Solstice Stock: Is SOLS Outperforming the Materials Sector?

With a market cap of around $7.6 billion, Solstice Advanced Materials, Inc. (SOLS) is a New Jersey-based specialty chemicals and advanced materials company that began trading publicly in late October 2025 after being spun off from Honeywell International Inc. (HON). It serves over 3,000 customers globally through a diversified portfolio focused on high-performance, application-critical materials.

The company runs two main businesses, with one centered on low-global-warming-potential refrigerants, blowing agents, and specialized chemical solutions, and the other focused on high-purity chemicals, advanced fibers, and engineered materials that support semiconductor, electronics, defense, and life-sciences applications.

Companies valued between $2 billion and $10 billion are generally considered "mid-cap" stocks, and Solstice fits this criterion perfectly. Leveraging its Honeywell heritage, Solstice is positioned to benefit from long-term trends in sustainable cooling technologies, semiconductor manufacturing, and advanced industrial applications.

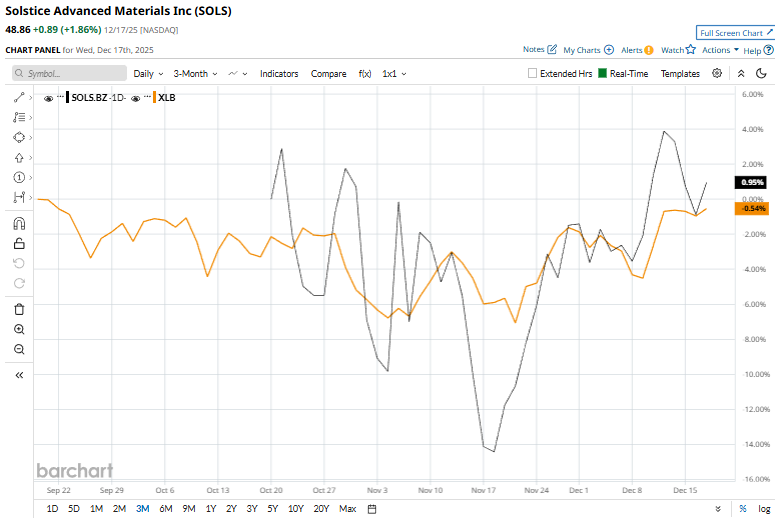

Solstice made a strong first impression on the public markets, hitting its all-time high of $61 on its very first trading day on Oct. 20. Momentum has only strengthened since then, with the stock rallying 17.5% over the past month, comfortably outperforming the Materials Select Sector SPDR Fund's (XLB) 5.8% rise during the same period.

From a technical standpoint, the trend has remained firmly constructive, as Solstice has traded above both its 50-day and 200-day moving averages since its debut.

Solstice Advanced Materials’ market drivers are anchored in several powerful structural and industry trends. Chief among them is rising global demand for low-global-warming-potential refrigerants and sustainable materials, driven by tightening environmental regulations and the ongoing transition in HVAC and cooling technologies. Additionally, growth in semiconductor manufacturing, electronics, and data-center infrastructure is another key catalyst, supporting demand for the company’s high-purity chemicals and advanced materials. Solstice also benefits from its broad exposure to resilient end markets such as defense, life sciences, and industrial applications, which helps mitigate cyclical volatility.

On Nov. 6, Solstice released its third-quarter results, prompting a positive market reaction that lifted its shares 5.5% in the following trading session. The earnings update highlighted resilient operating performance during a transitional period, with a 7% year-over-year increase in net sales to about $969 million, supported by steady demand across both Refrigerants & Applied Solutions and Electronic & Specialty Materials.

Although Solstice reported a net loss of $35 million, reflecting higher tax expenses and spin-off-related costs, adjusted standalone EBITDA came in at $235 million, representing a 24.3% margin. Management also reaffirmed its full-year 2025 outlook, calling for $3.75–$3.85 billion in net sales and an adjusted EBITDA margin around 25%, which helped underpin the positive market reaction.

Additionally, SOLS stock has outperformed its rival, Air Products and Chemicals, Inc. (APD). APD stock has dipped 2.7% over the past month.

SOLS stock has a consensus rating of “Moderate Buy” from six analysts in coverage, and the mean price target of $58.17 is a premium of 19.1% to current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English