Is Expro’s Onsite Fluid Analysis Breakthrough Reshaping the Investment Case for Expro Group Holdings (XPRO)?

- Expro Group Holdings recently announced the successful first deployment of its ELITE Composition™ service onsite for a major oil and gas operator in Cyprus, providing laboratory-standard fluid measurements directly at the rig within approximately eight hours.

- This innovative technology eliminates months-long delays associated with traditional offsite analysis and could accelerate reservoir evaluation and project planning for clients in exploration regions like the East Mediterranean.

- We'll examine how Expro's ability to deliver onsite, rapid analysis services shapes its investment narrative and future growth prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Expro Group Holdings Investment Narrative Recap

To invest in Expro Group Holdings, you need to believe in the long-term requirement for advanced oilfield services, even as the energy sector faces rising operational scrutiny and shifts toward renewables. While the successful Cyprus deployment of ELITE Composition™ signals the company’s ability to deliver new technology in niche offshore projects, potentially supporting order intake and backlog, it is not expected to materially shift the immediate risk posed by customer spending moderation or the pace of new project approvals.

Among recent news, Expro’s world record-setting Blackhawk Gen III Wireless Top Drive Cement Head deployment in the Gulf of Mexico, announced this August, stands out. It reinforces the company’s focus on technology leadership in complex offshore environments, a key element for near-term catalysts centered on project wins and backlog growth amid greater energy security priorities by operators.

But on the other hand, tightening customer budgets and delayed upstream project approvals remain crucial risks that investors should be aware of as...

Read the full narrative on Expro Group Holdings (it's free!)

Expro Group Holdings' outlook anticipates $1.7 billion in revenue and $83.2 million in earnings by 2028. This projection is based on a revenue decline of 0.3% per year and an increase in earnings of $11.9 million from the current $71.3 million.

Uncover how Expro Group Holdings' forecasts yield a $14.20 fair value, a 6% upside to its current price.

Exploring Other Perspectives

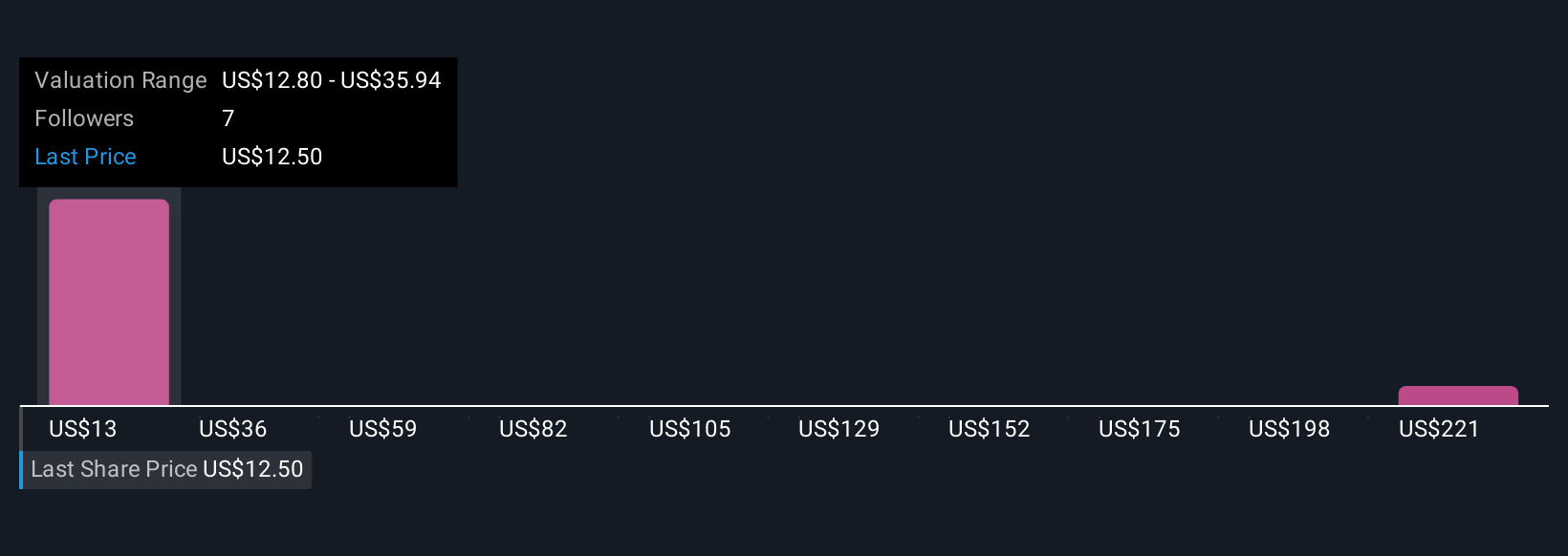

Three members of the Simply Wall St Community estimated XPRO’s fair value between US$14.20 and US$244.23, showing wide variance in expectations. In contrast, recent innovation highlights may support long-term technology-driven growth, while a more cautious pace of new project spending still shapes the stock’s outlook.

Explore 3 other fair value estimates on Expro Group Holdings - why the stock might be worth just $14.20!

Build Your Own Expro Group Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Expro Group Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Expro Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Expro Group Holdings' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English