US$500 Million Buyback Plan Might Change the Case for Investing in Teradata (TDC)

- On November 19, 2025, Teradata Corporation announced a new US$500 million stock repurchase program effective January 1, 2026, replacing its existing program set to expire at the end of 2025.

- This significant move underscores Teradata's ongoing efforts to actively manage its share count and adapt to evolving market and capital return priorities.

- We’ll explore how Teradata’s launch of the new US$500 million buyback program could influence its ongoing investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Teradata Investment Narrative Recap

To be a Teradata shareholder today, you'd likely need confidence in its ability to accelerate recurring and cloud revenue growth despite persistent top-line declines and a fiercely competitive market. The newly approved US$500 million stock repurchase program signals commitment to capital return, but doesn't materially shift the immediate issues of declining revenue or the critical need for sustainable net-new cloud customer wins, which remain the key catalyst and risk right now.

Among Teradata’s recent news, the introduction of new AI Services in October 2025 is highly relevant, aiming to help enterprise clients deploy AI solutions at scale. This aligns directly with the ongoing catalyst around growing demand for robust, AI-ready analytics infrastructure, which is central to Teradata’s narrative and its efforts to capture higher-value workloads and drive recurring revenue expansion.

Yet, while the buyback program showcases Teradata’s financial discipline, investors should also be aware that ongoing pressure on total revenue and recurring sales could...

Read the full narrative on Teradata (it's free!)

Teradata's narrative projects $1.6 billion revenue and $101.6 million earnings by 2028. This requires a -0.9% yearly revenue decline and a decrease of $8.4 million in earnings from the current $110.0 million.

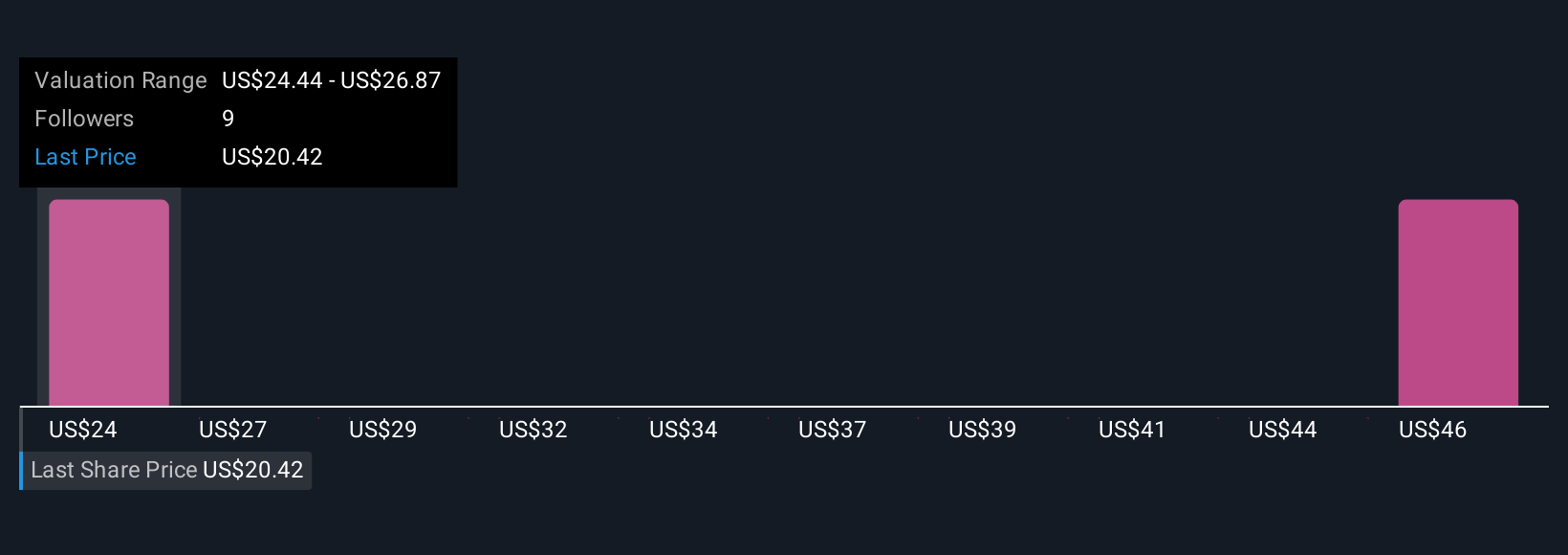

Uncover how Teradata's forecasts yield a $25.78 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community offered fair value estimates ranging from US$21 to US$79.96 per share. With persistent competition from cloud-native providers, perspectives on Teradata’s long-term resilience invite you to consider several alternative viewpoints.

Explore 3 other fair value estimates on Teradata - why the stock might be worth over 3x more than the current price!

Build Your Own Teradata Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teradata research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Teradata research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teradata's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English