The Market Doesn't Like What It Sees From China Chunlai Education Group Co., Ltd.'s (HKG:1969) Earnings Yet As Shares Tumble 26%

The China Chunlai Education Group Co., Ltd. (HKG:1969) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 25% share price drop.

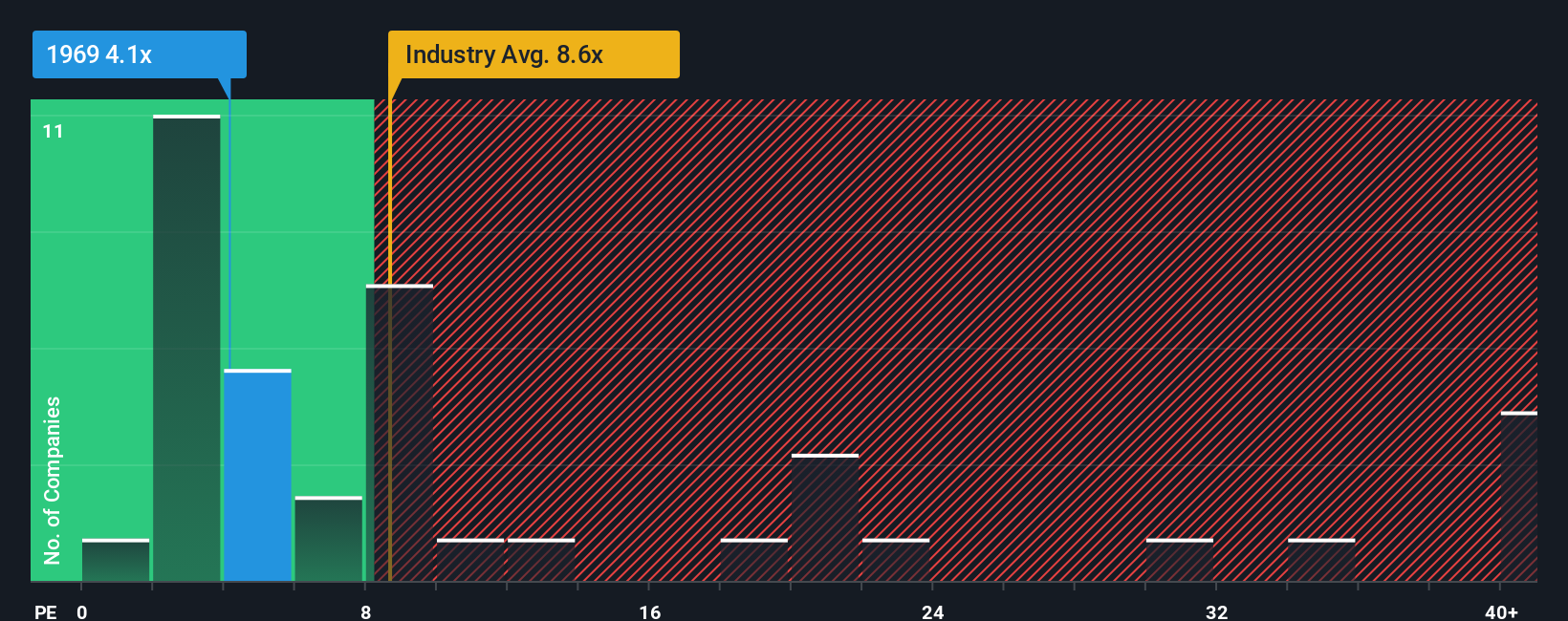

Although its price has dipped substantially, China Chunlai Education Group may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 4.1x, since almost half of all companies in Hong Kong have P/E ratios greater than 13x and even P/E's higher than 25x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Earnings have risen at a steady rate over the last year for China Chunlai Education Group, which is generally not a bad outcome. It might be that many expect the respectable earnings performance to degrade, which has repressed the P/E. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

See our latest analysis for China Chunlai Education Group

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, China Chunlai Education Group would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings growth, the company posted a worthy increase of 7.4%. Pleasingly, EPS has also lifted 51% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 20% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that China Chunlai Education Group's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

China Chunlai Education Group's P/E looks about as weak as its stock price lately. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of China Chunlai Education Group revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for China Chunlai Education Group with six simple checks.

You might be able to find a better investment than China Chunlai Education Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English