This Penny Biotech Stock Just Doubled on a Key Acquisition. Should You Buy Shares Here?

Q32 Bio (QTTB) shares more than doubled on Dec. 1 after the biotechnology company announced a strategic deal with the Cambridge-headquartered Akebia Therapeutics (AKBA).

Q32 sold its Phase complement inhibitor, ADX-097, to Akebia for $12 million in upfront payments, with the total transaction potentially reaching $592 million through development, regulatory, and commercial milestones.

At its intraday peak, Q32 Bio stock was seen trading nearly 350% above its year-to-date low. But it reversed much of those gains and closed the session at $3.82, up about 75% on the day.

Significance of Akebia Deal for Q32 Bio Stock

Akebia’s willingness to commit as much as $592 million validates Q32 Bio’s complement inhibitor platform, signaling significant commercial potential for the asset.

The transaction enables QTTB to monetize a key asset while retaining rights to its broader tissue-targeted complement inhibitor platform, including ADX-096 for ophthalmologic indications.

Divesting ADX-097 to AKBA provides immediate cash flow while maintaining long-term revenue potential through tiered royalties ranging from low single-digit to mid-teen percentages on future sales.

The biotech firm will now refocus its efforts on advancing Bempikibart – a treatment for alopecia areata – representing a fundamental pivot in its therapeutics strategy, which may drive QTTB stock higher in 2026.

Are QTTB Shares Worth Buying at Current Levels?

While the Akebia deal looks constructive for QTTB shares on the surface, the rapid price increase raises significant valuation concerns as well.

Much of the agreement’s value remains contingent on achieving multiple development, regulatory, and commercial milestones, which carry inherent execution risks typical of biotech investments.

It’s fair to assume, therefore, that the upside related to the AKBA transaction is more than priced in already, and Q32 Bio stock may actually struggle to sustain these gains over time.

Moreover, even after the rally, QTTB remains a penny stock only, which means it’s still vulnerable to unusual volatility that typically ends up hurting late investors.

Wall Street Remains Bullish on Q32 Bio

Despite the aforementioned risks, Wall Street remains bullish on Q32 Bio shares for 2026.

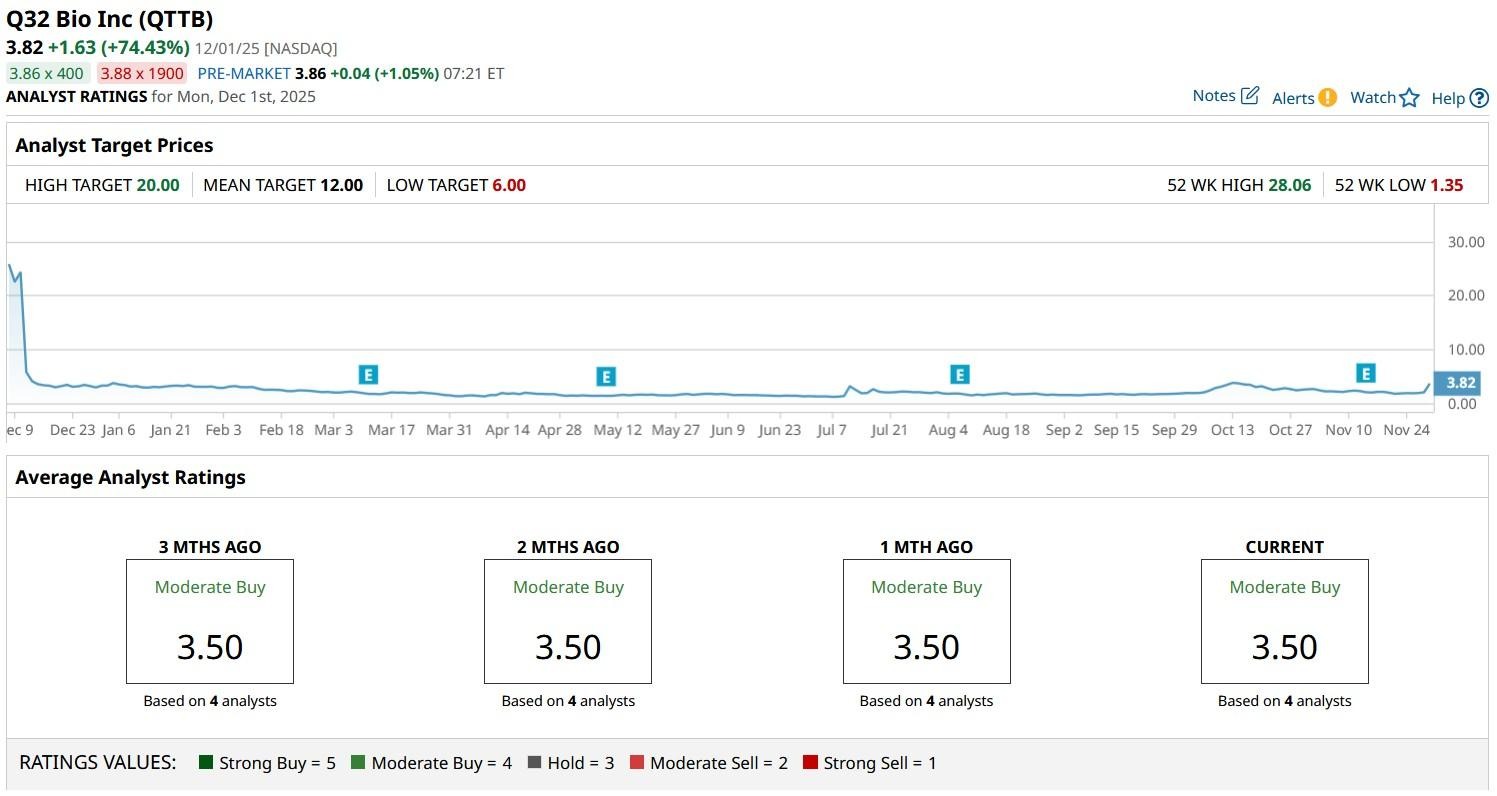

According to Barchart, the consensus rating on QTTB stock currently sits at “Moderate Buy” with the mean target of $12 indicating potential upside of more than 200% from here.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English