Does Phoenitron Holdings (HKG:8066) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Phoenitron Holdings (HKG:8066). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Fast Is Phoenitron Holdings Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So a growing EPS generally brings attention to a company in the eyes of prospective investors. Commendations have to be given in seeing that Phoenitron Holdings grew its EPS from HK$0.000052 to HK$0.072, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Phoenitron Holdings shareholders can take confidence from the fact that EBIT margins are up from -3.3% to 45%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

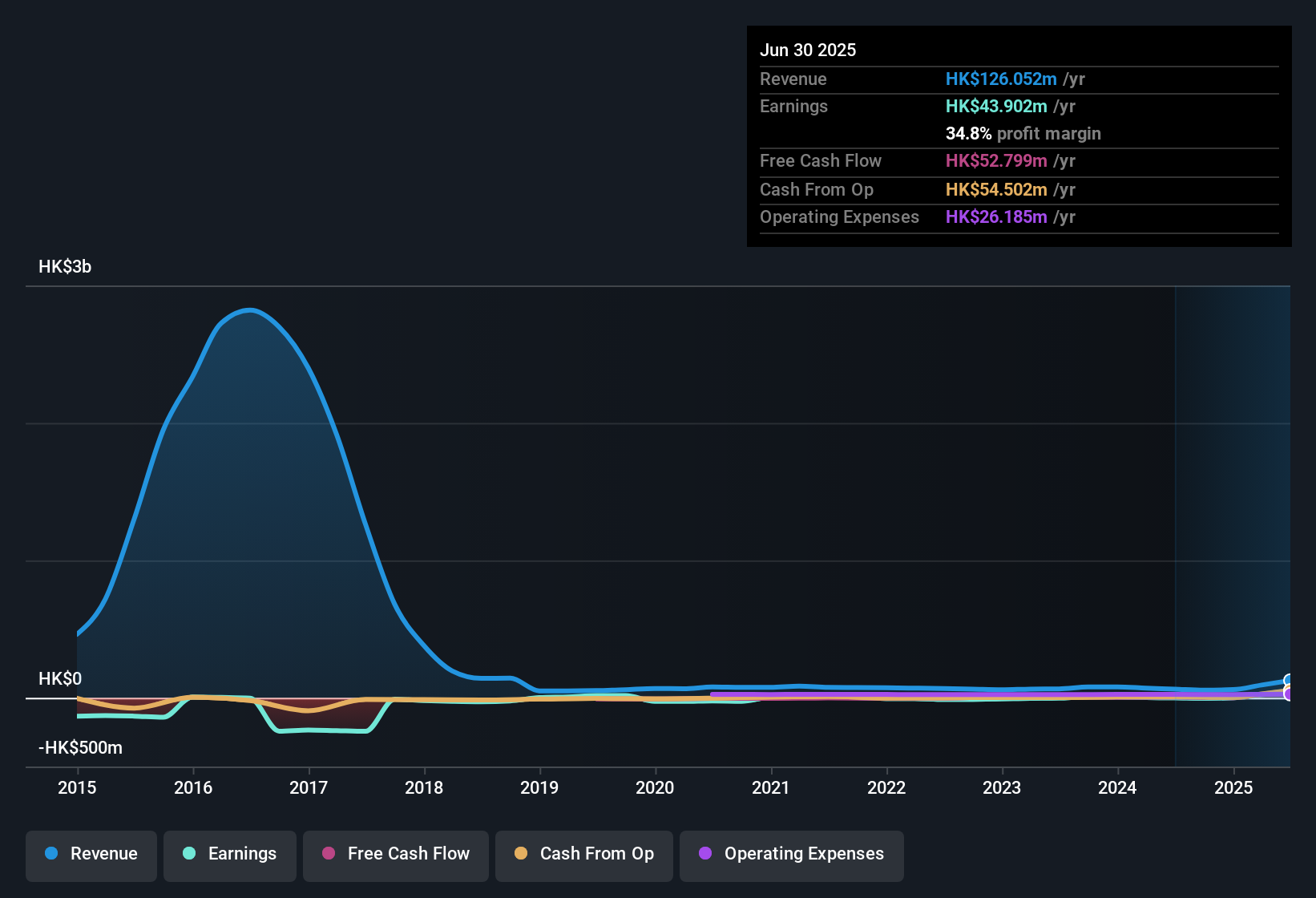

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Check out our latest analysis for Phoenitron Holdings

Since Phoenitron Holdings is no giant, with a market capitalisation of HK$318m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Phoenitron Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Shareholders in Phoenitron Holdings will be more than happy to see insiders committing themselves to the company, spending HK$5.6m on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. We also note that it was the company insider, Chi Yuen Tsai, who made the biggest single acquisition, paying HK$2.9m for shares at about HK$0.73 each.

The good news, alongside the insider buying, for Phoenitron Holdings bulls is that insiders (collectively) have a meaningful investment in the stock. As a matter of fact, their holding is valued at HK$106m. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 33% of the company; visible skin in the game.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Lily Wu, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Phoenitron Holdings with market caps under HK$1.6b is about HK$1.8m.

The Phoenitron Holdings CEO received total compensation of only HK$358k in the year to December 2024. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Phoenitron Holdings Worth Keeping An Eye On?

Phoenitron Holdings' earnings have taken off in quite an impressive fashion. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Phoenitron Holdings deserves timely attention. However, before you get too excited we've discovered 2 warning signs for Phoenitron Holdings that you should be aware of.

Keen growth investors love to see insider activity. Thankfully, Phoenitron Holdings isn't the only one. You can see a a curated list of Hong Kong companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English