Hong Kong Robotics (SEHK:370) Net Loss Deepens, Challenging Recovery Narratives in H1 2026 Results

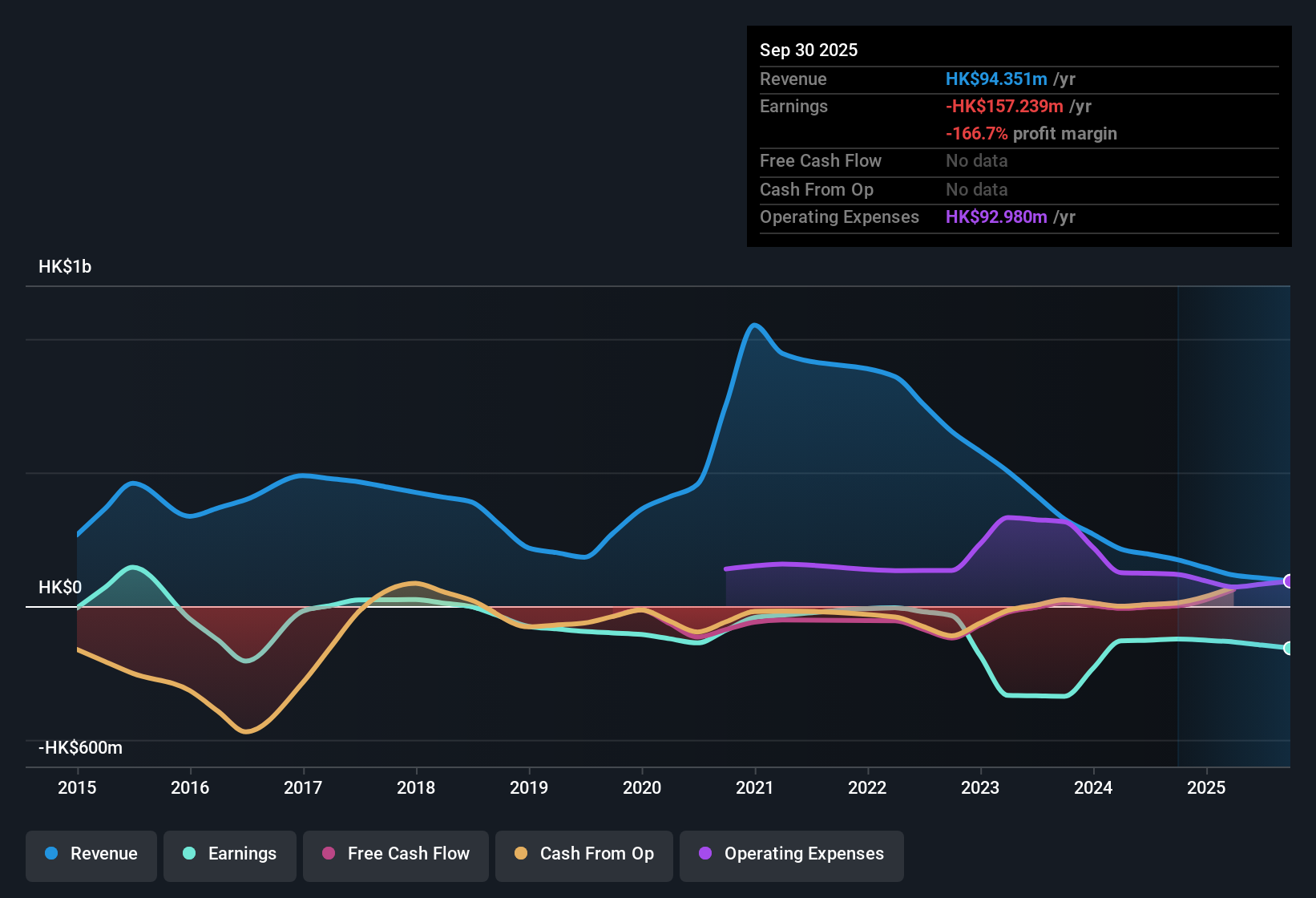

Hong Kong Robotics Group Holding (SEHK:370) has released its H1 2026 results, reporting revenue of HK$51.9 million and Basic EPS of -0.0483 HKD. Looking back at recent trends, revenue fell from HK$107.8 million in H2 2024 to HK$64.2 million in H1 2025, before landing at HK$51.9 million this half. EPS has moved from -0.0424 HKD to -0.0157 HKD and now sits at -0.0483 HKD. With losses continuing and margins under pressure, investors will be watching for signs of fundamental recovery.

See our full analysis for Hong Kong Robotics Group Holding.Next up, the latest figures can be compared with the prevailing narratives about the company. This may show which expectations hold up and where the outlook might be shifting.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Losses Accelerate to HK$157 Million

- For the trailing twelve months, net income (excluding extra items) deteriorated to a loss of HK$157.2 million, compared to a HK$123.2 million loss in earlier periods. This reflects a deepening of negative profitability.

- What stands out in the prevailing market view is that despite ongoing losses, the group’s rebranding and push into robotics has yet to produce any improvement in margins or profitability, as losses continue to increase rather than decrease.

- Annual net losses have increased at an average rate of 17% over the past five years, challenging any optimistic hopes of a near-term profit turnaround.

- Consensus narrative points to a lack of margin improvement, with persistent cost pressures visible in both the semiannual and trailing figures.

Price-to-Sales Ratio Far Exceeds Peers

- The company's current Price-to-Sales Ratio is 22.6x, which is considerably higher than its peer average of 4.3x and the broader Hong Kong Retail Distributors industry at 1.1x.

- Consensus narrative highlights that such a premium valuation is difficult to justify when performance lags behind competitors and there is no evidence of segment leadership.

- With the share price of HK$1.02 above the DCF fair value of HK$0.83, critics point out that speculative interest may be supporting the stock instead of tangible business progress.

- The absence of concrete earnings rewards makes this valuation gap even more difficult to support compared to industry norms.

No Evident Rewards Amid Persistent Losses

- The data shows no material rewards for shareholders over the past year, as high-quality earnings or improvement in margins have been absent throughout the reporting periods.

- The market view suggests that until fundamentals reflect a true turnaround, investor sentiment is likely to remain muted, with the focus on whether management can reverse the ongoing multi-year trend of deepening losses and disappointing returns.

- With basic EPS at -0.075 HKD for the trailing year and no indication of profitability, confidence in an imminent recovery remains low.

- Investors may continue to observe from the sidelines, waiting for a proven path to sustainable growth before re-engaging.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Hong Kong Robotics Group Holding's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

With persistent losses, elevated valuation, and no improvement in margins or profitability, Hong Kong Robotics Group faces major challenges to generating shareholder value.

If you want to focus on companies with solid value potential and lower risk of overvaluation, start your search with these 919 undervalued stocks based on cash flows to target stocks that offer better fundamentals and upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English