Asian Penny Stocks To Watch In November 2025

As global markets grapple with AI concerns and fluctuating valuations, Asian indices have mirrored these trends, reflecting investor caution. For those interested in smaller or newer companies, penny stocks—despite their somewhat outdated label—remain a relevant investment area. These stocks can offer unique opportunities for growth when backed by solid financial foundations, making them intriguing options for investors seeking under-the-radar potential.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.52 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB5.00 | THB3.1B | ✅ 3 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.44 | HK$2.02B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.03 | SGD417.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.098 | SGD51.3M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.37 | SGD13.26B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.20 | ₱859.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.85 | NZ$239.67M | ✅ 4 ⚠️ 1 View Analysis > |

| Lum Chang Holdings (SGX:L19) | SGD0.445 | SGD166.71M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 958 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Edvance International Holdings (SEHK:1410)

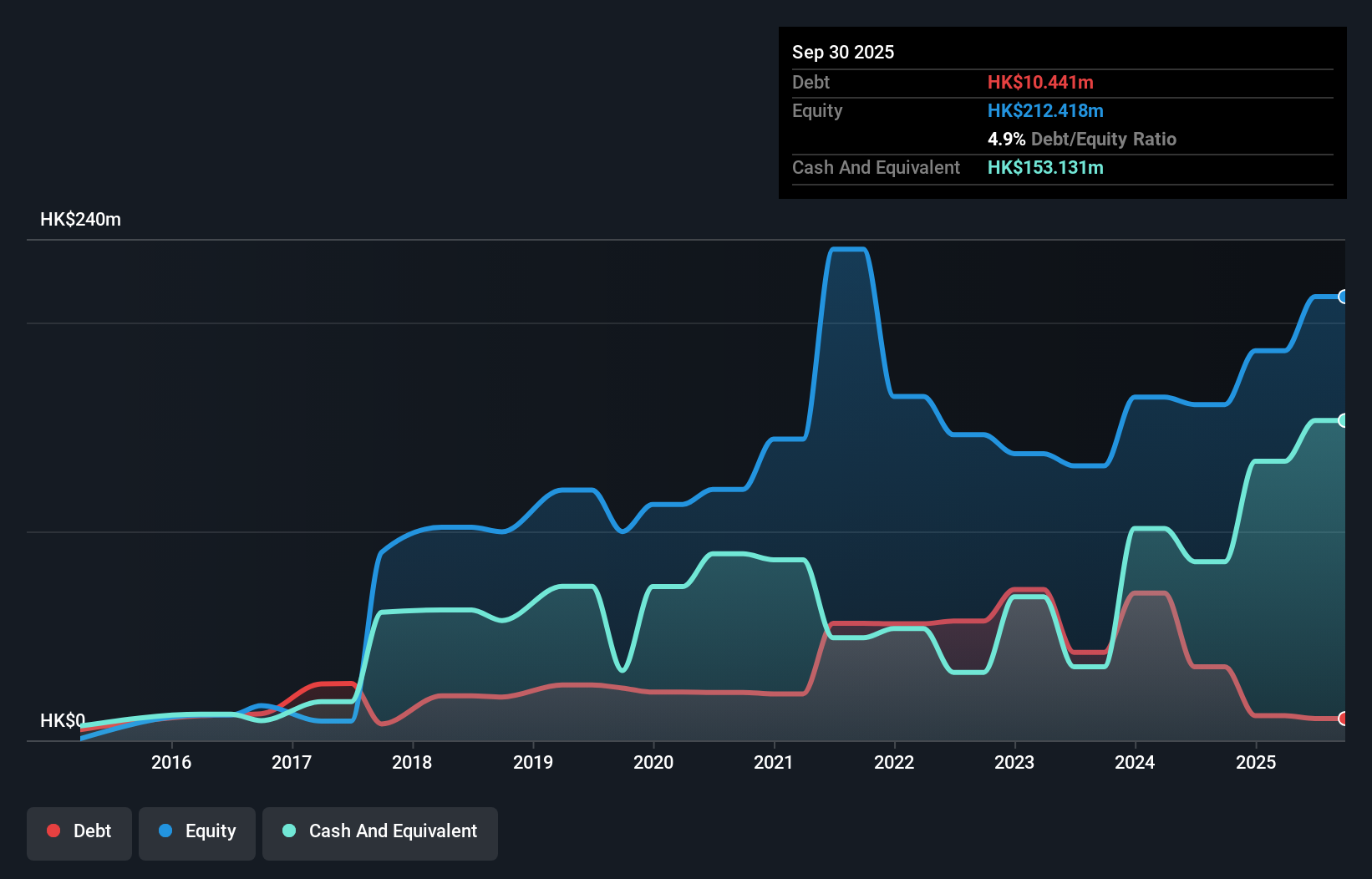

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Edvance International Holdings Limited is an investment holding company that distributes cybersecurity products and services across the People’s Republic of China, Hong Kong, Mongolia, Macau, and Singapore with a market cap of HK$572.40 million.

Operations: Edvance International Holdings Limited has not reported any specific revenue segments.

Market Cap: HK$572.4M

Edvance International Holdings has demonstrated a significant turnaround, reporting HK$391.29 million in sales and a net income of HK$25.99 million for the half year ended September 30, 2025, compared to a loss last year. The company's seasoned management and board contribute to its strategic direction, with high return on equity at 24.3% and a price-to-earnings ratio of 11.1x suggesting potential value relative to the market. Despite past earnings volatility and reliance on one-off gains impacting results, Edvance maintains strong cash positions covering both debt levels and short-term liabilities effectively.

- Click here and access our complete financial health analysis report to understand the dynamics of Edvance International Holdings.

- Gain insights into Edvance International Holdings' past trends and performance with our report on the company's historical track record.

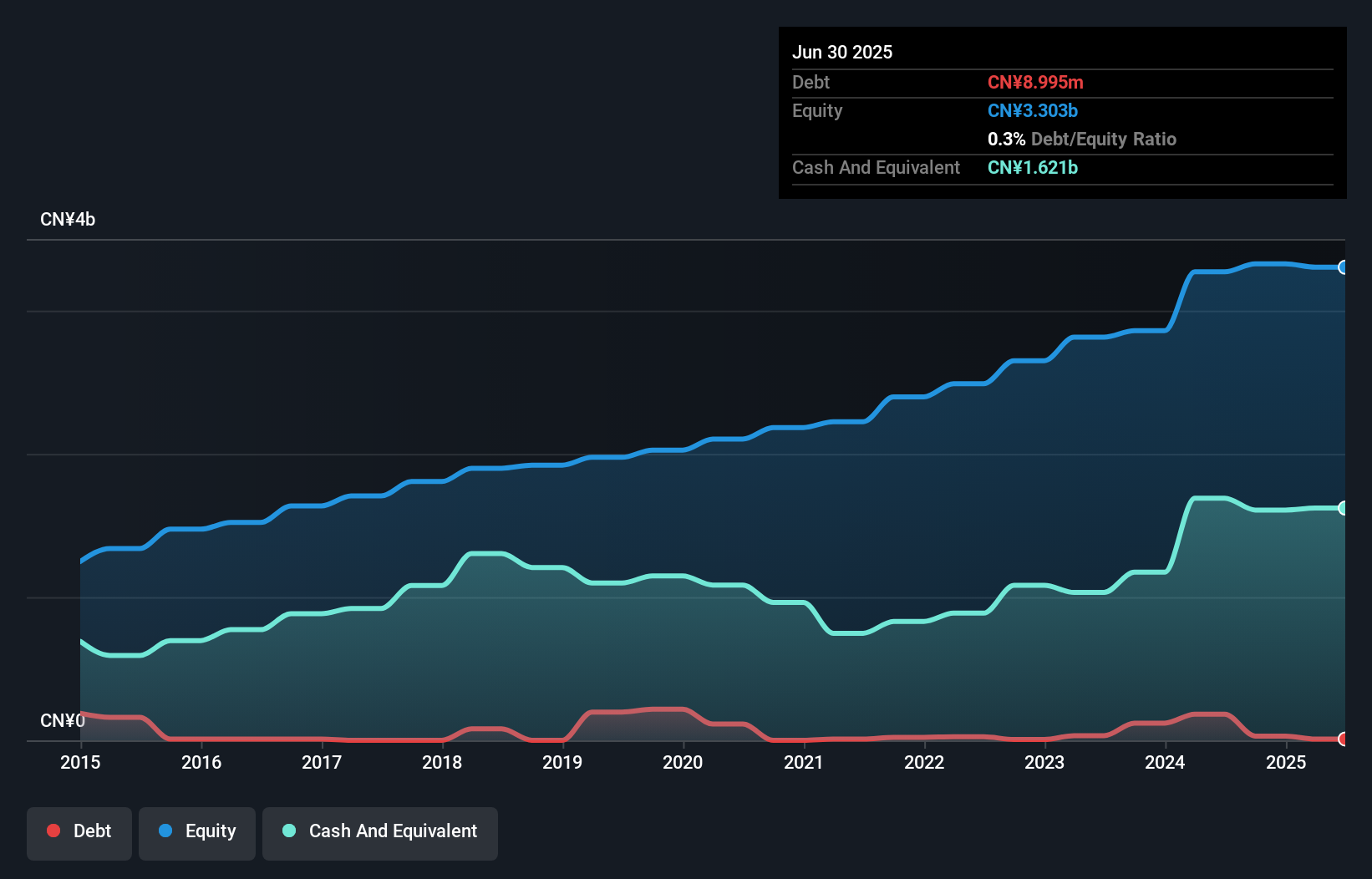

Dawnrays Pharmaceutical (Holdings) (SEHK:2348)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dawnrays Pharmaceutical (Holdings) Limited is an investment holding company that develops, manufactures, and sells non-patented pharmaceutical medicines in Mainland China and internationally, with a market cap of HK$1.86 billion.

Operations: The company's revenue is derived from two primary segments: Finished Drugs, contributing CN¥1.05 billion, and Intermediates and Bulk Medicines, accounting for CN¥164.60 million.

Market Cap: HK$1.86B

Dawnrays Pharmaceutical (Holdings) displays financial stability with short-term assets of CN¥2.1 billion surpassing both short-term liabilities and long-term obligations. Despite a seasoned management team and board, the company faces challenges with recent negative earnings growth and declining profit margins from 52.2% to 15.9%. However, Dawnrays maintains a low debt-to-equity ratio of 0.3%, reduced significantly over five years, and its operating cash flow comfortably covers debt obligations at a very high level. The price-to-earnings ratio of 9.6x indicates potential undervaluation compared to the broader Hong Kong market average of 12.2x.

- Click here to discover the nuances of Dawnrays Pharmaceutical (Holdings) with our detailed analytical financial health report.

- Evaluate Dawnrays Pharmaceutical (Holdings)'s historical performance by accessing our past performance report.

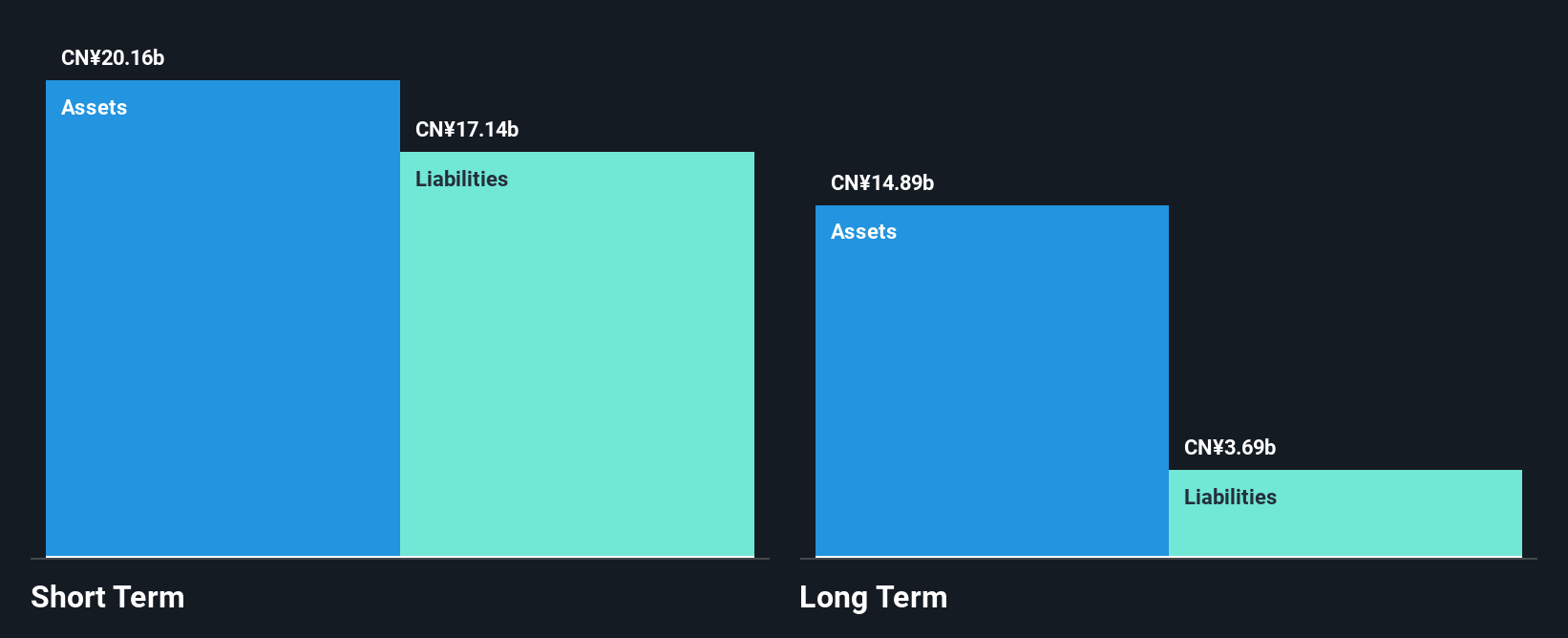

China Yongda Automobiles Services Holdings (SEHK:3669)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Yongda Automobiles Services Holdings Limited is an investment holding company that operates as a retailer and service provider for luxury and ultra-luxury passenger vehicles in China, with a market cap of approximately HK$3.30 billion.

Operations: The company generates revenue primarily from Passenger Vehicle Sales and Services, amounting to CN¥59.06 billion, and Automobile Operating Lease Services, contributing CN¥441.73 million.

Market Cap: HK$3.3B

China Yongda Automobiles Services Holdings faces challenges with profitability, evidenced by a negative return on equity of -32.54% and increasing losses over the past five years. However, its financial structure shows resilience; short-term assets of CN¥15.1 billion exceed both short-term and long-term liabilities, while operating cash flow covers 57.3% of debt, indicating sound debt management. The company has not significantly diluted shareholders recently and has reduced its debt-to-equity ratio from 101.7% to 33% in five years. Despite unprofitability, it trades at good value compared to peers and forecasts suggest robust earnings growth ahead at a very large rate annually.

- Unlock comprehensive insights into our analysis of China Yongda Automobiles Services Holdings stock in this financial health report.

- Gain insights into China Yongda Automobiles Services Holdings' outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Gain an insight into the universe of 958 Asian Penny Stocks by clicking here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English