A Closer Look at iRhythm Technologies’s (IRTC) Valuation After New Global Clinical Data Release

iRhythm Technologies (IRTC) presented new real-world data at a major heart rhythm conference, highlighting how their Zio service delivers consistent cardiac monitoring results for both Asian and non-Asian patient groups. This research could strengthen iRhythm’s global presence, particularly in Japan.

See our latest analysis for iRhythm Technologies.

iRhythm Technologies has seen impressive momentum in 2024, with the share price up over 110% year-to-date, reflecting renewed optimism about the company’s global growth prospects and the strength of its clinical evidence. Over the past year, total shareholder return stands at 111.5%. However, the stock’s long-term performance has been more mixed.

If healthcare tech breakthroughs grab your attention, consider discovering more innovators in the space with our curated See the full list for free..

With shares surging and clinical momentum building, the big question now is whether iRhythm’s valuation reflects all its future promise or if there could still be room for investors to benefit from further upside.

Most Popular Narrative: 14.4% Undervalued

With iRhythm Technologies closing at $188.30 and the narrative’s fair value pegged at $219.93, the current market price sits below expectations set by the most popular valuation story. This context sets the backdrop for a closer look at the factors that could justify such optimism.

Expansion into international markets (UK, EU, Japan), where iRhythm is seeing strong early uptake and building clinical validation, diversifies revenue streams and positions the company for long-term topline growth as aging populations drive global demand for remote cardiac monitoring. Investment in the Zio ecosystem, including next-generation patches, enhanced form factors, and AI-powered analytics (such as the Lucem Health partnership), is improving product differentiation, diagnostic yield, and workflow efficiency. This is likely leading to higher gross margins and operating leverage as software and data become a larger component of the business.

Want a glimpse at the numbers behind this valuation? The story hinges on ambitious growth assumptions, breakthrough margins, and a future profit forecast built around bold market expansion moves. Which specific projections unlock that higher price? Get the inside story in the full narrative.

Result: Fair Value of $219.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks remain, particularly if intensifying competition or unexpected regulatory challenges disrupt iRhythm’s growth momentum or pressure margins in the coming quarters.

Find out about the key risks to this iRhythm Technologies narrative.

Another View: Market Comparisons Raise Caution

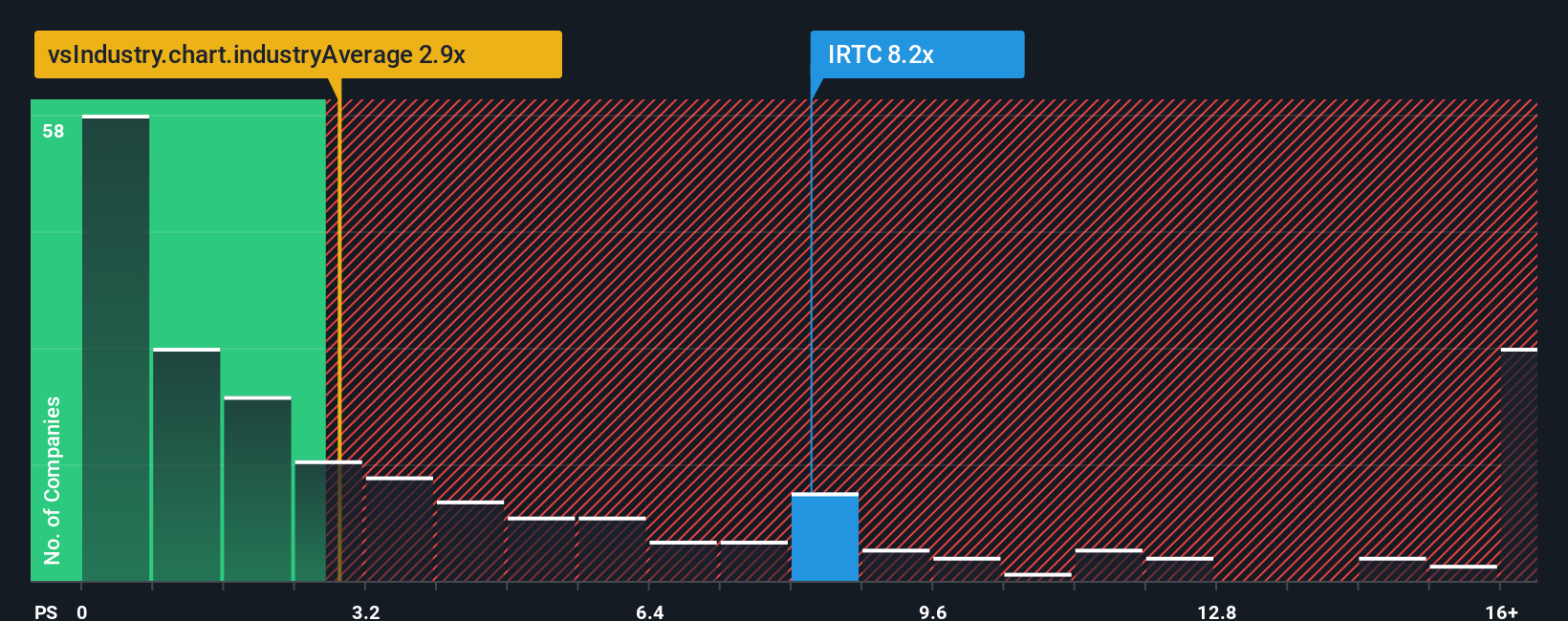

While the narrative’s fair value suggests upside, looking at price-to-sales ratios tells a different story. iRhythm trades at 8.6 times sales, much higher than both the US Medical Equipment industry average (3.3x) and its peer group (6.7x). The fair ratio, based on what the market could shift toward, is 4.8x. This premium signals real valuation risk; could investors be paying up too much for growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own iRhythm Technologies Narrative

If you have a different angle or want to test your own assumptions against the numbers, you can quickly craft your own perspective in just a few minutes. Do it your way.

A great starting point for your iRhythm Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself an edge by checking out other compelling stock opportunities that smart investors are acting on now. Your next winner might be just a click away.

- Capture the potential of tomorrow’s tech with these 26 AI penny stocks, which are reshaping industries through artificial intelligence and automation.

- Start building steady income streams with these 14 dividend stocks with yields > 3%, offering yields above 3% amid today’s volatile markets.

- Seize timely bargains as you spot these 924 undervalued stocks based on cash flows, which could unlock significant upside based on powerful cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English