Is Teradata (TDC) Quietly Reframing Its AI Moat Through High-Profile Conference Messaging?

- Teradata recently presented at the UBS Global Technology and AI Conference 2025 at The Phoenician Hotel in Scottsdale, Arizona, where CFO and Principal Accounting Officer John Ederer outlined the company’s positioning in data, cloud, and AI.

- This appearance puts Teradata’s financial leadership and AI-focused messaging directly in front of institutional investors, potentially sharpening how the market views its hybrid-cloud and analytics roadmap.

- We’ll now examine how CFO John Ederer’s appearance at UBS’s AI-focused conference may influence Teradata’s existing investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Teradata Investment Narrative Recap

To own Teradata, you need to believe its hybrid data and analytics platform can convert AI demand into growing cloud ARR despite current revenue declines and competitive pressure from hyperscalers. John Ederer’s appearance at the UBS Global Technology and AI Conference mainly reinforces the existing AI and cloud message rather than materially changing the near term catalyst of stabilizing recurring revenue or the key risk of ongoing top line contraction.

The most relevant recent development here is Ederer’s appointment as CFO and principal accounting officer in May 2025, which put the same finance leader now speaking at UBS in charge of guidance and capital allocation. That continuity between internal financial stewardship and external AI focused messaging may matter for how investors weigh Teradata’s effort to offset revenue headwinds with higher margin, AI driven cloud workloads.

However, beneath the AI story, investors should be aware of the risk that continued revenue declines could...

Read the full narrative on Teradata (it's free!)

Teradata's narrative projects $1.6 billion revenue and $101.6 million earnings by 2028. This implies revenue will decline by 0.9% per year and earnings will decrease by $8.4 million from $110.0 million today.

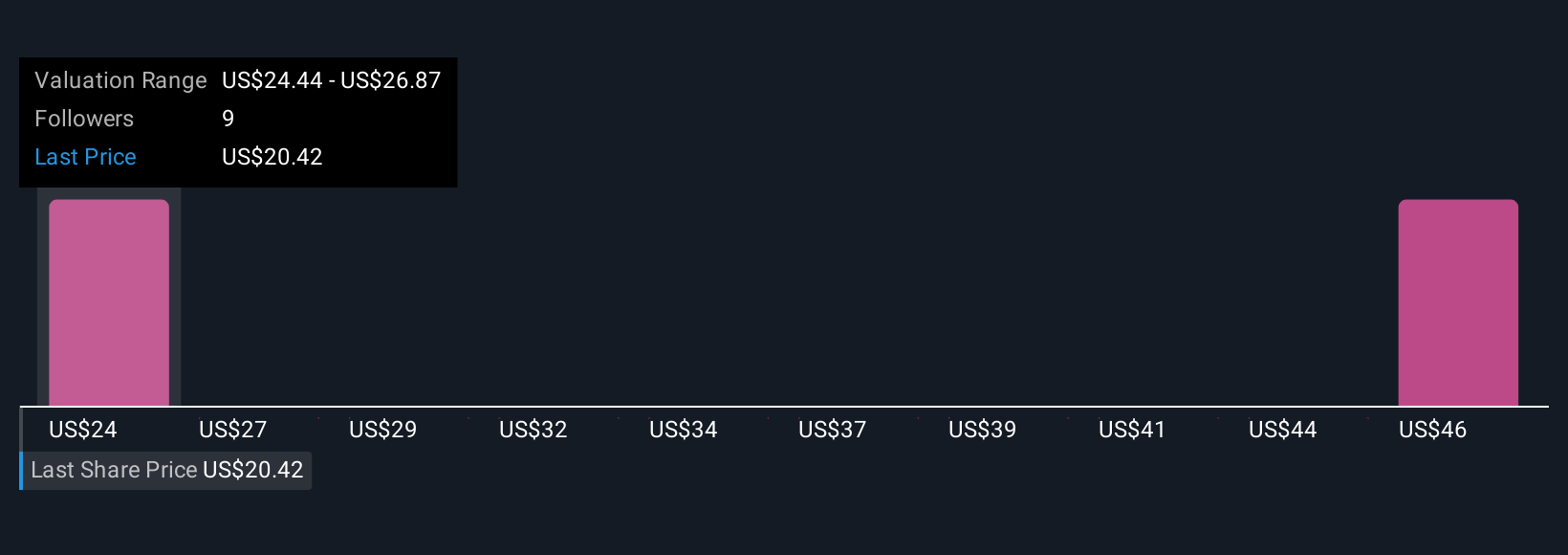

Uncover how Teradata's forecasts yield a $27.80 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates range from US$21 to about US$80.71, underscoring how differently private investors view Teradata’s earnings potential. Against that spread, the current risk of recurring revenue contraction and hyperscaler competition gives you a concrete lens to compare these viewpoints and consider how growth in AI driven workloads might influence future expectations.

Explore 3 other fair value estimates on Teradata - why the stock might be worth over 2x more than the current price!

Build Your Own Teradata Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teradata research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Teradata research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teradata's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English