A Look At Daktronics (DAKT) Valuation After Recent Share Price Pause And Multi Year Returns

Context for Daktronics stock after recent performance moves

Daktronics (DAKT) has drawn attention after a recent share price of $21.69 and a 1 day return decline of about 1%. Investors are weighing this against the company’s multi year total return record.

See our latest analysis for Daktronics.

While Daktronics’ latest 1 day share price return of about a 1% decline has cooled the move, a 30 day share price return of 14.04% and a very large 3 year total shareholder return suggest longer term momentum has been strong, even if shorter term sentiment now looks more measured.

If Daktronics’ recent run has you thinking about what else is moving in tech, it could be a useful moment to scan high growth tech and AI stocks for other ideas on your radar.

After a strong multi year total return record and a recent share price near $21.69 against an analyst target of $30.00, investors may be asking whether Daktronics is still undervalued or if the market is already pricing in future growth.

Most Popular Narrative: 27.7% Undervalued

With Daktronics last closing at $21.69 against a narrative fair value of $30.00, the current share price sits well below that implied level, which puts the focus firmly on what assumptions are doing the heavy lifting in that valuation.

Investments in digital transformation, manufacturing automation, and operational efficiency are reducing costs, improving inventory management, and supporting gross margin expansion, which should drive higher medium-to-long-term earnings.

Ongoing product innovation (narrow pixel pitch, chip-on-board tech, modular indoor/outdoor displays) and a strong balance sheet enabling M&A and buybacks position Daktronics to capture market share as industry consolidation progresses, bolstering both revenue growth and shareholder returns.

Curious what kind of revenue runway, margin uplift and future P/E multiple are baked into that US$30 call, and how analysts tie them together into one valuation story? The full narrative lays out a detailed earnings ramp, rising profitability and a future valuation multiple that is lower than the wider electronic industry yet still above today’s implied level. If you want to see which specific growth path needs to play out for that fair value to make sense, the complete breakdown is worth a closer read.

Result: Fair Value of $30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on cyclical end markets and tariff exposure, where weaker project demand or higher input costs could quickly challenge those earnings and valuation assumptions.

Find out about the key risks to this Daktronics narrative.

Another View: What Multiples Are Suggesting

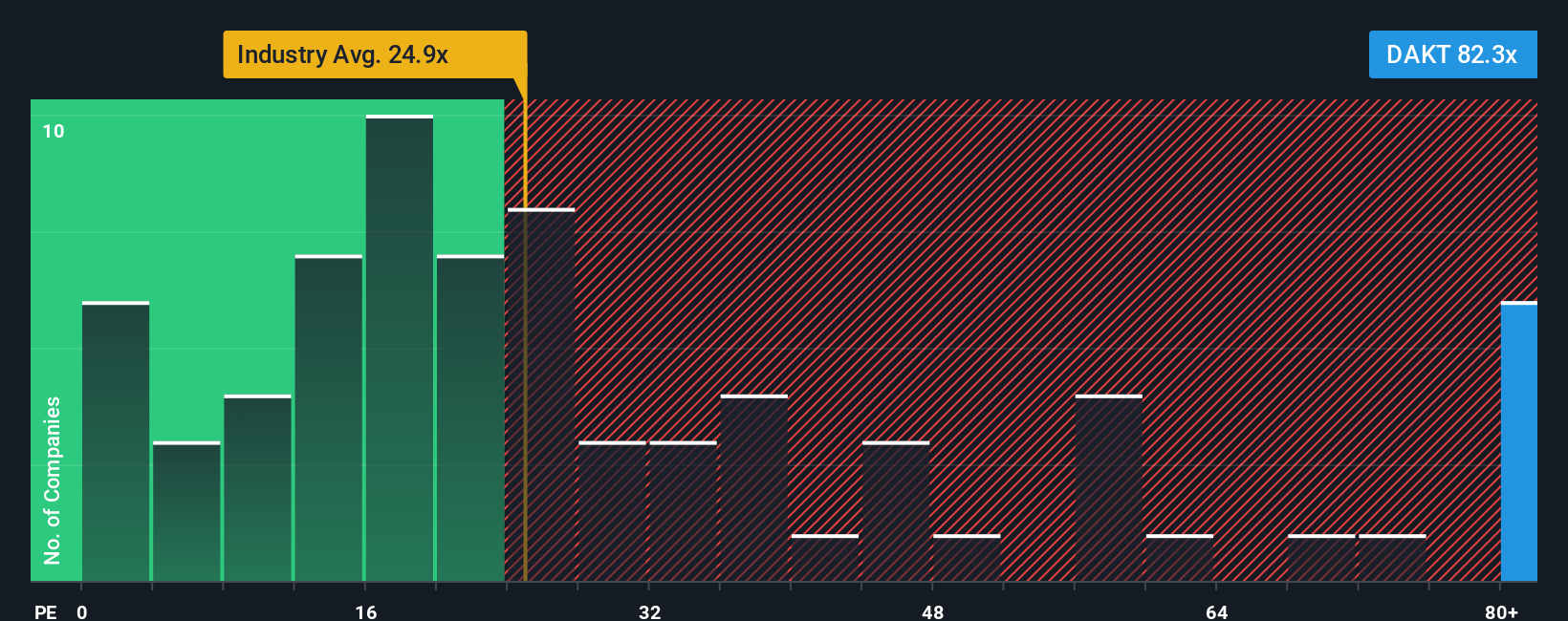

The fair value narrative leans on long term earnings growth, but the current P/E of about 143.5x tells a different story. That compares with 28x for the US Electronic industry, 37.7x for peers, and a fair ratio of 66.4x. This implies meaningful valuation risk if expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Daktronics Narrative

If you look at these numbers and reach a different conclusion, or simply prefer building your own thesis from the ground up, you can pull together a tailored Daktronics view in just a few minutes with Do it your way.

A great starting point for your Daktronics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Daktronics has caught your attention, do not stop there. Use the Simply Wall Street screener to uncover more focused ideas that match how you like to invest.

- Target potential high growth opportunities early by scanning these 3531 penny stocks with strong financials that pair smaller market caps with stronger financial foundations.

- Position your portfolio for long term tech shifts by checking out these 24 AI penny stocks that are directly tied to artificial intelligence themes.

- Focus your research time on value focused ideas by reviewing these 865 undervalued stocks based on cash flows identified using discounted cash flow based metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English