Chunlai Education (SEHK:1969) Net Margin Remains Sector-Leading, Testing Views of Unmatched Profitability

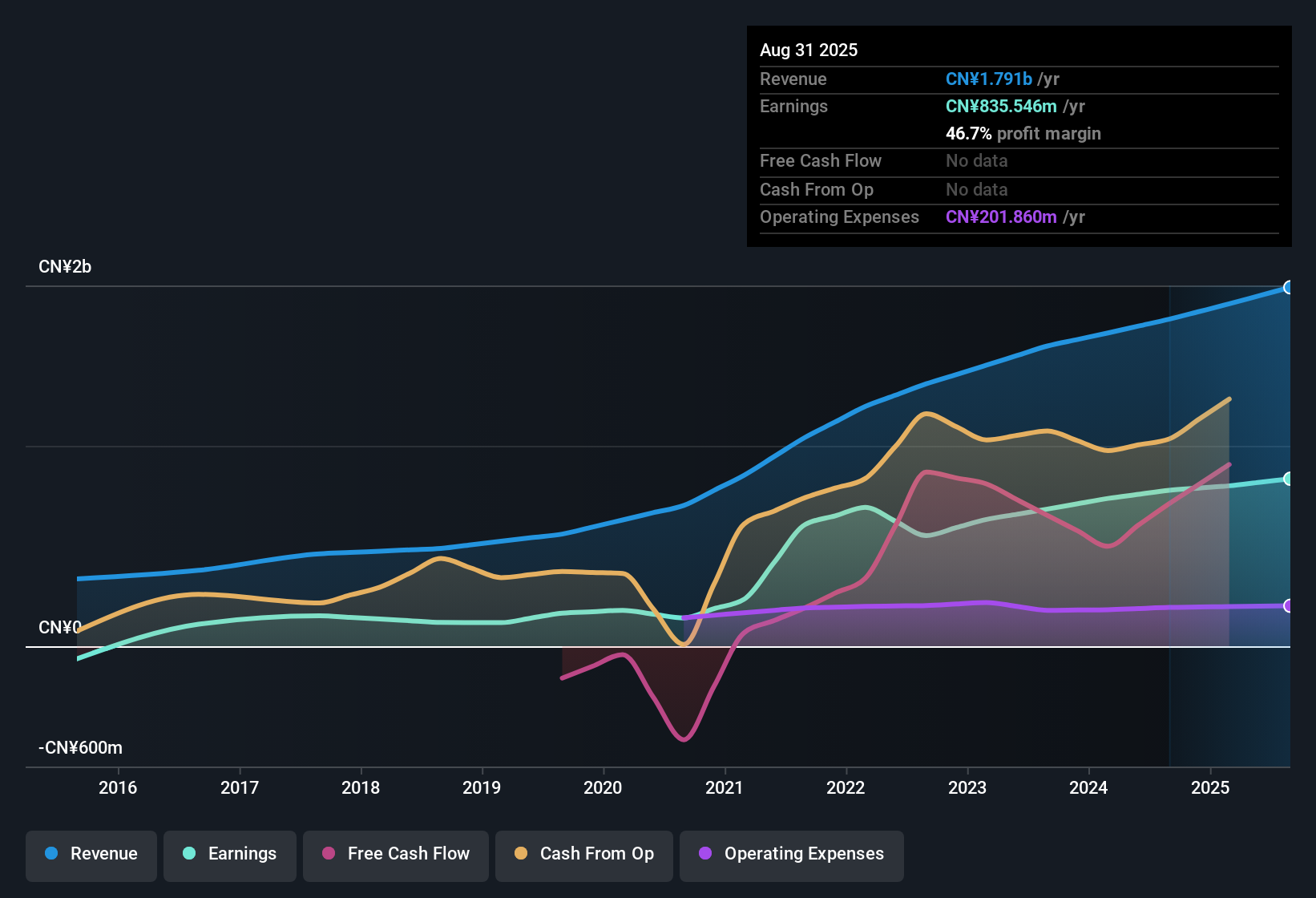

China Chunlai Education Group (SEHK:1969) has just released its FY 2025 results, reporting revenue of 890.72 million CNY and basic EPS of 0.34 CNY for the latest half. Net income stood at 406.56 million CNY. Over the past year, the company has seen revenue trend upwards across recent periods, moving from 813.91 million CNY in the first half of FY 2024 to 890.72 million CNY in the latest half, while EPS increased from 0.32 CNY to 0.34 CNY. Net profit margins remain among the highest in the sector, though there has been a slight compression compared to the prior year.

See our full analysis for China Chunlai Education Group.Now, we will see how these numbers compare to the prevailing narratives in the market. Some long-standing storylines may remain, while others might be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Still Among the Best in Sector

- Net profit margin stands at 46.7% for the past twelve months, only slightly lower than the prior year’s margin of 47.7%, and remains one of the highest rates among China education peers.

- Despite a marginal slip, the company’s history of high margins heavily supports the view that China Chunlai’s business model delivers consistent, high-quality profitability.

- The five-year annualized earnings growth rate remains strong at 18.7% per year, reinforcing the resilience of margins in a sector known for volatility.

- No major risks flagged in recent data, which supports the idea that profitability is a core pillar for optimism around the stock.

Valuation Well Below DCF Fair Value

- Shares are trading at a price-to-earnings ratio of 5.7x, notably cheaper than the Hong Kong Consumer Services sector average (7.3x) and peer group (13x). The HK$4.37 share price is 76.6% below the DCF fair value of HK$18.70.

- The market’s discount positions the company as a potential value opportunity, especially given no major risk flags and a historical track record of strong profit generation.

- Bulls highlight that other private education stocks rarely combine this level of profitability with such a pronounced value gap.

- With net income for the trailing twelve months at 835.5 million CNY, the disparity to fair value may prompt a re-rating if earnings momentum continues.

Earnings Growth Slows Versus Historical Trends

- Earnings expanded by 7.4% over the past year, which is below the five-year annual average growth rate of 18.7%, pointing to a deceleration in momentum.

- This moderation adds nuance to the prevailing market view that long-term demand drivers support steady growth, but reveals the debate over whether the company can return to its historical pace.

- Critics note the cooling pace may reflect broader sector pressures, but the sustained high margin and lack of flagged risks offset some concerns for now.

- Recurring semiannual net income gains, maintaining over 400 million CNY each half-year since FY 2024, indicate that even slower growth levels remain significant in absolute terms.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on China Chunlai Education Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While China Chunlai’s double-digit historical growth has slowed noticeably this year, this introduces questions about its ability to sustain stronger earnings momentum over the long term.

If consistent performance is high on your list, focus on steady-growing companies delivering reliable results across cycles by using stable growth stocks screener (2075 results) today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English