Assessing Hesai Group (HSAI) Valuation After New NVIDIA Partnership And Major Lidar Capacity Expansion

Hesai Group (HSAI) is back in focus after announcing new lidar partnerships with NVIDIA and motion capture startup MOVIN, along with plans to double annual production capacity to more than 4 million units by 2026.

See our latest analysis for Hesai Group.

The recent partnerships with NVIDIA and MOVIN, together with Hesai Group's capacity expansion plans, come after a 30 day share price return of 27.44% and a 90 day share price return of 17.02%. Its 1 year total shareholder return of 75.99% suggests that momentum has been building over a longer period.

If this kind of lidar driven growth story interests you, it could be worth seeing how other tech and AI names stack up through high growth tech and AI stocks.

With the shares up sharply over the past year and the company talking about multi million unit lidar volumes, the key question now is whether Hesai is still priced for skepticism or if the market is already factoring in years of growth.

Most Popular Narrative: 11.5% Undervalued

The most widely followed narrative puts Hesai Group's fair value at US$30.06, which sits above the last close of US$26.61 and sets up an ambitious earnings path.

The projection of 2025 LiDAR shipments reaching 1.2 million to 1.5 million units, with nearly 200,000 high-margin robotic LiDAR units, is expected to significantly boost revenue. Anticipated net revenues of RMB 3 billion to RMB 3.5 billion for 2025, driven by strong demand and mass market adoption, indicate potential growth in revenue.

This raises the question of what earnings profile and profit structure the narrative requires to support that valuation gap. The key factors are how growth, margins and future P/E relate to each other.

Result: Fair Value of $30.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh risks, such as concentrated exposure to key customers and the possibility that LiDAR adoption or overseas demand develops more slowly than analysts assume.

Find out about the key risks to this Hesai Group narrative.

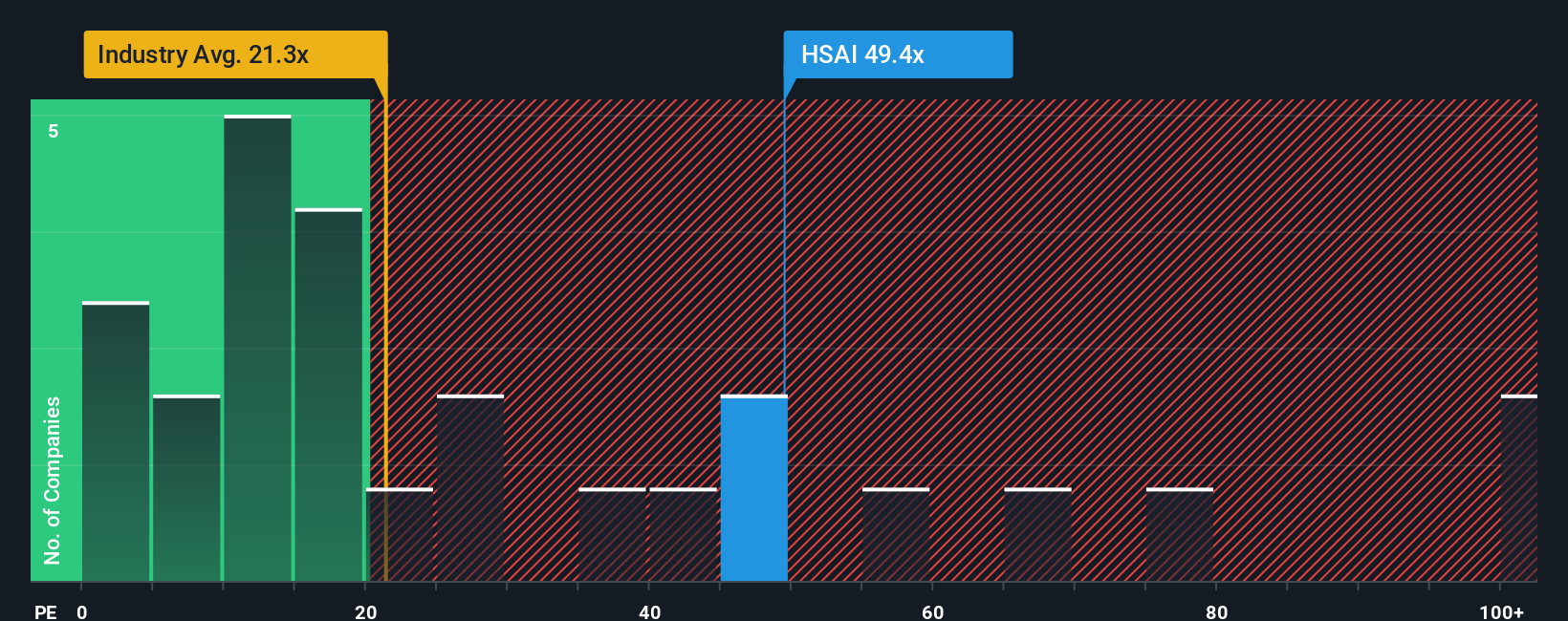

Another View: High P/E Puts Pressure On The Story

The fair value work suggests Hesai Group is 11.7% below our estimate of fair value, yet the current P/E of 67.4x is far above the US Auto Components industry at 22.9x and our fair ratio of 45.3x. That gap points to real valuation risk if growth or margins fall short, so it raises the question of which signal to rely on more.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hesai Group Narrative

If you are not fully on board with this view, or you would rather rely on your own analysis, you can build a custom story in minutes with Do it your way.

A great starting point for your Hesai Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready For More Investment Ideas?

If Hesai Group has sparked your interest, do not stop here. Use focused screens to spot other opportunities that fit your style before the crowd catches on.

- Target potential mispricings by running through these 884 undervalued stocks based on cash flows to compare current prices with underlying cash flows and fundamentals.

- Ride the AI trend more selectively by checking out these 25 AI penny stocks to connect artificial intelligence themes with listed companies.

- Tap into shifting income opportunities by scanning these 12 dividend stocks with yields > 3% to combine income potential with stock market exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English