Does Cathay Pacific (SEHK:293) View Buybacks as a Signal of Strength or Limited Growth Ambitions?

- On November 7, 2025, Cathay Pacific Airways announced its Board of Directors will consider launching a share repurchase program involving the company buying back its own shares.

- This move can be interpreted as a sign of management’s confidence in the airline’s prospects and a potential method of enhancing shareholder value by decreasing the number of shares outstanding.

- We’ll examine how the potential share repurchase program could influence Cathay Pacific Airways’ investment narrative, especially regarding shareholder returns.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Cathay Pacific Airways Investment Narrative Recap

To own Cathay Pacific Airways shares, you need to believe in the company’s ability to sustain its airline and cargo growth while carefully controlling costs amid ongoing fleet modernization. The potential share repurchase under discussion is encouraging in signaling board confidence, but it does not have a material short-term impact on the key catalyst: matching capacity growth with travel demand, nor does it meaningfully address the major risk of yield compression as new supply enters the market.

Among the latest announcements, the August 2025 aircraft acquisition stands out as most relevant, with Cathay securing rights to 14 Boeing 777-9 aircraft for about US$8.1 billion. This underscores management’s push to expand capacity, a move that intensifies the importance of balancing expansion plans with evolving passenger and cargo demand, a factor central to the current risk profile.

Yet in contrast to aircraft investments driving optimism, investors should also be aware of the possible pressures that excess capacity can place on yields...

Read the full narrative on Cathay Pacific Airways (it's free!)

Cathay Pacific Airways' narrative projects HK$123.7 billion revenue and HK$10.6 billion earnings by 2028. This requires 4.3% yearly revenue growth and a HK$0.7 billion earnings increase from HK$9.9 billion today.

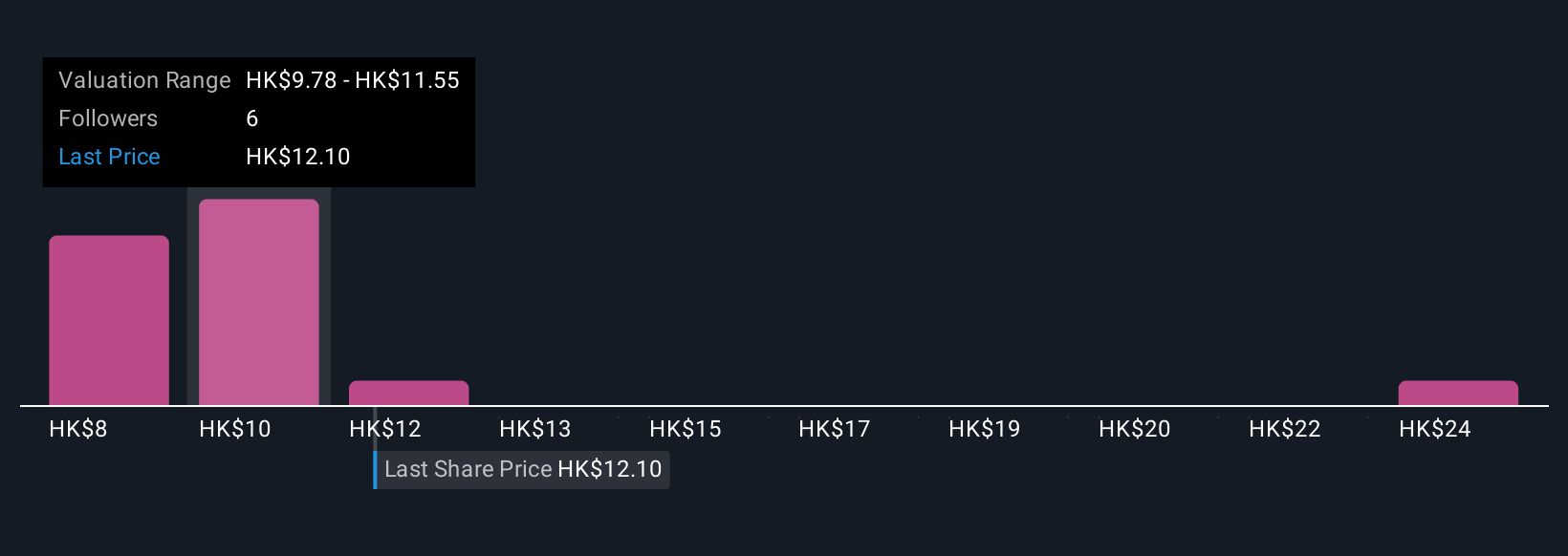

Uncover how Cathay Pacific Airways' forecasts yield a HK$10.80 fair value, a 9% downside to its current price.

Exploring Other Perspectives

Community fair value estimates for Cathay Pacific Airways from five contributors range widely from HK$8.02 to HK$25.84 per share. Participants weigh these against ongoing fleet expansion, prompting you to consider the impact of capacity and demand on future performance.

Explore 5 other fair value estimates on Cathay Pacific Airways - why the stock might be worth over 2x more than the current price!

Build Your Own Cathay Pacific Airways Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cathay Pacific Airways research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cathay Pacific Airways research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cathay Pacific Airways' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English