How Boise Cascade’s (BCC) CEO Transition Plan Could Shape Its Operational Focus for Investors

- Boise Cascade recently announced that long-time CEO Nate Jorgensen will retire on March 2, 2026, with current COO Jeff Strom stepping into the chief executive role the following day while Jorgensen remains on the board and the company leaves the COO position vacant.

- This carefully staged leadership transition, alongside Strom’s deep experience in Boise Cascade’s building materials distribution business, signals a continued emphasis on operational execution and distribution efficiency at the top of the organization.

- With this leadership transition outlined, we’ll explore how appointing Jeff Strom as CEO could influence Boise Cascade’s existing investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Boise Cascade Investment Narrative Recap

To own Boise Cascade today, you need to believe the company can translate its manufacturing and distribution footprint into steadier earnings despite recent margin pressure and softer residential construction. The CEO transition to Jeff Strom in 2026, with Nate Jorgensen staying on the board, looks orderly and does not materially change the near term catalyst, which remains how quickly demand and pricing in engineered wood and building materials stabilize versus the risk of prolonged earnings weakness.

The recent authorization of a new US$300,000,000 share repurchase program is especially relevant alongside the leadership news, because it highlights how the current team is already shaping capital allocation while the succession plan is set. For investors watching Boise Cascade’s high operational leverage and elevated capital expenditure plans, this combination of an experienced incoming CEO and ongoing buybacks adds important context to how management may balance growth projects with returning cash to shareholders.

Yet while leadership continuity and buybacks may appeal, investors should be aware that prolonged demand softness and pricing pressure in engineered wood products could still...

Read the full narrative on Boise Cascade (it's free!)

Boise Cascade's narrative projects $7.0 billion revenue and $285.8 million earnings by 2028. This requires 2.4% yearly revenue growth and about a $23.5 million earnings increase from $262.3 million today.

Uncover how Boise Cascade's forecasts yield a $90.33 fair value, a 24% upside to its current price.

Exploring Other Perspectives

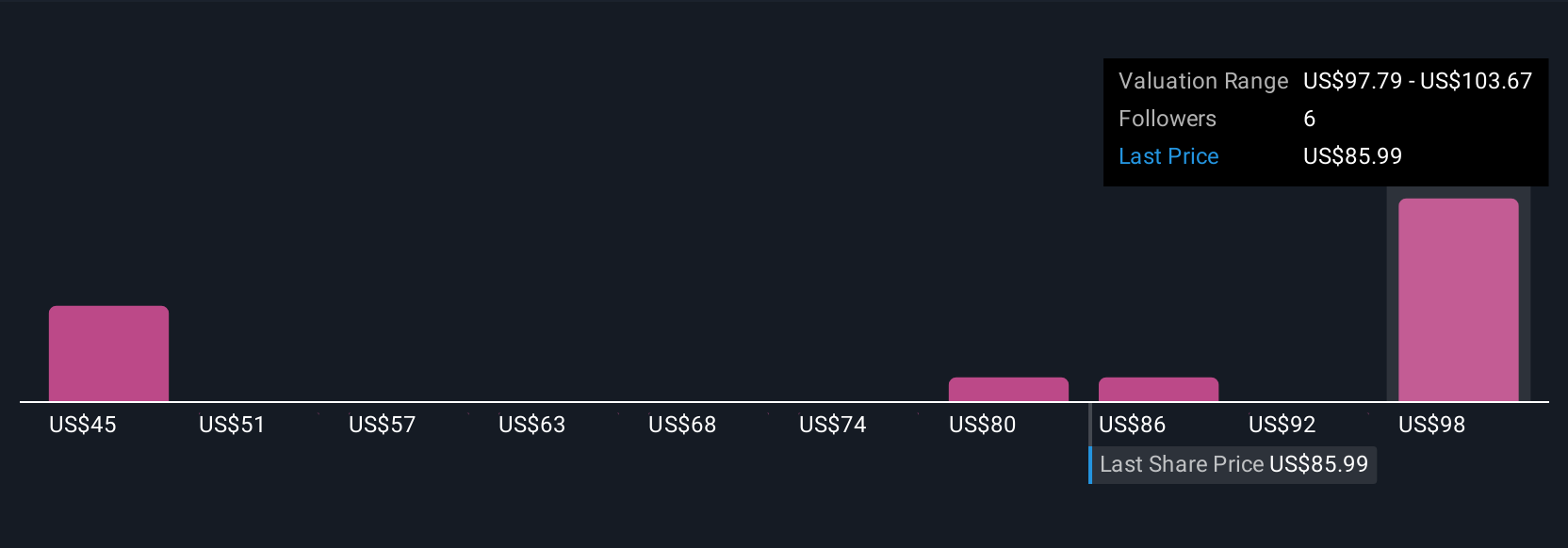

Five members of the Simply Wall St Community currently see Boise Cascade’s fair value anywhere between US$70 and about US$250, which is a wide spread. When you set those views against ongoing earnings pressure from weaker demand and softer pricing, it underlines why many investors may want to compare several different scenarios for the company’s future performance.

Explore 5 other fair value estimates on Boise Cascade - why the stock might be worth over 3x more than the current price!

Build Your Own Boise Cascade Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boise Cascade research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Boise Cascade research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boise Cascade's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English