Zio ECG Study Shows Cross-Population Efficacy and Might Change The Case For Investing In iRhythm Technologies (IRTC)

- iRhythm Technologies recently announced results from a large U.S. study presented at APHRS 2025, showing their Zio long-term ECG monitoring service delivered consistent performance and diagnostic yield for both Asian and non-Asian patients over a 14-day monitoring period.

- This cross-population evidence, bolstered by advanced AI analytics and broad clinical validation, is especially relevant for global markets where differences in patient demographics and lifestyle can affect device effectiveness.

- We'll now explore how this new evidence for cross-population effectiveness could shape iRhythm's investment narrative and international growth prospects.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

iRhythm Technologies Investment Narrative Recap

To be a shareholder in iRhythm Technologies, you need to believe that expanding clinical validation and use of its Zio platform can drive adoption in diverse, global healthcare markets. The recent U.S. study showing Zio’s consistent ECG monitoring performance across Asian and non-Asian patients provides meaningful support for international growth, but it does not materially change the primary short-term catalyst, which remains broader adoption among primary care and integrated health systems. The biggest risk is iRhythm’s heavy reliance on select channel partners, where any faltering could lead to significant revenue volatility.

The recent launch of the Zio ECG Recording and Analysis System in Japan, designed for uninterrupted 14-day monitoring and equipped with advanced AI, is particularly relevant. This move aligns well with the new evidence showcased at APHRS 2025, showing that iRhythm is focused on building clinical credibility in international markets, a key driver of ongoing revenue growth and diversification.

But despite these opportunities, investors should be aware that iRhythm’s dependence on a small number of large partners means that if even one relationship disappoints...

Read the full narrative on iRhythm Technologies (it's free!)

iRhythm Technologies' outlook anticipates $1.1 billion in revenue and $49.7 million in earnings by 2028. This is based on an annual revenue growth rate of 17.5% and a swing in earnings of $142.1 million, rising from a current loss of $92.4 million to a forecast profit of $49.7 million.

Uncover how iRhythm Technologies' forecasts yield a $219.93 fair value, a 18% upside to its current price.

Exploring Other Perspectives

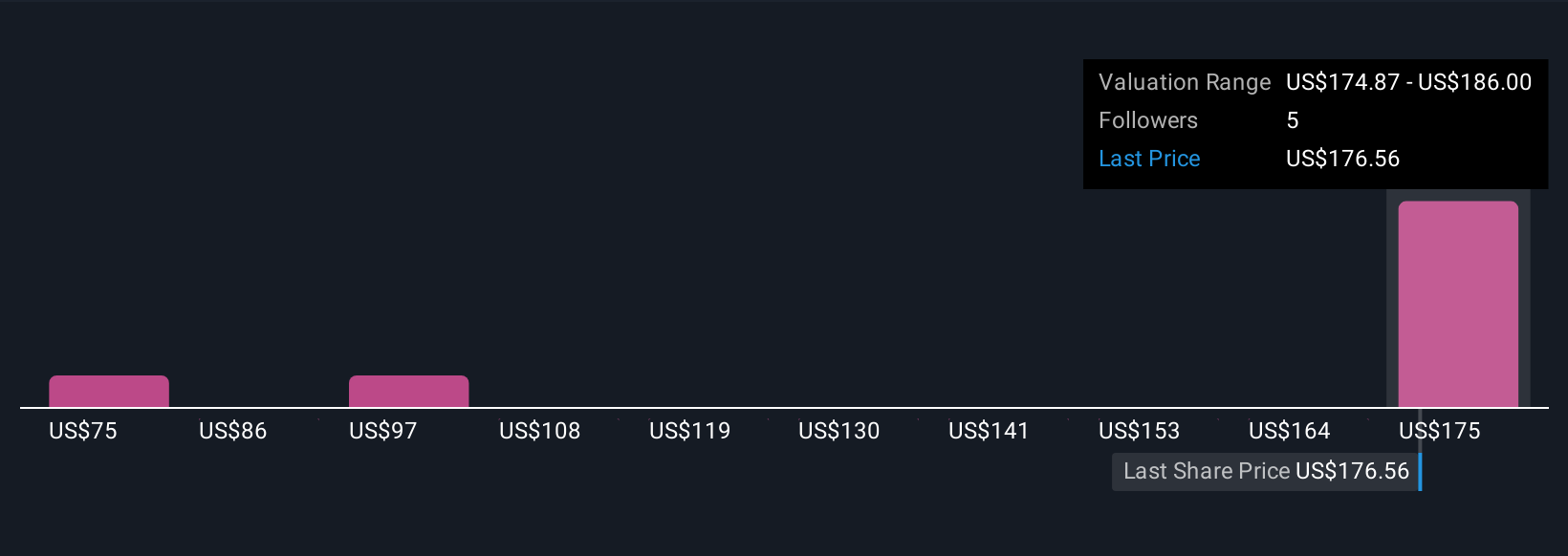

Simply Wall St Community fair value opinions for iRhythm range widely, from US$68 to US$220 across four investor analyses. As adoption across global healthcare markets grows, your perspective on the pace and stability of international expansion could shape your long-term outlook.

Explore 4 other fair value estimates on iRhythm Technologies - why the stock might be worth less than half the current price!

Build Your Own iRhythm Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your iRhythm Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free iRhythm Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate iRhythm Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English