How Will Yangtze Optical Fibre’s Governance Restructuring Shape Oversight for SEHK:6869 Investors?

- Yangtze Optical Fibre and Cable Joint Stock Limited Company has announced a proposal ahead of its December 5, 2025, extraordinary general meeting to amend its articles of association by abolishing its board of supervisors and assigning those responsibilities to the audit committee under the board of directors.

- This proposed shift signals a meaningful reorganization of the company’s corporate governance framework, aligning oversight functions with current PRC regulations and industry practices.

- We’ll explore how reassigning supervisory duties to the audit committee could influence the company’s investment narrative and approach to internal oversight.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Yangtze Optical Fibre And Cable Limited's Investment Narrative?

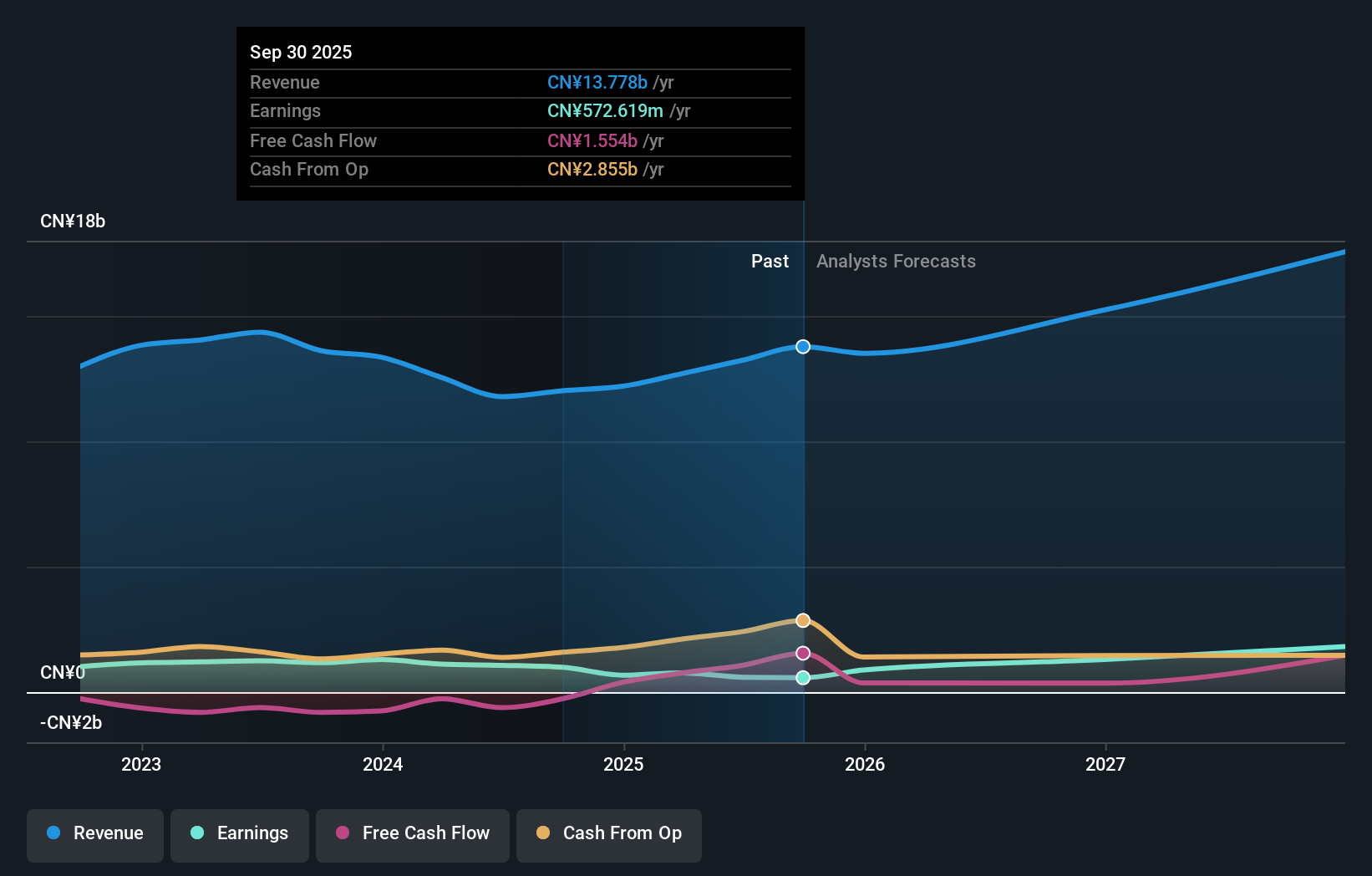

For anyone considering Yangtze Optical Fibre and Cable Limited, the investment story hinges on belief in the company's ability to deliver growth in a technically evolving sector while navigating regulatory and profitability challenges. The news that the audit committee may soon absorb the supervisory board’s roles highlights a shift toward streamlined governance, aimed at better aligning with PRC standards. While this proposed change is unlikely to shake up the company's biggest short-term catalysts, such as ongoing product innovation and expansion of high-capacity fibre solutions, the spotlight on governance could help address certain investor concerns about board effectiveness and internal oversight, both of which have lingered as risks given the moderate level of board independence and recent earnings pressure. Importantly, as share price volatility remains elevated and the company trades well below analyst targets, how smoothly this governance adjustment is managed may influence financial performance more in the medium term than immediately. On the other hand, the impact of less independent oversight is a key detail investors should bear in mind.

Despite retreating, Yangtze Optical Fibre And Cable Limited's shares might still be trading 26% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Yangtze Optical Fibre And Cable Limited - why the stock might be worth just HK$43.43!

Build Your Own Yangtze Optical Fibre And Cable Limited Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yangtze Optical Fibre And Cable Limited research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Yangtze Optical Fibre And Cable Limited research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yangtze Optical Fibre And Cable Limited's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English