Shangshan Gold (SEHK:1939) Losses Worsen 58.4% Annually, Reinforcing Bearish Narratives Ahead of H1 2026

Shangshan Gold International Holdings (SEHK:1939) just posted its H1 2026 results, with total revenue at HK$76.5 million and basic EPS of HK$0.000854. Looking back, the company’s revenue climbed from HK$31.9 million in H1 2025 to HK$76.5 million in the latest period. Net income shifted from a loss of HK$1.15 million last year to a profit of HK$0.43 million. Despite the headline improvement, margins remain under pressure and profitability is still a key concern for investors.

See our full analysis for Shangshan Gold International Holdings.Next, we will see how these latest numbers compare to the most widely followed narratives in the market and whether the data backs up or challenges the prevailing views.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Deepen by 58.4% Per Year

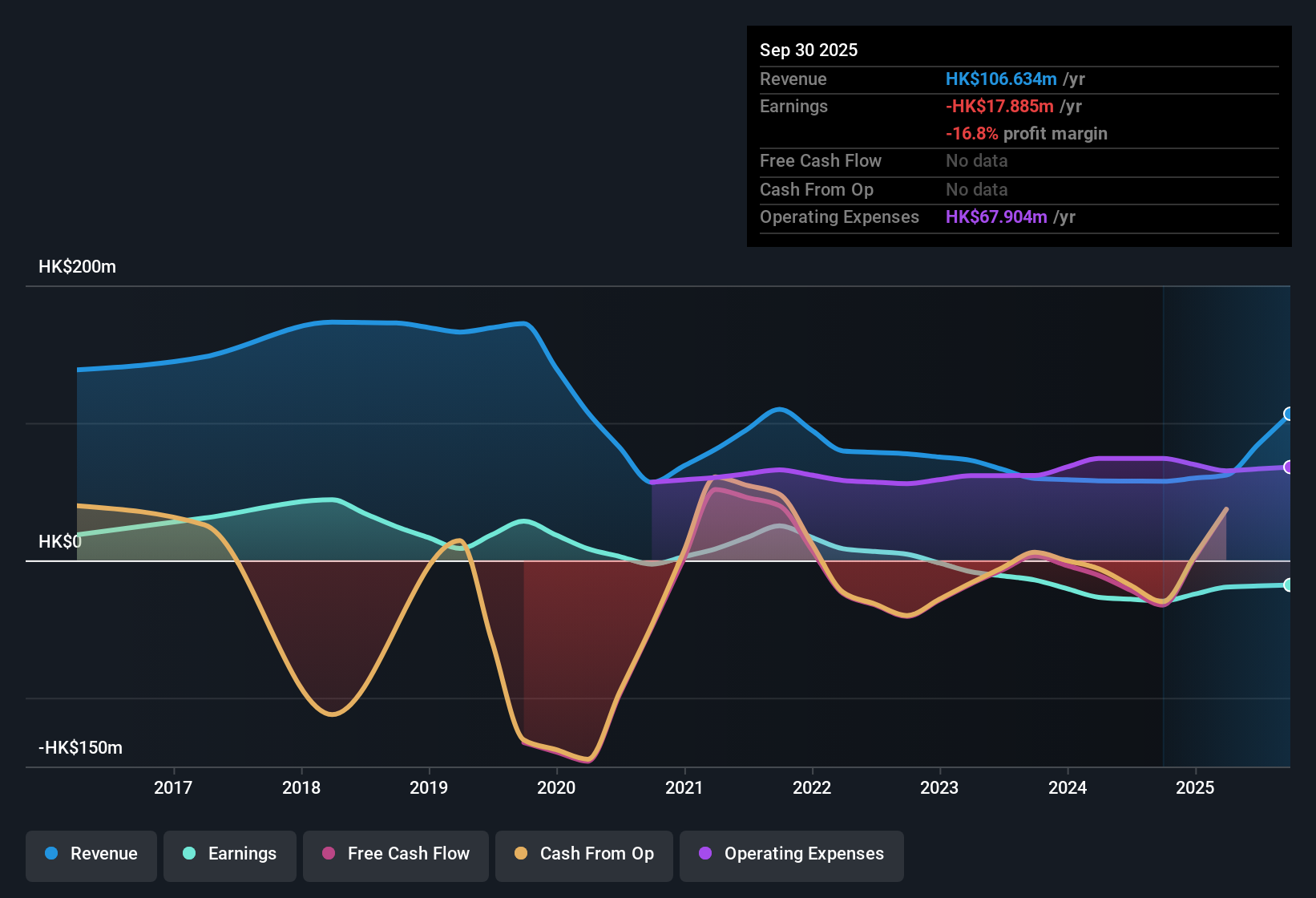

- Trailing twelve month net losses increased to HK$17.89 million, up sharply from earlier periods, with losses compounding at a rate of 58.4% per year over the last five years.

- Despite revenue gains, sustained operating losses support the prevailing view that profitability remains elusive for Shangshan Gold International Holdings. Losses widened even as total revenue for the latest twelve months reached HK$106.63 million.

- Profit margin remains negative over the last twelve months, and there is no evidence of a turnaround or meaningful improvement in net income in any recent period.

- Continued negative earnings challenge the optimistic case for a quick recovery and highlight the difficulty of overcoming entrenched costs even amid top-line growth.

Share Price Trades Well Above DCF Fair Value

- The company's current share price is HK$5.10, which is significantly above the estimated DCF fair value of HK$1.91 per share and also well above peer valuation metrics. The Price-To-Sales ratio stands at 24.5x compared to an industry average of 1.2x.

- This premium valuation supports concerns about over-optimism described in prevailing market analysis, especially when considered alongside the company's ongoing unprofitability.

- No reported improvements in net profit or earnings quality, together with a share price that is multiples higher than the calculated fair value, reinforce the risk of a future correction if fundamentals do not improve.

- Investors face a classic value trap scenario, where high expectations are priced in but actual results lag far behind sector and peer standards.

Volatility Outpaces the Hong Kong Market

- Share price volatility for Shangshan Gold International Holdings outpaced that of the broader Hong Kong market in the last year, with the company's stock experiencing meaningfully higher price swings.

- Prevailing analysis ties this volatility directly to both deepening losses and premium valuation, suggesting that even small changes in sentiment or performance could drive disproportionate moves in the stock's price.

- High volatility is often seen when companies are unprofitable and trading at elevated multiples. This makes the stock particularly sensitive to new information or investor expectations.

- No offsetting reward signals or signs of stability have been reported, so volatility may remain elevated as long as fundamentals do not improve.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Shangshan Gold International Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Shangshan Gold International Holdings faces persistent losses, negative profit margins, and a share price that looks risky given weak underlying fundamentals and lack of profitability.

If you want to focus on stocks that are trading well below their fair value and may offer a better risk-reward balance, see these 920 undervalued stocks based on cash flows as your next step.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English