Is Quali-Smart Holdings (HKG:1348) Using Debt Sensibly?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Quali-Smart Holdings Limited (HKG:1348) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Quali-Smart Holdings's Debt?

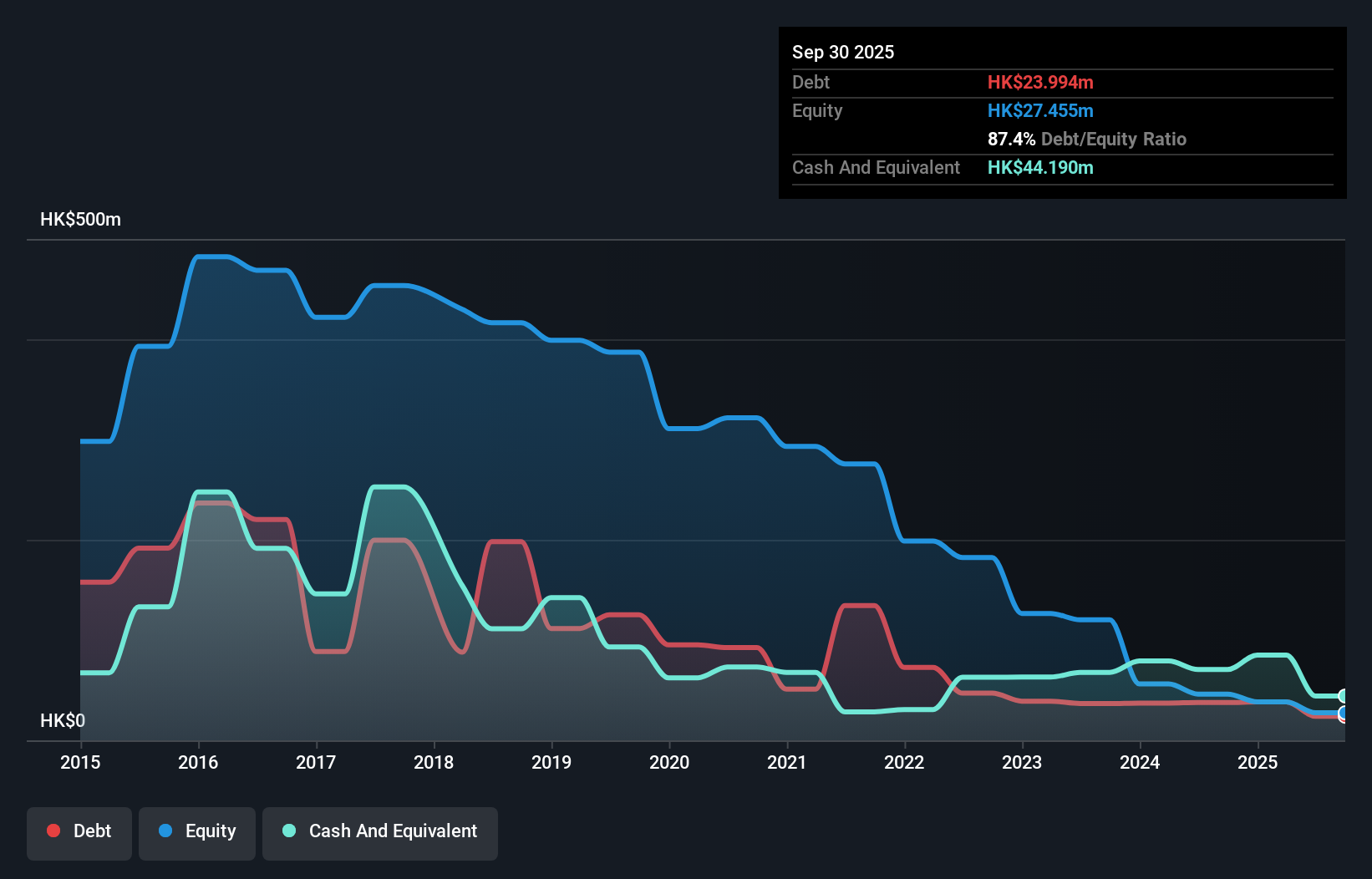

The image below, which you can click on for greater detail, shows that Quali-Smart Holdings had debt of HK$24.0m at the end of September 2025, a reduction from HK$37.7m over a year. But on the other hand it also has HK$44.2m in cash, leading to a HK$20.2m net cash position.

A Look At Quali-Smart Holdings' Liabilities

Zooming in on the latest balance sheet data, we can see that Quali-Smart Holdings had liabilities of HK$24.1m due within 12 months and liabilities of HK$16.1m due beyond that. Offsetting this, it had HK$44.2m in cash and HK$16.4m in receivables that were due within 12 months. So it can boast HK$20.4m more liquid assets than total liabilities.

This short term liquidity is a sign that Quali-Smart Holdings could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Quali-Smart Holdings boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is Quali-Smart Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Check out our latest analysis for Quali-Smart Holdings

Over 12 months, Quali-Smart Holdings made a loss at the EBIT level, and saw its revenue drop to HK$41m, which is a fall of 62%. To be frank that doesn't bode well.

So How Risky Is Quali-Smart Holdings?

Although Quali-Smart Holdings had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of HK$19m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. We'll feel more comfortable with the stock once EBIT is positive, given the lacklustre revenue growth. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with Quali-Smart Holdings , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English