Asian Penny Stock Spotlight: Chaoju Eye Care Holdings And Two More Opportunities

Amidst global market fluctuations driven by AI concerns and valuation anxieties, investors are increasingly exploring diverse opportunities across different regions, including Asia. While the term 'penny stock' might evoke images of speculative ventures from the past, these smaller or newer companies can still offer valuable prospects when supported by solid financials. In this article, we highlight three Asian penny stocks that combine balance sheet strength with potential for growth, offering investors a chance to uncover hidden value in promising enterprises.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.49 | HK$921.6M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.47 | HK$2.05B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.01 | SGD409.34M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.94 | THB2.96B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.097 | SGD50.78M | ✅ 2 ⚠️ 4 View Analysis > |

| Gunkul Engineering (SET:GUNKUL) | THB1.84 | THB15.83B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.33 | SGD13.11B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$0.94 | HK$2.52B | ✅ 3 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.03 | NZ$146.62M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.80 | NZ$235.47M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 962 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Chaoju Eye Care Holdings (SEHK:2219)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chaoju Eye Care Holdings Limited operates a network of ophthalmic hospitals and optical centers in China, with a market cap of HK$1.78 billion.

Operations: The company's revenue is derived from Basic Ophthalmic Services (CN¥678.09 million), Consumer Ophthalmic Services (CN¥689.45 million), and Sales of Equipment and Medical Consumables (CN¥1.88 million).

Market Cap: HK$1.78B

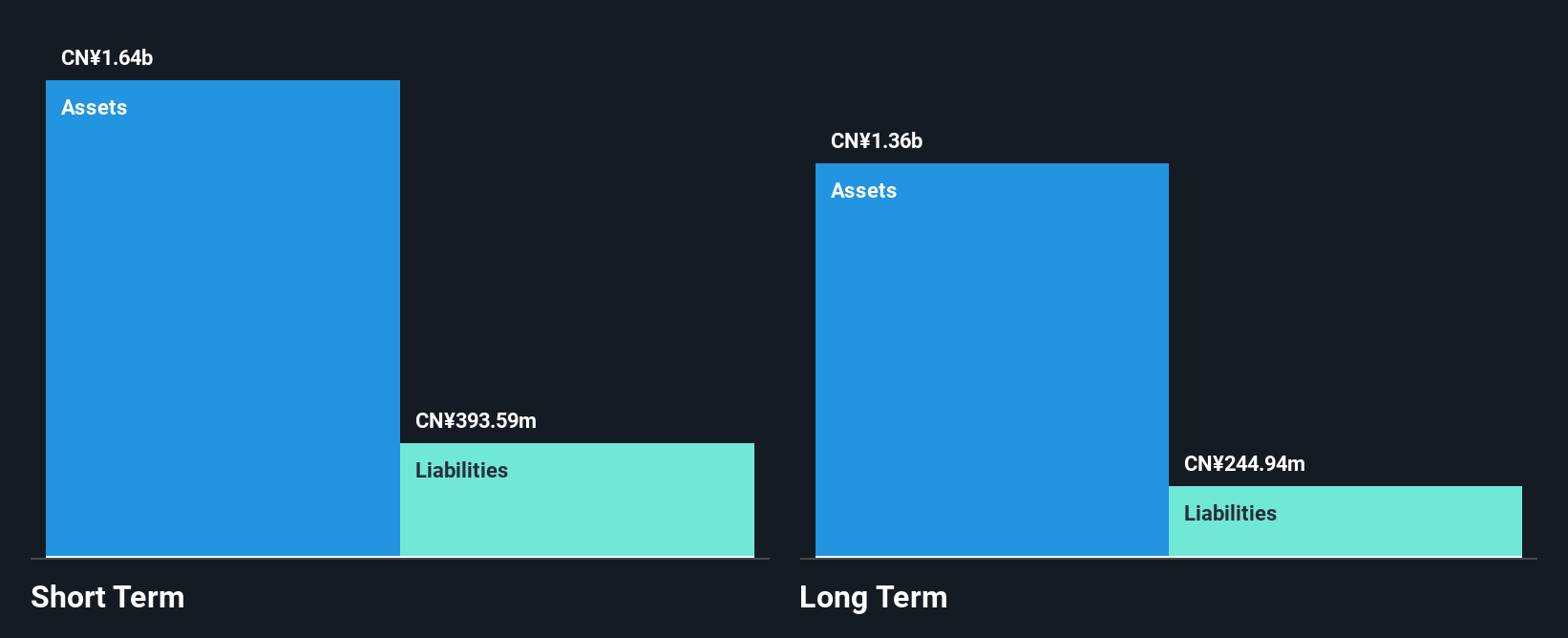

Chaoju Eye Care Holdings has shown resilience in its financial structure, with short-term assets of CN¥1.6 billion covering both long-term and short-term liabilities. The company reported sales of CN¥698.26 million for the first half of 2025, though this is a decline from the previous year. Despite a decrease in net income and profit margins, Chaoju maintains high-quality earnings and strong cash flow coverage for its debt. However, the absence of an interim dividend signals caution amid negative earnings growth over the past year. Its stock trades significantly below estimated fair value, offering potential relative value compared to peers.

- Click here and access our complete financial health analysis report to understand the dynamics of Chaoju Eye Care Holdings.

- Gain insights into Chaoju Eye Care Holdings' future direction by reviewing our growth report.

China PengFei Group (SEHK:3348)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China PengFei Group Limited is an investment holding company that manufactures and sells rotary kilns, grinding equipment, and related machinery both in China and internationally, with a market cap of HK$640 million.

Operations: The company generates CN¥1.20 billion in revenue from its Machinery & Industrial Equipment segment.

Market Cap: HK$640M

China PengFei Group Limited has demonstrated financial stability, with short-term assets of CN¥2.1 billion surpassing its short-term liabilities of CN¥1.7 billion and long-term liabilities of CN¥50.9 million. Despite a decline in sales to CN¥571.58 million for the first half of 2025, net income increased to CN¥41.99 million compared to the previous year. The company benefits from experienced management and board teams, while maintaining more cash than total debt and strong operating cash flow coverage for its debt obligations. However, negative earnings growth and lower profit margins present challenges amidst an unstable dividend history.

- Navigate through the intricacies of China PengFei Group with our comprehensive balance sheet health report here.

- Learn about China PengFei Group's historical performance here.

Yunhong Guixin Group Holdings (SEHK:8349)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yunhong Guixin Group Holdings Limited is an investment holding company focused on the research, development, production, and sale of fiberglass reinforced plastic products in China, with a market cap of HK$868 million.

Operations: The company generates revenue from two main segments: the Fiberglass Business, contributing CN¥9.95 million, and the Silica Sand Business, with CN¥13.64 million.

Market Cap: HK$868M

Yunhong Guixin Group Holdings, focused on fiberglass reinforced plastic products, faces challenges with declining revenue and increasing losses. For the half year ended June 2025, sales fell to CN¥12.67 million from CN¥16.08 million a year prior, while net loss widened to CN¥4 million. Despite being debt-free and having sufficient cash runway for over three years due to positive free cash flow, the company remains unprofitable with volatile share prices. Management changes include the resignation of Ms. Jin Dan as an executive director in August 2025 due to other commitments.

- Take a closer look at Yunhong Guixin Group Holdings' potential here in our financial health report.

- Assess Yunhong Guixin Group Holdings' previous results with our detailed historical performance reports.

Make It Happen

- Discover the full array of 962 Asian Penny Stocks right here.

- Looking For Alternative Opportunities? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English