Is It Too Late To Consider Jabil After Its Remarkable Multi Year Share Price Surge

- If you are wondering whether Jabil’s roaring share price still leaves any real value on the table, you are not alone, and this is exactly what we are going to unpack.

- Despite a recent 5.9% pullback over the last week, the stock is still up 7.9% over the past month, 51.4% year to date, and 50.8% over the last year, building on gains of 210.1% in 3 years and 408.7% in 5 years.

- That kind of run has been underpinned by Jabil’s strategic pivot toward higher margin, technology focused manufacturing solutions, including deeper exposure to sectors like cloud infrastructure, electric vehicles, and healthcare. Alongside portfolio reshaping and capital allocation moves, these shifts have reshaped how the market thinks about the company’s long term growth and risk profile.

- Yet, on our framework Jabil only scores 1/6 on valuation checks. This suggests investors need to look carefully at how much future growth is already priced in. In a moment we will break down the usual valuation methods before exploring a more powerful way to judge whether the stock truly offers good value.

Jabil scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Jabil Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth today by projecting its future cash flows and then discounting those back into today’s dollars.

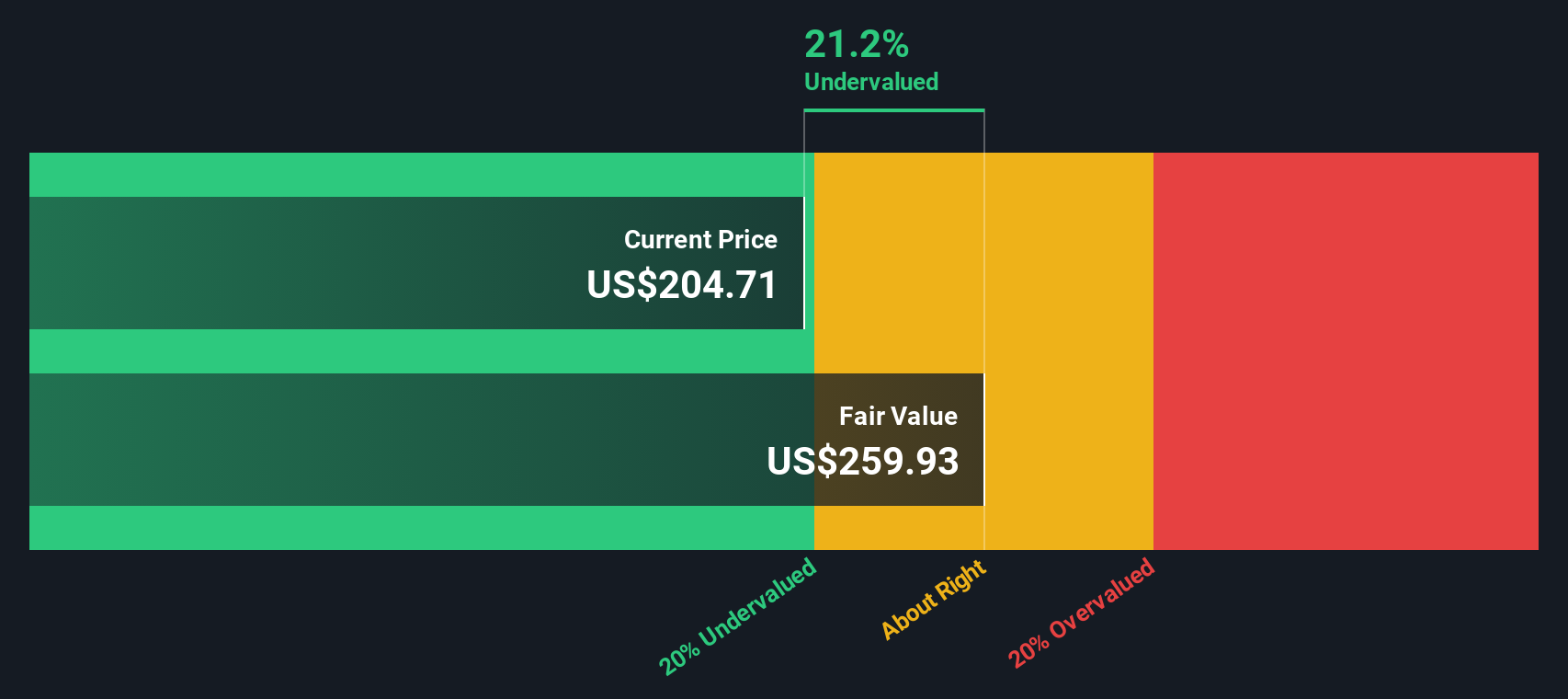

For Jabil, the model starts with last twelve months Free Cash Flow of about $911.8 million and projects it to rise to roughly $1.36 billion by 2026 and $1.53 billion by 2028, based on analyst inputs and then Simply Wall St extrapolations. Longer term, annual Free Cash Flow is projected to move above $2.0 billion by 2035, reflecting ongoing growth in the business rather than a one off spike.

Using a 2 Stage Free Cash Flow to Equity framework to discount these future cash flows back to today yields an estimated intrinsic value of about $248.90 per share. Compared with the current market price, this implies Jabil trades at roughly a 13.1% discount, suggesting the stock is modestly undervalued on a cash flow basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Jabil is undervalued by 13.1%. Track this in your watchlist or portfolio, or discover 911 more undervalued stocks based on cash flows.

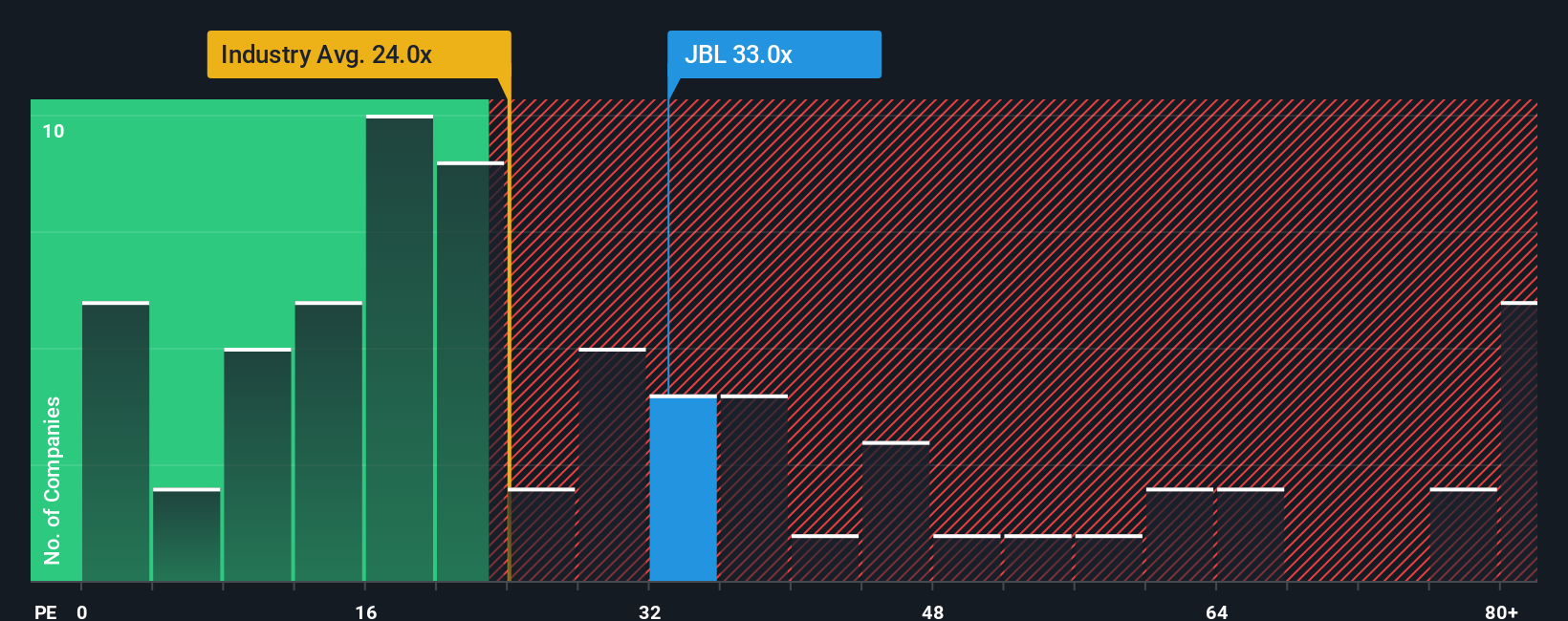

Approach 2: Jabil Price vs Earnings

For profitable companies like Jabil, the Price to Earnings, or PE, ratio is a straightforward way to gauge how much investors are willing to pay for each dollar of earnings. A higher PE can be justified when a business is growing quickly and has relatively lower risk, while slower growth or greater uncertainty usually warrants a lower, more conservative multiple.

Jabil currently trades on a PE of about 35.2x, which is slightly above both the broader electronic industry average of roughly 24.3x and the peer group average of around 34.3x. To go a step further, Simply Wall St calculates a proprietary Fair Ratio of 27.3x, which is the PE that would be expected given Jabil’s specific mix of earnings growth, margins, industry dynamics, market cap and risk profile. This Fair Ratio is more informative than a simple comparison with peers or the industry, because it adjusts for the company’s own fundamentals rather than assuming all firms deserve the same multiple.

With Jabil’s actual PE of 35.2x sitting meaningfully above the Fair Ratio of 27.3x, the stock screens as expensive on an earnings basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Jabil Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you turn your view of a company into a clear story. You can link that story to specific forecasts for revenue, earnings and margins, and then calculate a Fair Value you can compare to the current price to help inform a decision on whether to buy or sell. Everything dynamically updates as new news or earnings arrive. For Jabil, one investor might build a bullish Narrative around AI, cybersecurity and BESS expansion that justifies a Fair Value near the higher end of recent targets around 256 dollars. A more cautious investor might focus on EV softness, tariff risk and margin pressure to anchor a Narrative closer to the lower end near 176 dollars. The platform helps you see, test and refine which of these stories you believe and what price you are therefore willing to pay.

Do you think there's more to the story for Jabil? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English