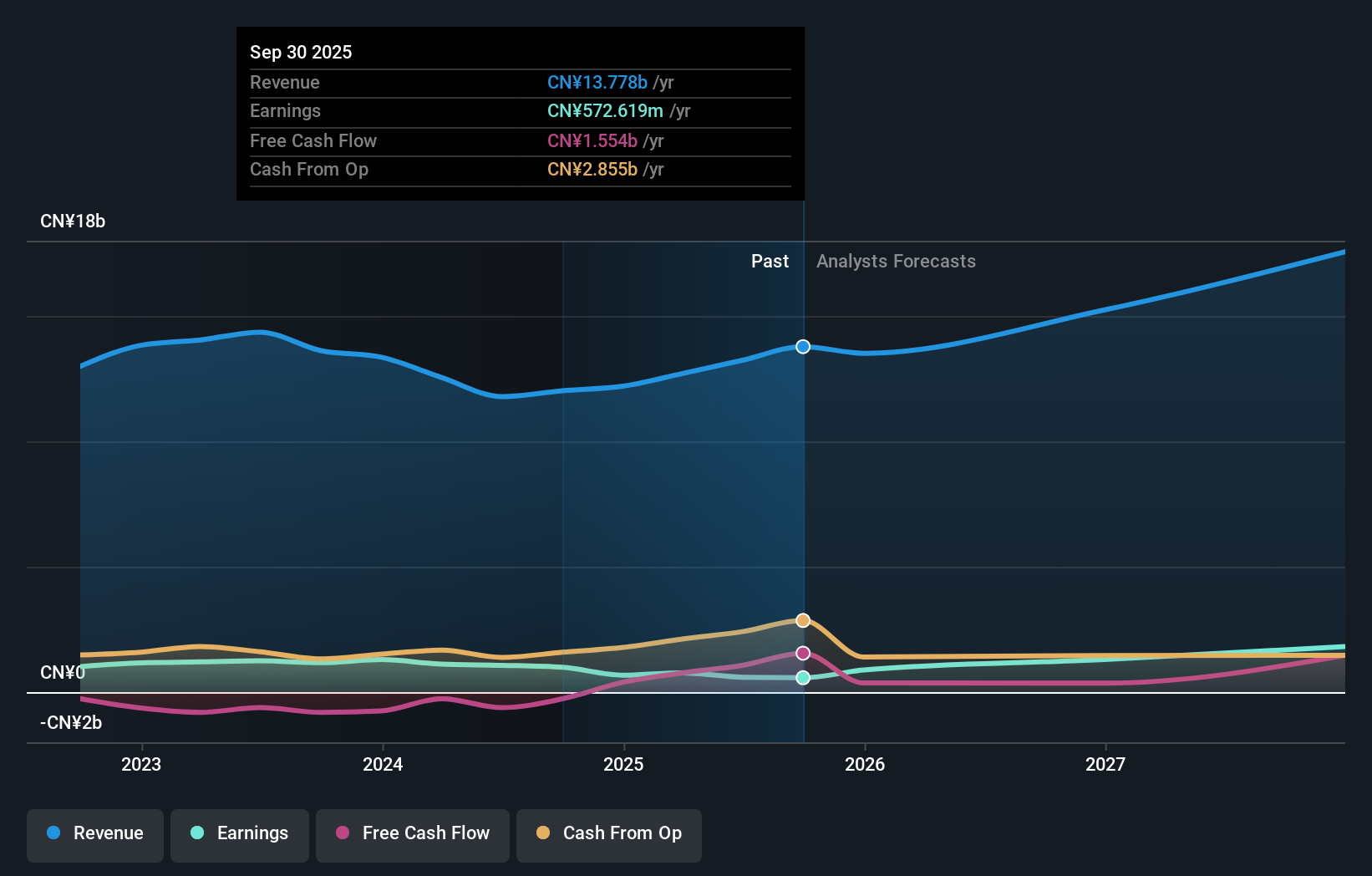

- While revenue increased to CNY 10.28 billion over the prior-year period, both net income and earnings per share fell, highlighting a shift in the company's operational dynamics as a long-serving director exits.

- We’ll explore how the mix of higher revenue and reduced earnings, coupled with a board change, is shaping Yangtze Optical Fibre’s investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

What Is Yangtze Optical Fibre And Cable Limited's Investment Narrative?

Being a shareholder in Yangtze Optical Fibre and Cable Limited right now means believing in the company's ability to translate robust sales growth into more sustainable earnings momentum, especially after a mixed nine-month result that saw revenue climb to CNY 10.28 billion while net income pulled back. The recent retirement of long-serving non-executive director Mr. Xiong, who helped shape YOFC’s strategic direction, adds a layer of boardroom change to the picture and may prompt some investors to reassess confidence in ongoing execution. However, with a seasoned management team and new leadership already in place, the impact on short-term catalysts, such as continued innovation and expanding demand for advanced fiber solutions, appears manageable for now. The biggest immediate risks stem from narrowing profit margins and earnings volatility, which could be amplified as the board settles into its new composition. Share price volatility and a recent double-digit pullback also signal heightened sensitivity to results and leadership stability.

But with profit margins under pressure, there’s more to uncover about profitability risks. Despite retreating, Yangtze Optical Fibre And Cable Limited's shares might still be trading 21% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Yangtze Optical Fibre And Cable Limited - why the stock might be worth as much as 27% more than the current price!

Build Your Own Yangtze Optical Fibre And Cable Limited Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yangtze Optical Fibre And Cable Limited research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Yangtze Optical Fibre And Cable Limited research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yangtze Optical Fibre And Cable Limited's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English