Arta TechFin (SEHK:279) Posts HK$41.2M H1 Revenue; Losses Persist Despite Valuation Premium

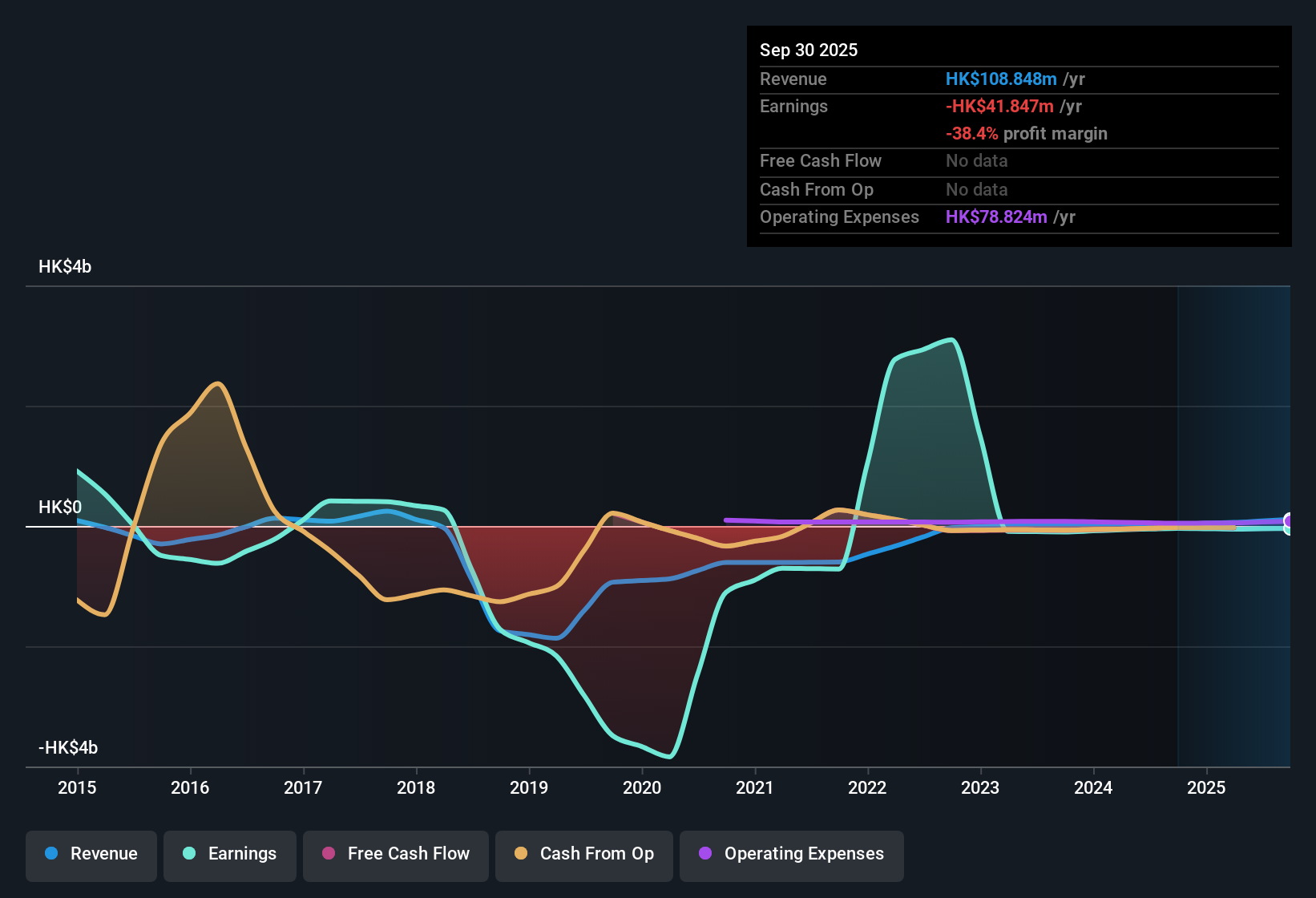

Arta TechFin (SEHK:279) has just released results for H1 2026, reporting revenue of 41.2 million HKD and a basic EPS of -0.029 HKD, as the company remains in the red. Over recent periods, revenue moved from 13.9 million HKD in H2 2024 to 17.6 million HKD in H1 2025 and 41.2 million HKD in H2 2025, while reported EPS stayed negative throughout. Persistent losses and compressed margins continue to shape investor sentiment following these results.

See our full analysis for Arta TechFin.Now let’s see how the fresh numbers compare to the prevailing narratives about Arta TechFin. Some expectations may be confirmed, while others might get a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

Valuation Stands Out: 8.5x Price-to-Sales Ratio

- Arta TechFin is trading at a price-to-sales ratio of 8.5x, which is well above the Hong Kong capital markets industry average of 5.1x and a peer average of 5.8x. This indicates its relatively expensive valuation in the sector.

- This premium valuation is not supported by any clear improvement in profitability or profit margins, which remain in negative territory according to recent financial data.

- Net income for H1 2026 reported a loss of 30.1 million HKD, extending the negative trend seen in earlier periods.

- Analysts point out that the higher multiple could affect near-term investor sentiment if stronger earnings or a clear catalyst do not emerge.

Shareholder Dilution Intensifies Valuation Pressure

- Substantial shareholder dilution emerged as a key risk over the past year, as ownership was distributed across a larger base without accompanying profits.

- Critical observers note that this dilution, in combination with ongoing losses, limits potential upside for existing shareholders.

- With net income negative and no margin improvement evident, the dilution adds further pressure on future returns.

- The data does not mention any catalysts to offset these structural challenges.

Consistent Losses Despite Revenue Gain

- Trailing twelve-month net income stayed negative at 41.8 million HKD, and losses have been increasing at an annual rate of 1.1% for the last five years, even though revenue has shown substantial growth in recent periods.

- Prevailing analysis notes that, without a turnaround in profitability or costs, these losses continue to challenge arguments for operational improvement.

- The consensus suggests that revenue growth alone is insufficient unless it leads to improved margins or bottom-line results.

- Sector-wide caution remains in place, especially given the lack of significant positive earning shifts in the latest filings.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Arta TechFin's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

With Arta TechFin’s persistent losses, negative margins, and shareholder dilution, investors face elevated risk and no clear path to improved profitability.

If you’re seeking potential opportunities with more attractive valuations and better downside protection, check out these 919 undervalued stocks based on cash flows to uncover companies trading at a discount with stronger fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English