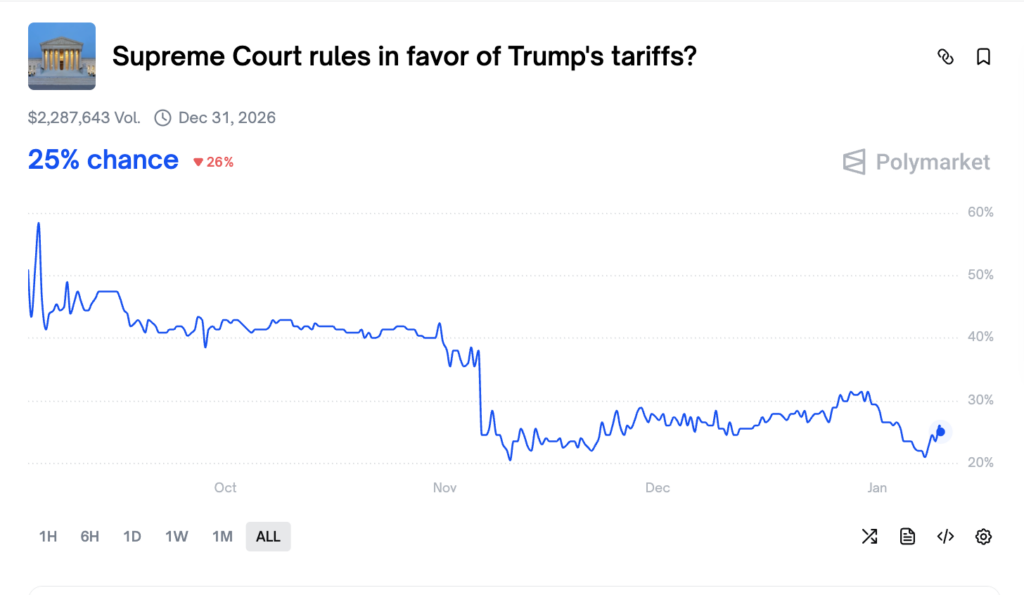

Trump Tariffs Allowed To Stand For Now, But Polymarket Traders Predict Only 25% Chance Of SCOTUS Approval

The U.S. Supreme Court did not issue a ruling Friday on President Donald Trump’s sweeping global tariffs, as traders price in a 75% chance that the Supreme Court ultimately rules in favor of Trump’s tariffs.

Polymarket Shows 25% Odds Trump Wins Tariff Case

The court has not announced when it will decide the case.

Trump invoked the International Emergency Economic Powers Act (IEEPA) to impose “reciprocal” tariffs on goods from nearly every foreign trading partner, citing trade deficits as a national emergency.

He used the same law for duties on China, Canada, and Mexico, citing fentanyl trafficking.

Trump imposed the duties by invoking a 1977 law meant for national emergencies, and lower courts ruled he exceeded his authority.

The administration appealed those rulings, setting up the current Supreme Court review.

$150B In Refunds At Stake For Major Companies

Company executives, customs brokers, and trade lawyers are bracing for a potential fight over $150 billion in refunds from the U.S. government for duties already paid if Trump loses.

Major companies that have filed lawsuits challenging the tariffs and seeking refunds include Costco Wholesale Corp. (NASDAQ:COST), Alcoa Corp. (NYSE:AA), EssilorLuxottica SA (NYSE:EL), Goodyear Tire & Rubber Co. (NASDAQ:GT), BorgWarner Inc. (NYSE:BWA), GoPro Inc. (NASDAQ:GPRO), and Revlon Inc.

Dole Fresh Fruit Company filed Jan. 2, seeking a declaration that IEEPA tariffs were unlawful, a full refund for all tariffs paid, and an injunction preventing future tariffs.

J.Crew Group filed Jan. 6 seeking similar protections.

Toyota subsidiaries, Bumble Bee Foods, Kawasaki Motors Manufacturing, Yokohama Tire, and Yamazaki Mazak also filed protective suits to preserve refund rights.

Why Bitcoin Traders See Tariff Loss As Bullish

Crypto traders argue that striking down Trump’s tariffs would provide multiple catalysts for Bitcoin (CRYPTO: BTC) and risk assets.

Market clarity would improve as $130 billion+ in annual tariff revenue faces legal challenge.

Cost pressures would ease for corporations, improving earnings outlooks.

The removal of tariff uncertainty would allow risk-on capital flows to return to growth assets like Bitcoin and tech stocks.

Trump acknowledged the stakes, saying in a Jan. 2 social media post that a Supreme Court ruling against the tariffs would be a “terrible blow” to the United States.

He has argued tariffs made the country stronger financially.

Partial Rollback More Likely Than Clean Outcome

Even if the court strikes down tariffs imposed under IEEPA, other duties imposed under different statutes would remain in force. Any rollback would likely be partial, slow, and messy rather than an immediate removal of all trade barriers.

The challenge marks a major test of presidential powers and the court’s willingness to check Trump’s far-reaching assertions of authority.

The outcome will impact the global economy beyond just Bitcoin price action.

Image: Shutterstock

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English