Teradata (TDC): Evaluating Valuation After $500 Million Share Buyback Approval

Teradata (TDC) is set to launch a new $500 million stock repurchase program in January 2026, approved by its Board of Directors. The move highlights management’s focus on enhancing shareholder value and optimizing the company’s capital structure.

See our latest analysis for Teradata.

Teradata’s announcement comes just after the company made an appearance at the recent Dell Technologies Forum in New York, adding to a period of renewed attention. While the shares have surged with a robust 27% gain over the past month, this only partially recovers ground lost earlier. The total return over the last year remains down 11.4%. Market momentum lately hints at returning investor enthusiasm, even as the long-term performance still reflects past challenges.

If you’re weighing up your options, now is the perfect moment to discover fast growing stocks with high insider ownership and see which other dynamic companies are gaining momentum right now.

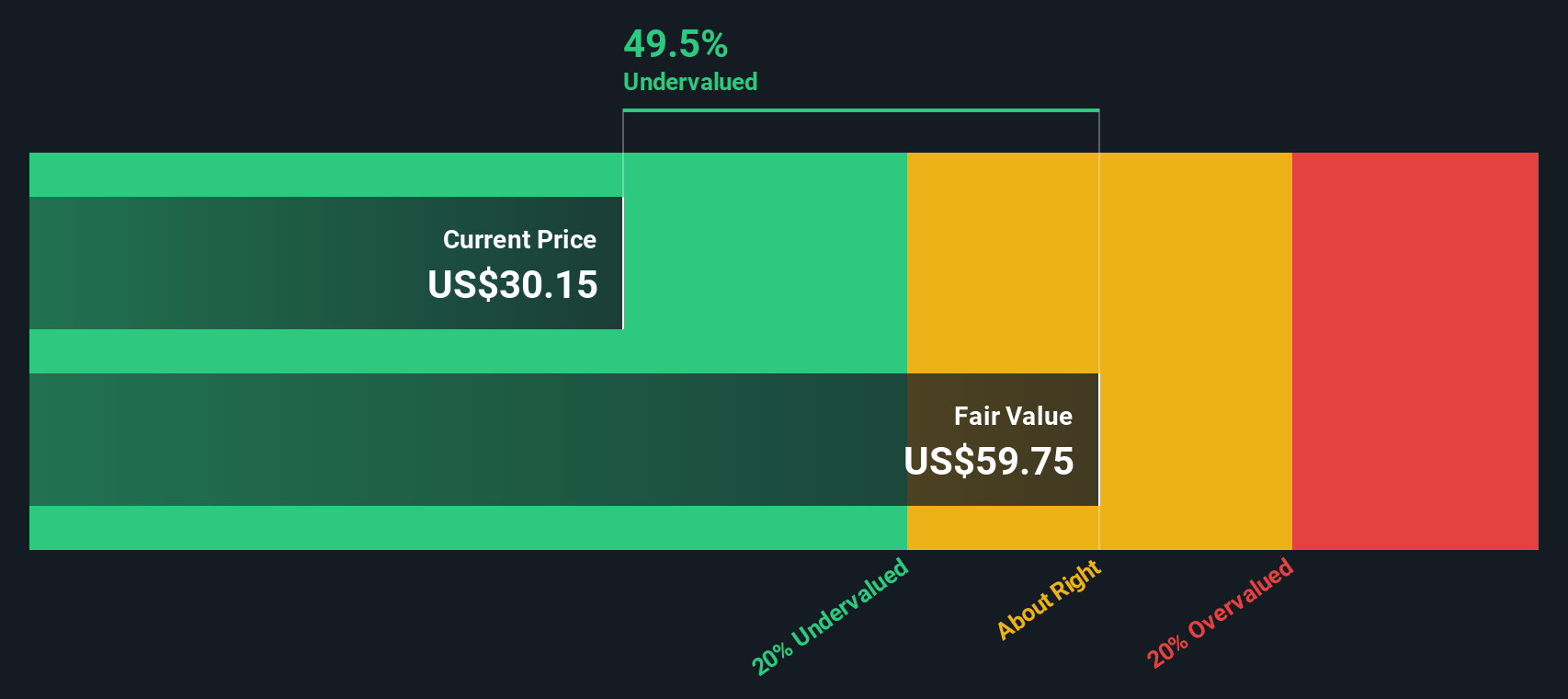

With shares still trading below last year's levels and a new buyback in focus, is Teradata's recent momentum a sign the stock is still undervalued, or has the market already priced in the company's future growth potential?

Most Popular Narrative: 5.5% Overvalued

Teradata’s most followed narrative puts its fair value at $25.78, about 5.5% below its last close of $27.20. The debate centers on whether recent margin improvements and product innovations are enough to support today’s price.

Ongoing product innovation (AI Factory, Enterprise Vector Store, LLMOps, and open source MCP server) is increasing platform differentiation by integrating AI/ML capabilities and supporting industry-specific use cases. This is expected to drive higher average contract values and improve net retention rates over time.

Curious about the earnings and revenue assumptions that shape this verdict? The full narrative reveals an intriguing mix of ambitious profitability targets and a future valuation multiple that rivals software industry leaders. Uncover the surprising drivers behind this contested price.

Result: Fair Value of $25.78 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent revenue headwinds and tough competition from cloud-native rivals could undermine recent gains and challenge Teradata’s long-term earnings growth.

Find out about the key risks to this Teradata narrative.

Another View: SWS DCF Model Shows Deep Undervaluation

While traditional ratios suggest Teradata is slightly overvalued at current prices, a fresh look with our SWS DCF model finds the stock trading at a steep 66% discount to intrinsic value. That’s a powerful counterpoint that raises eyebrows. Are market pessimists missing something, or are DCF assumptions too generous?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Teradata Narrative

If you see things differently or want to dig into the numbers yourself, it takes just a few minutes to build your own view and uncover new angles. So why not Do it your way?

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Teradata.

Ready for More Smart Investing Opportunities?

Don't sit on the sidelines while powerful market shifts unfold. Fuel your portfolio with stocks making an impact. These tailored ideas could be your next winning move.

- Capture the growth potential of rapidly expanding artificial intelligence companies by starting with these 26 AI penny stocks. Get ahead of the tech curve before others catch on.

- Boost your income stream and strengthen portfolio resilience by tapping into these 15 dividend stocks with yields > 3% with yields higher than 3%.

- Ride the transformation of digital finance, security, and payments by acting now on these 81 cryptocurrency and blockchain stocks, which is at the forefront of blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English