How Investors May Respond To Diebold Nixdorf (DBD) Powering ROSSMANN's Swiss Launch With Retail Tech

- Diebold Nixdorf announced it has successfully supported the Swiss market entry of ROSSMANN, providing managed services and retail technology, including self-checkout and POS systems, based on their earlier German partnership model.

- This expansion highlights how a scalable technology and managed services model developed in Germany is now enabling international retail growth for both companies.

- We'll examine how Diebold Nixdorf's rollout of managed services for ROSSMANN in Switzerland influences its investment narrative and future growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Diebold Nixdorf Investment Narrative Recap

To be a Diebold Nixdorf shareholder, you need to believe in the company’s ability to execute its transition from hardware-driven sales to a higher-margin, recurring software and managed services model. While the ROSSMANN Swiss expansion validates the exportability of Diebold’s retail technology and services blueprint, it is not likely to shift the main short-term catalyst, which continues to be the ramp-up of software-and-service contract wins; the largest risk remains slower-than-expected growth in these high-margin recurring services, which could stall margin improvement and earnings predictability.

Among recent updates, the Q3 2025 earnings report stands out, with Diebold Nixdorf posting US$945.2 million in quarterly revenue and a swing to net income after a prior-year loss. This supports near-term optimism around sustained revenue trends and margin improvements, key short-term drivers given the company’s emphasis on expanding recurring service revenues like those in the ROSSMANN partnership.

In contrast, investors should be aware of the possibility that recurring service contracts ramp up more slowly than forecast, as...

Read the full narrative on Diebold Nixdorf (it's free!)

Diebold Nixdorf is projected to reach $4.2 billion in revenue and $312.7 million in earnings by 2028. This outlook requires annual revenue growth of 4.3% and an earnings increase of $325.6 million from the current earnings of $-12.9 million.

Uncover how Diebold Nixdorf's forecasts yield a $79.00 fair value, a 22% upside to its current price.

Exploring Other Perspectives

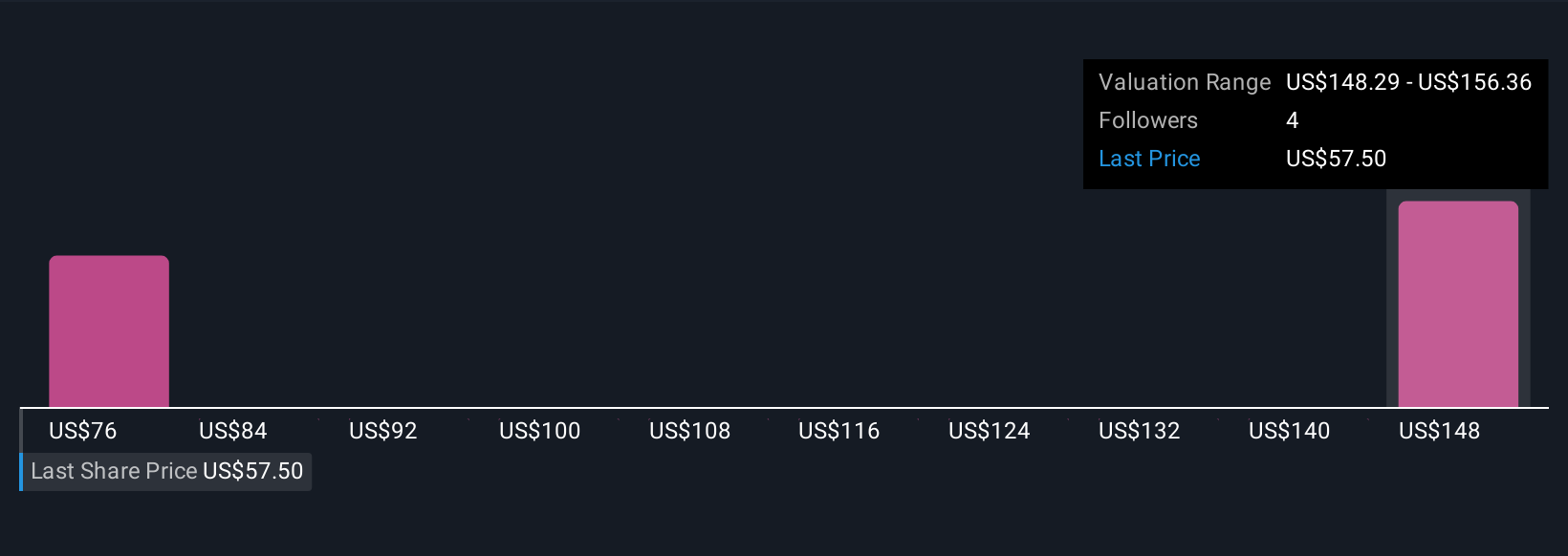

Simply Wall St Community members provided a broad range of fair value estimates for Diebold Nixdorf, from US$79 to US$115.47, across two analyses. With growing focus on managed and software services as a catalyst, these diverse opinions underscore how much broader expectations still diverge for the company’s future performance.

Explore 2 other fair value estimates on Diebold Nixdorf - why the stock might be worth just $79.00!

Build Your Own Diebold Nixdorf Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Diebold Nixdorf research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Diebold Nixdorf research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Diebold Nixdorf's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English