Asian Market Insights: Jiangxi Rimag Group And 2 Stocks That May Be Trading Below Estimated Value

As global markets navigate the complexities of economic data releases and policy decisions, Asia's stock markets are capturing attention with their unique challenges and opportunities. In this environment, identifying undervalued stocks, such as Jiangxi Rimag Group and others potentially trading below estimated value, requires a focus on strong fundamentals and resilience amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Leapmotor Technology (SEHK:9863) | HK$52.25 | HK$102.81 | 49.2% |

| Sinolong New Materials (SZSE:301565) | CN¥28.12 | CN¥55.54 | 49.4% |

| PharmaResearch (KOSDAQ:A214450) | ₩450500.00 | ₩884165.70 | 49% |

| Nippon Thompson (TSE:6480) | ¥703.00 | ¥1403.73 | 49.9% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.34 | CN¥26.23 | 49.1% |

| New Zealand King Salmon Investments (NZSE:NZK) | NZ$0.196 | NZ$0.39 | 49.2% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.10 | CN¥20.17 | 49.9% |

| Jiangxi Rimag Group (SEHK:2522) | HK$17.24 | HK$34.25 | 49.7% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.15 | CN¥56.25 | 50% |

| ASE Technology Holding (TWSE:3711) | NT$215.00 | NT$426.77 | 49.6% |

Let's explore several standout options from the results in the screener.

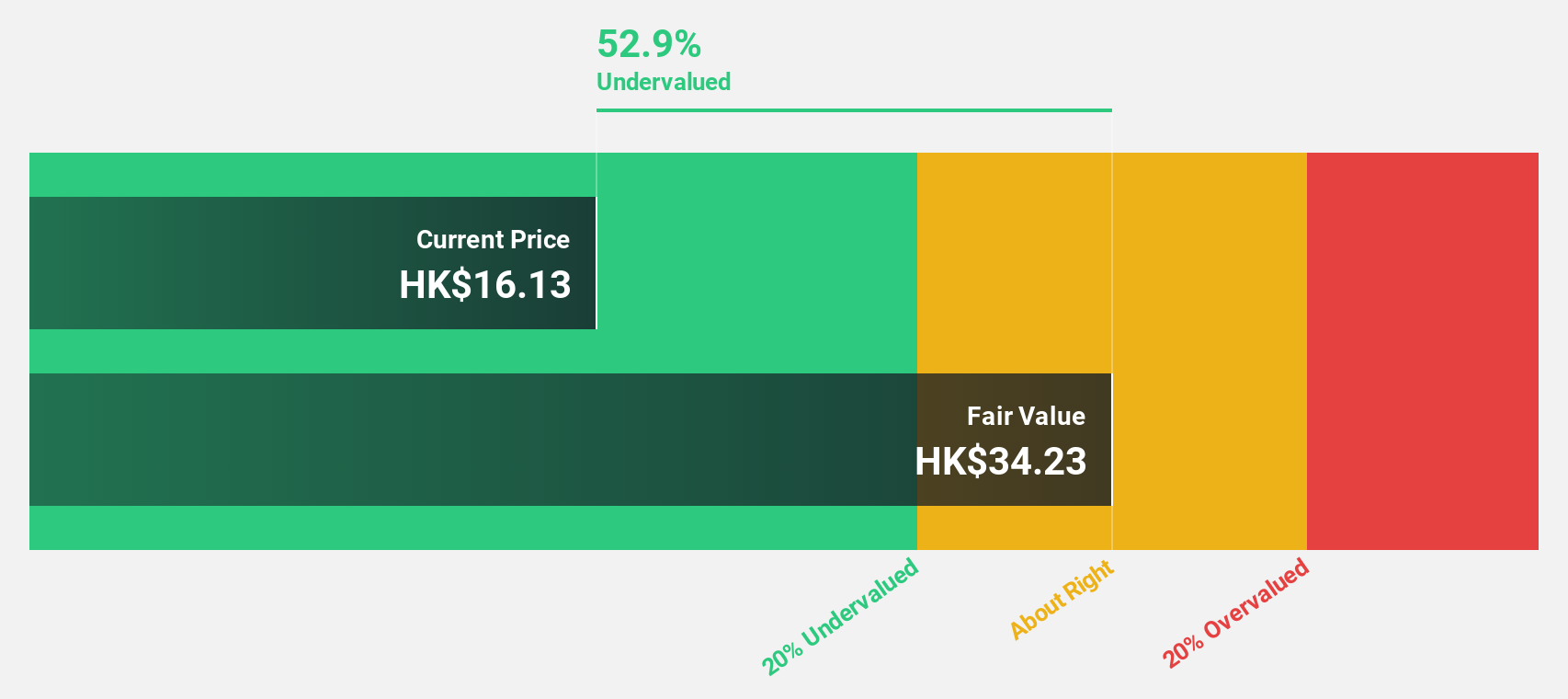

Jiangxi Rimag Group (SEHK:2522)

Overview: Jiangxi Rimag Group Co., Ltd. invests in and operates medical imaging centers in China, with a market cap of HK$6.90 billion.

Operations: The company generates revenue primarily from its medical labs and research segment, amounting to CN¥813.93 million.

Estimated Discount To Fair Value: 49.7%

Jiangxi Rimag Group is trading at HK$17.24, significantly below its estimated fair value of HK$34.25, indicating potential undervaluation based on cash flows. The company's revenue is projected to grow 24.3% annually, surpassing the Hong Kong market's average growth rate of 8.5%. Recent strategic alliances in AI-based medical imaging have led to a RMB 10 million commercialization contract, enhancing its data business competitiveness and supporting sustainable development through innovative collaborations.

- Our growth report here indicates Jiangxi Rimag Group may be poised for an improving outlook.

- Get an in-depth perspective on Jiangxi Rimag Group's balance sheet by reading our health report here.

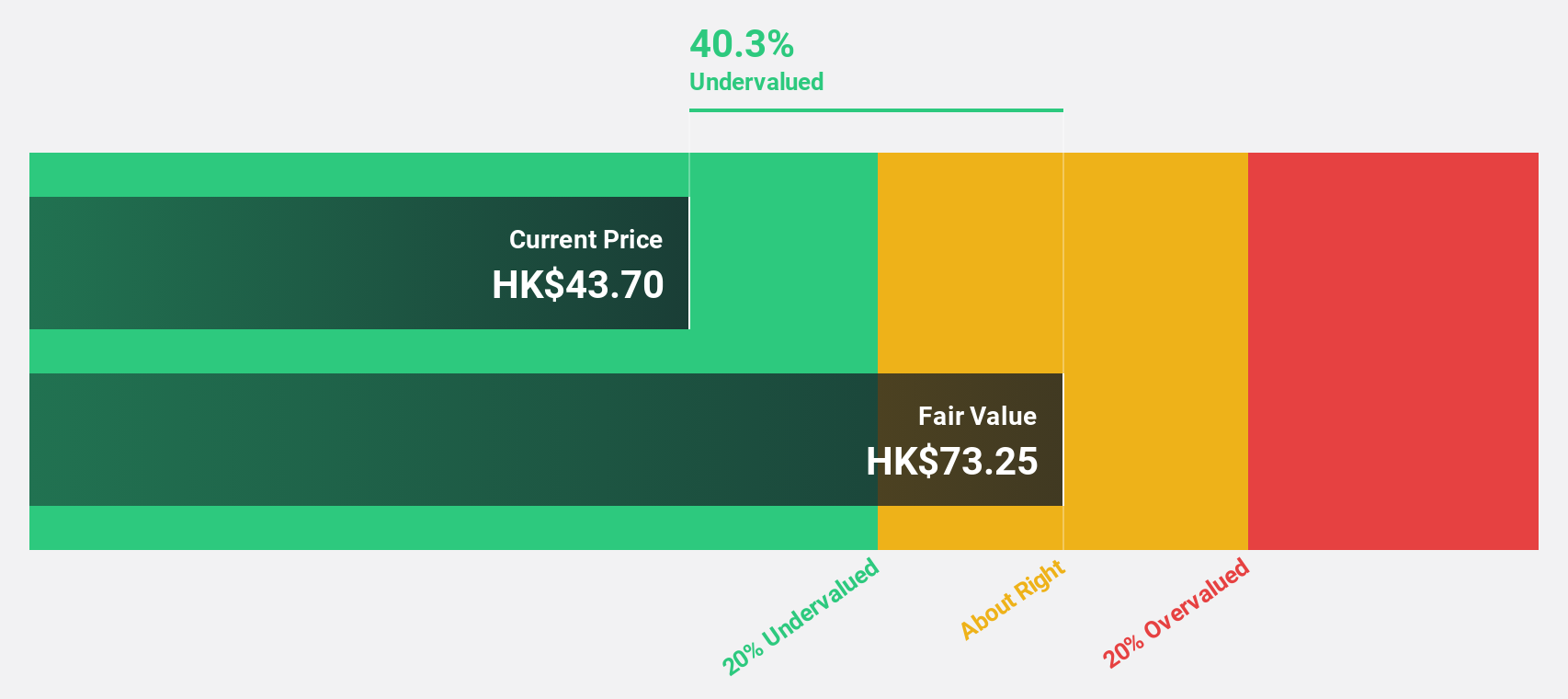

Yangtze Optical Fibre And Cable Limited (SEHK:6869)

Overview: Yangtze Optical Fibre And Cable Joint Stock Limited Company produces and sells optical fiber preforms rods, optical fiber, and optical fiber cables both in China and internationally, with a market cap of HK$47.41 billion.

Operations: The company's revenue segments include the production and sale of optical fiber preforms rods, optical fiber, and optical fiber cables both domestically and abroad.

Estimated Discount To Fair Value: 22.9%

Yangtze Optical Fibre And Cable Limited is trading at HK$33.72, over 20% below its estimated fair value of HK$43.73, highlighting potential undervaluation based on cash flows. Despite a recent decline in profit margins and net income for the nine months ending September 2025, the company's earnings are forecast to grow significantly at 45.3% annually, outpacing the Hong Kong market average. However, share price volatility remains a concern for investors.

- Upon reviewing our latest growth report, Yangtze Optical Fibre And Cable Limited's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Yangtze Optical Fibre And Cable Limited with our comprehensive financial health report here.

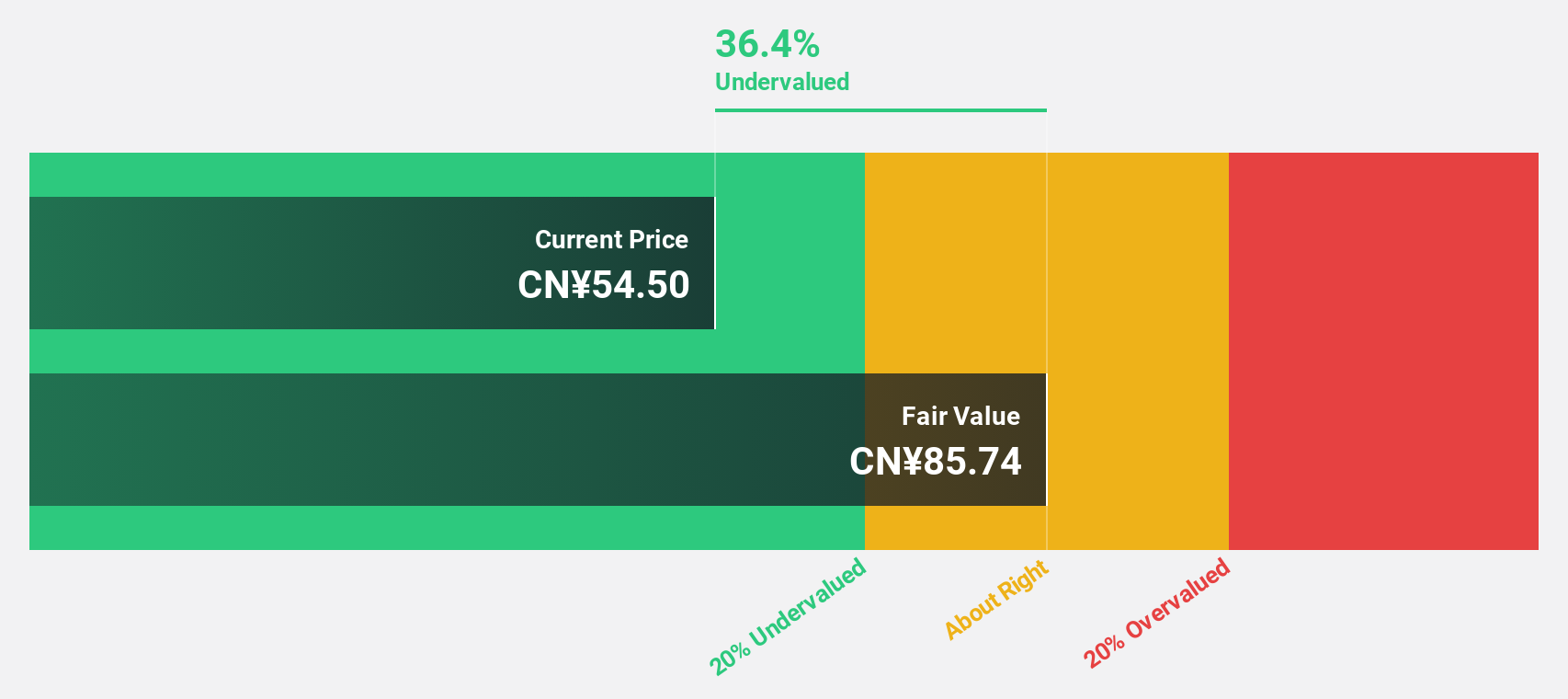

Hanshow Technology (SZSE:301275)

Overview: Hanshow Technology Co. Ltd, with a market cap of CN¥22.60 billion, specializes in providing electronic shelf labeling solutions.

Operations: Hanshow Technology's revenue is primarily generated from its Electric Equipment segment, amounting to CN¥4.14 billion.

Estimated Discount To Fair Value: 38.3%

Hanshow Technology is trading at CN¥53.5, significantly below its estimated fair value of CN¥86.71, suggesting potential undervaluation based on cash flows. Despite a decline in net income for the nine months ending September 2025, earnings are forecast to grow substantially at 31.6% annually, surpassing the Chinese market average. Recent strategic collaborations and a share repurchase program highlight efforts to enhance digitalization and shareholder value amidst current financial challenges.

- Our comprehensive growth report raises the possibility that Hanshow Technology is poised for substantial financial growth.

- Dive into the specifics of Hanshow Technology here with our thorough financial health report.

Make It Happen

- Take a closer look at our Undervalued Asian Stocks Based On Cash Flows list of 279 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English